时间:2024-01-02|浏览:347

10月16日,比特币大阳,刺穿“8·18”暴跌前期高点,开启新一轮上涨周期,从27000 USDT上涨至最高44000 USDT,最高累计涨幅超60 %。

与此同时,链上一个神秘地址(0x1dbbbc3fdb2c4fabd28fd9b84ed99ceb84bfbec5),从10月20日开始,已陆续获得Tether铸造的18.1亿USDT,并转入Kraken、Coinbase、OKX等合规交易所、运营节点并上涨时机本轮行情完美匹配,被认为是小牛本轮行情的“潜力引擎”之一。

OKLink链上的天眼数据(下同)

那么,这个神秘地址的具体购买情况和销售模式是怎样的呢? 背后可能是哪个组织,背后又隐藏着怎样的逻辑? 本文旨在利用OKLink(链上天眼等)、Arkham等链上数据分析工具对该地址进行深入探索。

50天,17.6亿USDT

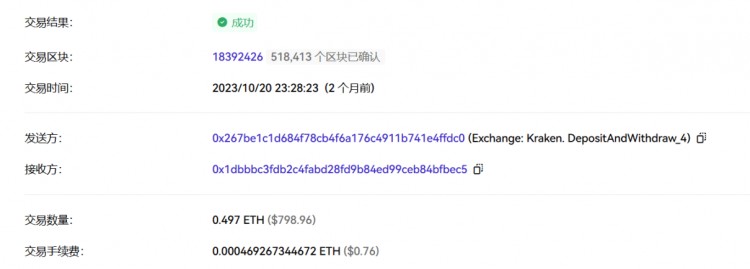

首先,OKLink浏览器数据显示,该地址初始手续费来源为2023年10月20日23:28:23从Kraken充值地址转入的0.497 ETH。

随后,根据OKLink链上天眼的统计,在手续费转入神秘地址22分钟后,原来的Kraken充值地址调用Tether USDT铸币合约,首次向神秘地址转入20 USDT。

理论上来说,此次小额铸造20 USDT应该是为了第一次USDT转账测试,以确保该神秘地址可以用于后续USDT转账。

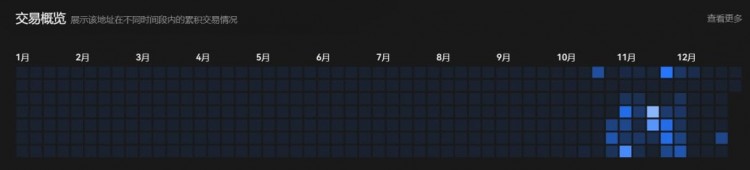

随后,从10月20日到12月9日,该神秘地址从Tether转出共计17.6亿USDT 38次,并向Kraken、Coinbase、OKX、Huobi等中心转出298次。 交换。

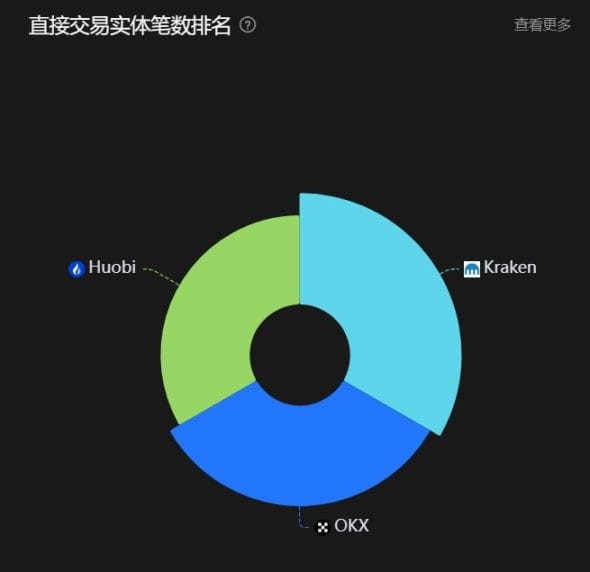

其中,天眼在OKLink链上整理的《直接交易主体排行榜》显示,Kraken以51笔交易排名第一,其次是OKX(25笔交易)和火币(2笔交易)。

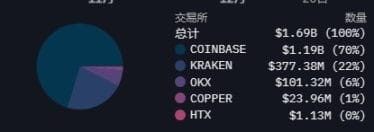

结合Arkham的补充数据,Coinbase存款金额排名第一:

这个神秘地址已向Coinbase存入约11.9亿美元,占比近70%;

这个神秘地址总共存入了Kraken 3.77亿美元,占比约20%;

这个神秘地址总共向OKX存入了1.01亿美元,占比约6%;

阿卡姆数据

交易信息背后的规则

接下来我们结合OKLink链上的天眼和Arkham来分析这个地址的交易数据背后隐藏的信息。

Close to North American schedules and focus on working days

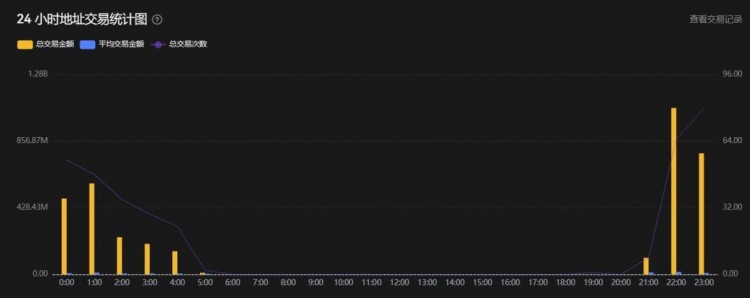

The "24-hour address transaction statistics chart" of the OKLink chain shows that the transaction time preference of the mysterious address is from 21:00 Beijing time to 5:00 the next day, especially between 22:00 and 1:00.

This also coincides perfectly with the US trading time - from early November to early March, US stocks adopt winter time, and the trading time is exactly 22:30-5:00 Beijing time.

From this perspective, there is a high probability that the mysterious address is a trading institution that adopts the North American trading market routine.

At the same time, if you make statistics based on coordinates in North America, you will find that from a date perspective, all transactions happen to be concentrated during the working days from Monday to Friday, which further verifies the feasibility of this guess:

There were a total of 347 transactions, of which there were only 21 transactions on Saturday and Sunday, and as many as 326 transactions from Monday to Friday (the transactions on Saturday and Sunday do not rule out the time difference between Friday night and Monday morning).

During the same period, the main focus should be on buying BTC

Between October 20 and December 9, this address transferred a total of 1.76 billion BTC to the exchange via USDT, which perfectly matched the timing of the market rise - during the same period, the price of BTC rose from 27,000 USDT to a maximum of 44,000 USDT.

If the mysterious address is frequently transferred to the exchange, BTC will rise significantly in the next few days:

Taking November 7th and 8th as an example, the mysterious address transferred a total of 30 USDT to the exchange, and then BTC rose for 4 consecutive days, from 35,000 USDT to 37,300 USDT;

Taking November 28 to December 1 as an example, the mysterious address transferred a total of 55 USDT to the exchange, and then BTC rose for 5 consecutive days, from 37,700 USDT to 44,000 USDT;

But at the same time, ETH is relatively weak, and the exchange rate ratio of ETH/BTC fluctuates widely around 0.051-0.055.

Overall, the mysterious address's move coincided perfectly with the market's (especially) rising timing. After the move stopped on December 9, the market experienced a sharp drop on December 11, and has since fluctuated at a high level.

In comparison, this mysterious address can basically be determined to be one of the leaders of the spot market in this round of market. Every time the exchange is active, the market price rises, and when it is dormant, the price fluctuates/falls.

考虑到该地址原来的Gas资金来源为Kraken,交易对手仅为Coinbase、OKX、Kraken等合规机构,且如此大额的数十亿美元购买,基本可以确定不是币圈机构,但总部 传统机构位于北美,需要在香港等地设有办事处。

12月28日再次发生变化

值得注意的是,12月28日,在沉寂了20天之后,神秘地址终于再次出手,从Tether获得了5000万美元,而交易对手只有三个:Kraken、Bitgo、Coinbase。

在:

Kraken分三笔转账,累计金额达1300万USDT;

已向Bitgo转账3次,累计金额达到1000万USDT;

已向Coinbase转账3次,累计金额达到2700万USDT;

坎伯兰 DRW 落后吗?

阿卡姆赋予这个神秘地址的AI智能标签是“Cumberland DRW”。 坎伯兰 DRW 是谁?

Cumberland DRW作为一家位于芝加哥的衍生品交易公司,是DRW Trading Group的全资子公司,在芝加哥、伦敦、新加坡和香港设有办事处。 还与“北美作息”、“OKX”以及火币交易对手信息点匹配进行合作。

其中,专注于衍生品交易,包括期货、期权等衍生品。 它在加密货币交易方面也非常活跃,为机构客户提供交易、研究和托管服务。 根据 Cumberland DRW 网站的数据,该公司的资产管理规模约为 100 亿美元。

无论这个神秘地址的背后是谁,18.1亿美元的海量申购本身就揭示了一个重要信号,尤其是在叠加现货比特币ETF的时间节点日益临近的情况下,后续行动无疑非常有意义。