时间:2024-01-26|浏览:344

BONK, one of the most prominent meme tokens in the cryptocurrency market, has not yet made the anticipated move. However, I believe that it will go to significant heights in line with the ' #MEME ' token trend. Therefore, everyone should have a small amount of #BONK in their portfolio.

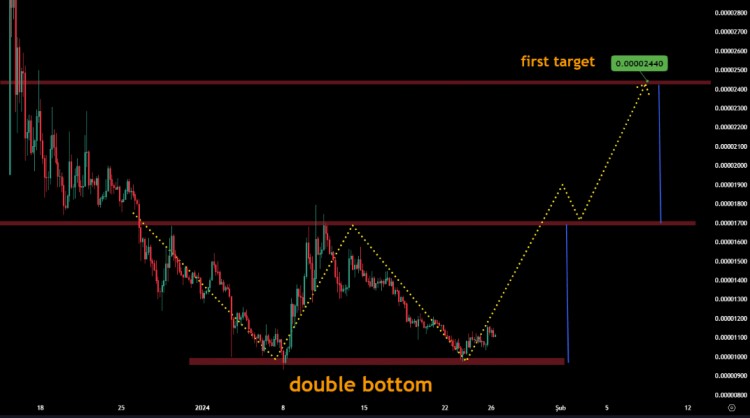

When we examine the chart below, it is observed that it has executed a double bottom movement. This formation is a bullish pattern indicating a reversal of the downward trend in financial markets. Hence, the target of this formation should also be monitored.

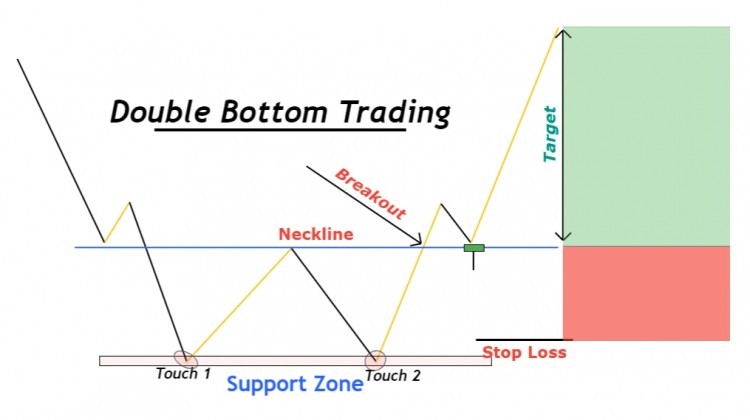

A "Double Bottom" formation is a technical chart pattern commonly observed in financial markets, particularly in stock trading and other asset markets. It is considered a reversal pattern, signaling a potential change in the prevailing trend from a downtrend to an uptrend. The Double Bottom pattern typically occurs after a prolonged downward movement in prices.

Here are the key characteristics of a Double Bottom formation:

Initial Downtrend: The price of the asset is in a downtrend, experiencing a series of lower lows.

First Trough (Bottom): The first low point in the price movement forms the first trough. This is where selling pressure has been strong, but it is followed by a moderate upward price correction.

Intermediate Uptrend: After the first trough, the price experiences a temporary rally or recovery, forming a peak before declining again. This rally is often less intense than the previous downtrend.

Second Trough (Bottom): The price declines again, forming a second trough at a similar level or slightly above the level of the first trough. The second trough typically indicates a test of the previous low, but the selling pressure is usually weaker.

Confirmation Uptrend: After the formation of the second trough, the price starts a more sustainable uptrend. The breakout above the intermediate peak (formed after the first trough) is considered confirmation of the Double Bottom pattern.

Traders and technical analysts often use the Double Bottom pattern to identify potential buying opportunities. The pattern suggests that the selling pressure has weakened, and buyers may be gaining control. The confirmation of the pattern is crucial, as it helps traders avoid false signals.

It's important to note that while the Double Bottom pattern can be a powerful signal, not all instances result in a trend reversal. Traders typically use additional technical indicators and analysis to support their decision-making. #BONK $DOGE $BONK $SHIB