时间:2024-01-30|浏览:260

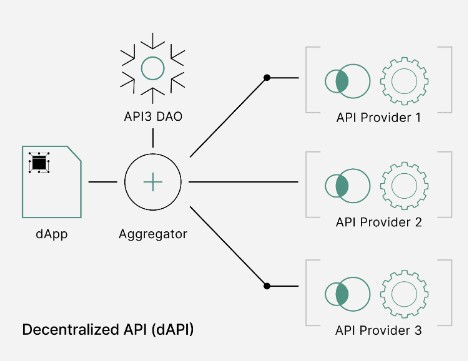

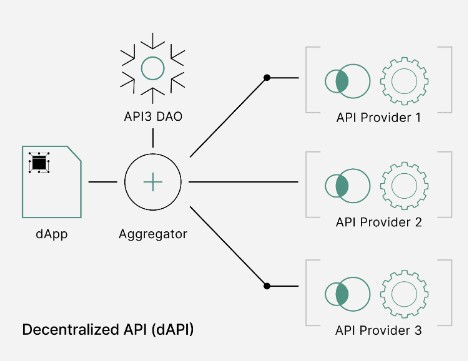

Airnode is the core component of the API3 project, which allows API providers to easily run their own oracle nodes and directly publish data sources (dAPIs) without middlemen to any on-chain decentralized applications (dApp) interested in its services. Airnode's design philosophy is to provide API providers with almost zero-maintenance deployment capabilities. It aims to drive meaningful use cases by simplifying the connection of APIs to the blockchain, giving smart contract engineers easy access to the data they need.

Airnode is designed as a lightweight wrapper for Web APIs, enabling it to communicate with smart contract platforms without incurring any overhead or payment token friction. Airnode's design is based on the "set and forget" principle, requiring no specific operating knowledge and providing excellent resistance to permanent downtime and operational intervention. The service is built on on-demand pricing, allowing node operators to pay only for node usage, offering API providers the possibility to run oracles for free.

dAPIs (Decentralized APIs) are a key component of the API3 project and are on-chain data sources provided by first-party oracles owned and operated by the API providers themselves. These data sources are continuously updated using signed data by first-party oracles, allowing dApp owners to read the on-chain value of any dAPI in real time. dAPIs consist of a beacon or a set of beacons and are sometimes called first-party data sources because they originate from first-party oracles. At its core, dAPIs connect smart contracts to first-party data sources, providing greater security, cost efficiency, and scalability.

dAPIs are maintained and supported directly by the owners of the data, the API providers, effectively eliminating the third-party middlemen that other oracle solutions rely on. Its operation is efficient and flexible, and dAPIs are built on an on-demand pricing service, allowing API providers to run oracles for free and only start paying when they start generating revenue. It has a standardized, user-friendly interface: dAPIs have a standardized, user-friendly interface that aims to abstract away technical implementation.

Oracle Extractable Value (OEV) is a subset of MEV and refers to those extractable values associated with Oracle services. In DeFi applications, data provided by oracles are often used to determine the price of assets, perform liquidation, or other key functions. When oracles update the data they provide to smart contracts, these updates can affect the state of DeFi markets, creating opportunities for arbitrage or liquidation. When oracle updates occur, certain participants may attempt to exploit these opportunities to extract value from market participants such as liquidity providers. According to Flashbots statistics, the revenue captured by MEV reaches hundreds of millions of dollars every year.

OEV network is a zk rollup network customized with Polygon CDK, which is used to capture OEV in all Dapps using API3 data sources. OEV network is a specialized order flow auction platform that sells the right to execute updates to specific data sources for a specific Dapp to the highest bidder. Winners pay when data source updates are performed, allowing decentralized applications to receive revenue immediately on their native chain. This all runs as an adjunct to our regular data sources, meaning decentralized applications using API3 data sources will be able to simply enable the OEV network and start earning revenue.

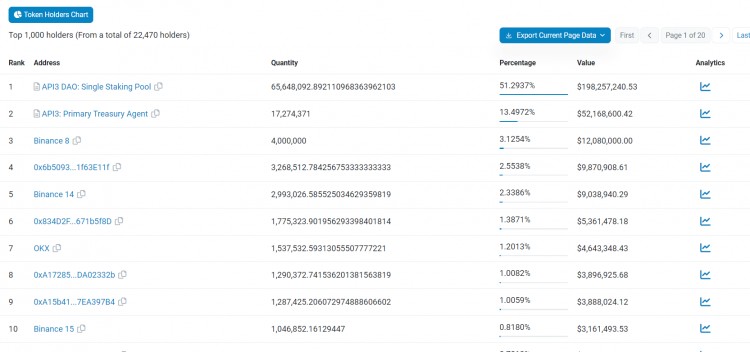

The total supply of API3 is 127 million, the circulating supply is 1.02, and the circulating market value is US$300 million.

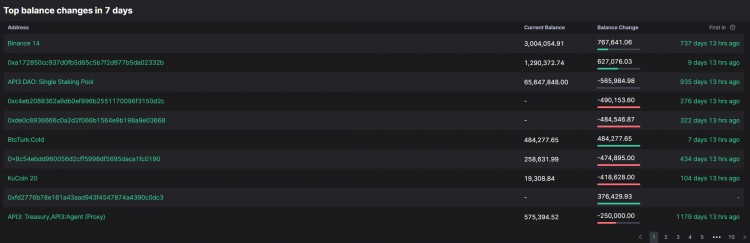

Judging from the on-chain data, the largest position is the API3 pledge pool.

Position address 1: API3 pledge address

Position address 2: National Treasury

Position address 3: Binance cold wallet

Position address 4: transferred in December 2022, not moved

Position address 5: Binance wallet

Position address 6: coinbase wallet

Position address 7: ok wallet

Position address 8: coinbase wallet

Position address 9: upbit wallet

Position address 10: Binance wallet

Judging from the on-chain data, up to 65.54 million API3s are placed in the pledge pool, and there are approximately 13.86 million tokens in the exchange. The two items add up to 79 million pieces. Apart from these two items, there are not many chips circulating outside.

Since the currency price has fluctuated violently in the past two days, we check the address changes in the last seven days from the scope. The largest inflow was from the recharge address of Binance 14, with a total net inflow of 760,000 coins, and the address on the second day of inflow was the coinbase wallet, with an inflow of 627,000 coins. The largest outflow was from pledge addresses, with a total of 560,000 coins flowing out.

But in general, although there is inflow and outflow, the overall volume is not large. In particular, 560,000 pieces were outflowed from the pledge wallet, which is less than 1% compared to the total number of pledges of 65.54 million. It can be said that there was no severe selling pressure during the sudden pullback in the past two days.

You can see the specific situation

https://www.scopescan.ai/token/0x0b38210ea11411557c13457d4da7dc6ea731b88a?network=eth&pp=ryxc

![[艾略特]Art Collectibles: Can Inflation Bring the Struggling Bitcoin Community Back Together? Crypt](/img/btc/14.jpeg)