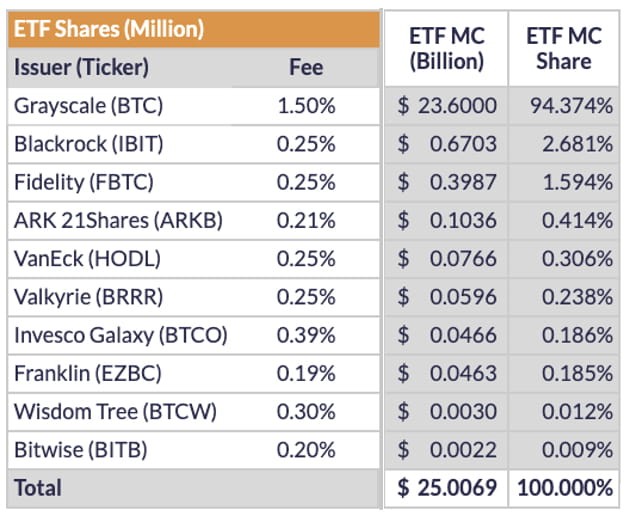

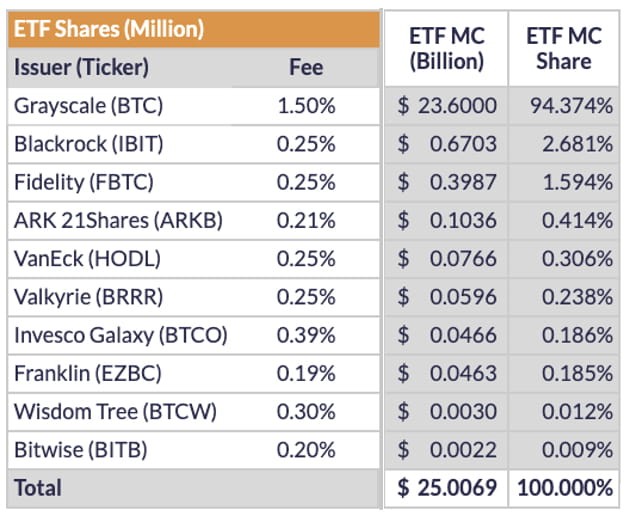

Let me explain a little bit, why Grayscale raised the handling fee (management fee) to 1.5% to retain users. Doesn’t Grayscale know that more than 4 times the ETF handling fee of others will accelerate the escape of users?In an interview yesterday, Grayscale CEO publicly stated, “As an investor, when you choose among these products, fees are a consideration. The asset management company and the issuer behind it are also a consideration, but the scale, liquidity and Sexuality and track record should also be considerations.”In other words, the high fees are because Grayscale believes that it is necessary to maintain a "normal" ecology. Of course, this is Grayscale's own view. It is not impossible that there is a compromise with the SEC and other institutions. , but in general, Grayscale believes that high handling fees are the main reason for maintaining the normal operation of the fund.In fact, if you look at the current liquidity, except for funds with trillions of assets like BlackRock and Fidelity, even Sister Mu’s ARK is still so-so, and others including Franklin Templeton are only very small. With capital inflow and this kind of management fee, the possibility of making ends meet is very high.

热点: