时间:2024-01-11|浏览:290

今天加密货币领域发生了什么:SEC 的 ETF 推文是否处于草案阶段? 分析师这么认为!

昨天,随着 SEC 批准现货比特币 ETF 申请的最后期限临近,加密世界屏住了呼吸。 当 SEC 的官方 X 账户突然发推文“BTC ETF 获批!”时,价格飙升至 4.8 万美元。 但几分钟后这条推文就消失了,詹斯勒否认有任何突破。 事实证明,该账户被黑客入侵,导致价格暴跌。

今天,我们的目标是通过我们对顶级加密货币新闻的综述,在混乱中提供一些理智。

总而言之:

SEC 账户被黑,BTC 坐过山车

预期 ETF 批准的影响

离职的 Evmos 联合创始人返还 760 万美元️

AI币正在崛起

新加坡张开双臂欢迎加密货币

现在让我们更深入地探讨每个标题——从 SEC 的错误开始,导致比特币陷入疯狂……

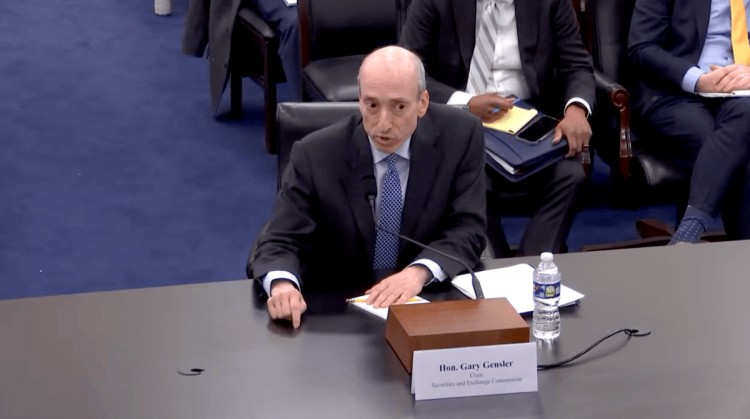

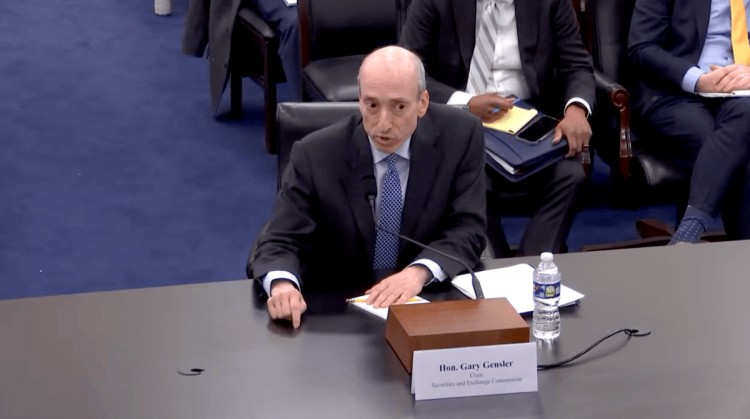

SEC 的错误

昨天,当 SEC 的官方 X 账户突然投下一枚禁忌炸弹时,一场混乱海啸席卷了加密推特:

“BTC ETF 获批!”

但几分钟后这条推文就消失了,让社区陷入阴谋混乱。

Gensler 本人跳到网上否认 ETF 的任何突破,同时提出了“未经授权的访问”的问题。

一些人推测推文草稿是由浏览私人文件夹的流氓员工或黑客泄露的。

一些观察人士认为,泄露的推文可能是美国证券交易委员会安排在明天发布的,但今天却错误地提前发布了。

彭博社的知名分析师埃里克·巴尔丘纳斯 (Eric Balchunas) 指出,所使用的语言本质上非常“SEC 风格”,表明这很可能是一份内部草案。 因此,在他看来,有人可能只是搞砸了日历安排,导致 hopium 过早 24 小时到达互联网。

不管怎样,交易员们在混乱中坐上了猛烈的过山车。 随着买单涌入,比特币飙升至 4.8 万美元。但一旦澄清消除了这种氛围,比特币就迅速回落至 4.5 万美元。

那么这个账号真的被黑了吗? 还有谁同意埃里克的观点? 阅读完整的故事!

预期 ETF 批准的影响

K33 Research 表示,一旦 SEC 支持比特币现货 ETF,上周的剧烈去杠杆化可能已经为顺利航行扫清了道路。

1 月 2 日至 6 日期间,永续资金转为中性,未平仓合约减少了 12%。

这表明市场有更坚实的基础来消化任何现货 ETF 裁决,而无需进行级联清算。

此外,根据 CME 60 亿美元的未平仓合约数据,机构乐观情绪持续接近历史高位。

那么当美国证券交易委员会宣布其裁决时,价格不会出现上涨和下跌吗? 阅读完整的故事!

这就是我们的每日一词!

这就是“级联清算”!

Cascading liquidations refer to a scenario in crypto trading when a series of forced liquidations of leveraged positions occur successively, triggering further liquidations. This happens when prices experience significant downside volatility.

As prices rapidly decline, leveraged long positions start becoming underwater, meaning the collateral deposited is no longer sufficient to meet the maintenance margin requirements on exchanges. This prompts exchanges to forcefully close out these positions to recoup funds.

These forced liquidations automatically trigger market sell orders that push prices even lower.

As prices continue to drop from these liquidations, more and more long positions are knocked out due to insufficient collateral, creating a cascading effect of successive liquidations being triggered.

The rapid dumping of leveraged positions creates substantial selling pressure, exacerbating price declines and volatility.

But what exactly triggers this event? Read more!

Now back to our daily stories!

It’s Time for AI Coins!

Per Binance Research, AI coins beat almost every category - second only to white-hot Ethereum layer 2 ecosystems.

When you filter noise from meme mania, AI coin gains hit 185%.

So which AI coins truly went interstellar?

Fetch.AI exploded by 659% in 2023 thanks to its decentralized machine-learning marketplace and autonomous agent network.

And SingularityNET wasn't far behind after its AI services emporium on Ethereum pumped 616%.

Clearly, AI adoption accelerated into light speed across crypto last year! Which other AI coins showed outstanding performance? Read the full story!

Evmos Co-Founder’s Good Faith ️

Departed co-founder Akash Khosla resurfaced bearing gifts of 59 million EVMOS tokens worth $7.6 million!

Khosla's peace offering aims to redistribute influence to current core contributors. Part of broader initiatives to bolster community trust and stabilize token value.

This Olive branch closure comes after Khosla's sudden departure last year over operational disagreements.

Will this token surrender help the price of EVMOS tokens? Read the full story!

Singapore’s Making Moves

Major regulatory moves by leading crypto custodian BitGo this week. The platform secured preliminary approval for a payments license from Singapore's central bank.

This stamp positions BitGo's Singapore outfit for full clearance to enable crypto services within the city-state. We're talking exchange offerings, web3 remittances, institutional client asset support and beyond!

Singapore is making moves to become the haven for crypto companies. Read the full story!

That wraps up today's top crypto headlines. See you tomorrow for more updates from this rapidly evolving space!

Before you head out, take a sec to sign up for our newsletter below, and we'll deliver the hottest crypto stories straight to your inbox!

Subscribe to Our Newsletter!

![[加密365]这是今天加密货币领域发生的事情](/img/20240126/3290688-1.jpg)

![[加密艺术家]抵押不足贷款是否可能放手?野猫是这么认为的](/img/20240106/3144819-1.jpg)

![[加密艺术家]抵押不足贷款是否可能放手?野猫是这么认为的](/img/20240106/3144819-1.jpg)