时间:2024-02-01|浏览:378

I had watched the movie "Yellow Sea" many years ago, and I was used to the restrained violent aesthetics of Chinese directors. The scenes of people fighting hand to hand with each other and blood splattering made me depressed and sad. The people in "Yellow Sea" are all mad dogs carrying rabies virus, biting wildly in order to survive. Later, I really went to the Yellow Sea. The sea was gray and extremely cold, and the wind cut my face like a knife with a fishy smell. The small fishing boat followed the waves up and down like paper and could be overturned at any time. My feelings many years ago were released. This is my wandering hometown and my grave.

When violence becomes the main way to solve problems, crime no longer exists in the name of evil. This is the law of survival of the weak and the strong.

When fraud becomes a business model, victims often become perpetrators.

This is a market that rewards greed and hard work.

There are still many entrepreneurial teams in Shenzhen and Hangzhou. They are hidden in various low-key office buildings, without logos, no front desks, and even landlines. Having an office is all about not being considered a scam company when recruiting people. It seems to go back to the beginning of the story. When asked at a family gathering when returning to my hometown during the Chinese New Year, I would subconsciously say a career that everyone can accept. When all the ways to make money have been carved up, their goal in China is even clearer: they go to the sea to fish. The bigger the wind and waves, the more expensive the fish.

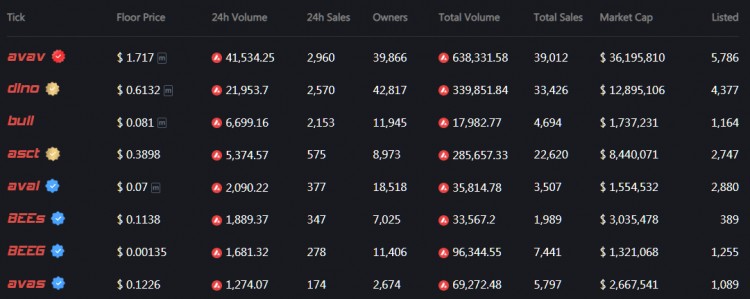

Shenzhen is keen on cash flow business, engaging in Jenga and researching money matryoshka games. Adapting to the rules, we basically set up an all-English social media team. Only a handful of people know the true background, and most of it is guesswork. When you find that a project suddenly appeared on a certain chain, its TVL reached the top three within a week. Major players entered the project a few months ago. There are all kinds of hot spots in the staking model. The community is abuzz, and analysis articles appear in major Chinese media. I checked the official website and didn’t see the main creative team. Congratulations, Brother Shenzhen is going to make you rich.

Friends from Hangzhou chose popular infrastructure construction, contributed code, wrote 20 projects, and bet on one in the bull market. This trip was not in vain. As for Beijing and Shanghai, there is nothing to say. A few funds still have offices or mobile personnel from overseas project parties. Everyone who needs to leave has left, and sometimes the party can’t even get together a table of hot pot. In the past, there were blooming flowers, but now we are speechless.

He said: I have never seen an industry with such a high tolerance for fraud.

"It is very insecure to start a business in this industry. Of course, since I have chosen this path, I cannot talk about safety. As a founder, I feel that I need to be like a demining soldier, first of all, not to blow up myself and the team. Secondly, investors, This is not a technology-first industry. We must go where the hot money is. The team cannot afford it and must achieve the goal in a limited period, otherwise it will be liquidated. You said that everyone should watch the US trading time every day. Institutional deposits and withdrawals, paying attention to US macroeconomic policies. He also claims that he wants to subvert the traditional financial order, don’t be ridiculous.”

"The ideal state is of course the hot spot in the middle of the track. Today's investors will directly ask you for data and plans to go public. Basically, you can't get money for equity. They only talk about currency prices and lock-up. When talking about equity here, just It's too unrealistic. Among those who claim to be focused on Level 1, do any of them only invest in equity? No." "A more perfect state is when the value is discovered by the community and driven purely by users. I won't bet on this probability, I don't believe it. This kind of perfection." "Looking better, the mainstream financial world has accepted this industry. But it has shut out many ordinary people, and the threshold for entrepreneurship has become higher and higher. What you say is high is relative. It's a scam. The cost is getting lower and lower. In northern Myanmar, you still have to hire security guards in the park. After so many years of market education in this industry, users’ tolerance for fraud is surprisingly high. From my perspective, technology is used It is here to solve problems, but it will not make the world a better place. But for the project side, you will basically get rewards for your investment. Technology, market, operations, users see sincerity and hard work, and the market will reward you. It doesn't matter if you get scolded or something like that, as long as you survive, it's a different story if you don't survive the bear market."

When fraud becomes a business model, victims often become perpetrators. It’s easy to see this cycle of deceit, the habituation and numbness laid bare. Going back nine years, friends who are entrepreneurs in Shanghai will never forget the scene of the first Vitalik road show. What I remember is a large plastic poster printed by a street printing company, several rows of office chairs, and a skinny V and a fat Chuxia Hu standing together. Some of the audience members changed their nationality after a few years, some lost everything in gambling, some returned to their original life trajectory, some were on the edge of the industry, and some became fraudsters. The reality is that the success you see will always be very, very rare. Hitting the bottom - knocking down - another round - killing all, such cool stories are only found in short skits, or in story meetings with KOLs.

Investors: Empty talk is misleading, embrace reality.

Changing fundamentals. “Many people will go bankrupt this year,” this is what he said when interviewing the head of a fund. Many people cheer for ETFs, unaware that the price has already been marked. You laugh at yourself that you were promoted from a bad speculator to a US stock trader, but you stepped into another foggy and dark forest without knowing it.

I thought of my friend’s comments a few days ago: If the blockchain becomes an alternative financial circle, then it will deviate from its original intention—to become an antidote to the failed financial system. An alternative financial circle has no value to the world. True value will only flow to new places of hope.

In the past, the ideal role of an investor was to support the horse and give him a ride, but in the money market, this model is completely inappropriate. Funds that have been working hard in the primary market for many years have quietly transformed, and the representative one is LD CAPITAL. Its secondary funds are in charge of Lou Jiyue. I simply asked Lou a question: "How do you feel about LD's layout in the secondary market compared to investing in the primary market in the past? In other words, what's the biggest difference between the two?" I got a slightly surprising answer.

She said: "I have never done Level 1. In fact, Level 2 is definitely more difficult."

I personally think that in the secondary market, buying and selling is relatively easy if it is not exposed on the chain. Lou replied with three crying emojis and added: "That's it."

The rumors, slander, and conspiracy theories faced by Level 2 employees are no less than those at Level 1. The professionalism requirements are very high.

Lou said: "The main reason is that it is difficult to do. This year will definitely be very volatile, and the US stock market here is also uncertain. If there is no ultra-high level this year, you may not be able to survive. As long as you can survive, the returns will be very high."

"There are many people who can analyze the data and get a 123, but that doesn't mean you are a master if you have a lot of data. Those who can ignore a lot of invalid junk information and correctly judge the mid-term trend are powerful. These masters are usually silent. (Done) I only know it after Level 2) My level is average, I didn’t understand anything before, but now I understand a little bit and I know I don’t know anything anymore.”

Lou is cautious and pragmatic in his attitude toward the secondary market.

There are also some investors who are eager to move to the second level, perhaps driven by anxiety to make the transition. Hot narratives have become too fast, and projects invested at high valuations have now been left out by the market. Especially this year, when Bitcoin Ecological Inscription and MEME became popular, they were launched fairly. Many hot projects with wealth effects have no VC involvement at all. Primary investment is sometimes glamorous on the surface, but in fact it has many pitfalls. If you suffer a loss, you can only break your teeth and swallow it in your stomach. A bunch of projects that I invested money in either died on the way, or their life or death is uncertain. Those responsible for the project will send an email to apologize, sorry we failed.

Even if the project won the first-tier exchange, a group of people sent private messages to congratulate them, thinking that they would be financially free with this project. In fact, the project team changed the terms and extended the unlocking period before listing on the exchange, and could only reap the book value. It often takes 8 years or more from investment to unlocking everything. After two rounds of bull and bear cycles, the final return may not be as good as high-quality assets such as BTC/ETH/SOL, which are secondary hoarding points during the bear market. "Good projects" are strong, and VCs have no say. During a dinner party, while we were drinking, the investor complained helplessly: He had invested more than tens of millions of dollars in total and had no "return" yet, and he wanted to find a project to defend his rights (but I was wearing a long gown and endured it).

Anonymous VC: No matter whether it is level one or level two, you will always have to withdraw and cash out in the end. When the market discovers or has verified it countless times that most people are not suitable for primary investment (there are still very accurate and good primary funds in this industry), it is wise to move to secondary investment. "Coin speculation" is also an important track and very professional. Your investment research capabilities, control of market trends, and analysis of macro and micro situations will all affect the results. The thing is, I feel less anxious. It is too passive when investing in the first level, and Asian funds can invest in too few good projects. Moreover, there is probably no pure equity investment in the current market.

Jayden (Greythorn): End of 2022. Because we found that primary investment is very different from the industry a few years ago. For us, on the one hand, projects with real technological innovations that are popular in the West have very high valuations, and it is difficult for us to participate. Second, we have invested in first-level projects many times. Due to various reasons, the project team changed SAFT and other nonsense, and did not give coins during the unlocking period. It is better to go directly to the second level. I also voted for Level 1, but the proportion was very small. They are more projects that come out of the developer community, and their mentality is more like "donation" in the early currency circle.

Lee (Xinhuo Asset Management): We will mainly focus more on the secondary level. Because we feel that the secondary market has better liquidity, better price discovery, and more transparent information. After entering the bear market in 2022, several leading asset management institutions collapsed, and market sentiment continued to decline. But in 2023, the market turned from bear to bull. Everyone saw the arrival of a new bull market cycle in 2024 and 25, so major institutions and asset management platforms are increasing investment in secondary investments. Invest in Level 1 in bear markets and Level 2 in bull markets. The cycle is short, the results are quick, and the price-performance ratio is higher.

Whether it is raising funds or investing, secondary funds are simpler than primary funds.

By giving cryptocurrencies higher “legitimacy”, Bitcoin spot ETFs have made crypto assets an attractive alternative asset when yields in the traditional world are declining and the situation is turbulent. Judging from the data disclosed this year, primary funds that have experienced cycles have moved to secondary funds, and traditional capital is also entering the market.

VCs outside the circle have also experienced several rounds of market education. In the early days, they threw money just like investing in the Internet, but later found that they were completely treated like pigs and killed. There are bad debts lying on the books, LPs have been drained of funds, and GPs have no shame to open the annual report PPT during the meeting.

Jack works for a first-tier USD fund and is starting to set up his own crypto secondary fund. He has invested in many Internet unicorn companies for many years and has been listed on Nasdaq and Hong Kong Stock Exchange. The founders who were once invested have become emerging high-net-worth individuals worth hundreds of millions/billions of dollars, and these people are all his potential LPs. His strategy is very simple. Fundraising mainly comes from the traditional world, including Internet upstarts and real estate veterans. Investment is mainly Beta, while using his own information advantages to earn part of Alpha.

As for the rate of return, he said he is not worried, not only because "the overall beta of the encryption industry has exceeded the rate of return of the traditional industry", but also because LPs may not care that much at all.

In his view, for some truly high-net-worth family offices, the core is asset allocation and they will not bet on a single type of asset. Most asset allocation categories are still fixed income (bonds), equity and real estate. Cryptocurrency is an alternative asset. For alternative assets, the amount of participating funds is small and has little impact on the entire asset portfolio, but they are not willing to miss it.

Therefore, what he meets is not the need to "make money", but "asset allocation", which can also be regarded as arbitrage in the traditional and crypto worlds.

Use benefits to make friends, and the benefits will be dispersed.

After talking to investors and project developers respectively, I found that the perspectives from different positions are very interesting.

There are not many investors and project parties who get along well with each other and achieve mutual success, maintaining the superficial peace. From the perspective of the project founder, he chose an extremely risky path. During the difficult financing period, he organized a team to lead employees, develop users, and survive the bear market. In his opinion, the money lying in the account and the logos of financial institutions and exchanges on the website are all deserved. When it comes to specific profit distribution, he will thank the VCs who invested money, and even cry with tears in his eyes. Looking at the investment agreement originally signed, "compliance with the terms" is already the greatest face given to investors.

Jasmine, founding partner of A&T Capital, published an article in November 2023. It has been more than half a year since A&T stopped actively investing. It has slowly shifted from focusing entirely on the primary market to primary and a half and secondary markets. Part of the reason is to prepare for exit. She believes that it is easier to operate a new primary fund than to incubate and develop a secondary fund.

In her view, “The community is getting stronger and stronger, and the call for Fair Launch is getting louder and louder. From the perspective of some scammy project parties, it is far easier to fool the community than to seek VC; from the perspective of some serious project parties, VC may not understand In my industry, rather than “wasting time” educating VCs, I would rather educate my potential users. There may also be less room left for Tier 1 VCs. "

VCs have figured it out. Instead of doing this, it is better for everyone to speculate in coins together. Quoting Jayden from Gray Thorn Capital again: Go directly to Level 2!

![[艾略特]Art Collectibles: Can Inflation Bring the Struggling Bitcoin Community Back Together? Crypt](/img/btc/10.jpeg)