时间:2024-02-05|浏览:280

The much-anticipated Bitcoin spot ETF was finally stolen after the SEC’s Twitter account was stolen. The chairman used his personal account to tweet before approval, reluctantly shouting to the people: Bitcoin is not a good thing. I approved it involuntarily. Passed with great breath!

As in my previous analysis, the adoption of the Bitcoin ETF will not be Wall Street bankers rushing into the market to take over small retail investors, but more like a recruitment order from traditional finance to the crypto market. The good side is that after 15 years of underground And the gray journey, Bitcoin finally came to the fore and became an asset recognized in the international capital market. However, after it was officially passed, the market did not see a violent rise as many traders imagined. Instead, under the selling orders of more than 10,000 Bitcoins per day by Grayscale, Shengsheng went from nearly 50,000 to 39,000. Knife, retail investors who need to look forward to the bull market were caught off guard.

Many traders who have not experienced a complete bull and bear experience, or who have added leverage, have developed severe price anxiety and are staring at Grayscale’s operational changes every day. The sharp fall of Bitcoin has further triggered the rise of altcoins. The sharp decline, such as this wave of Mavericks' main inscription series, has basically returned to zero or is on the way to zero! A large number of cryptocurrencies are weak or oversold in the short term.

However, I smell a different smell in this tragic land. Combining various macro policies and micro operations, we may be able to take a closer look at the possible scenarios:

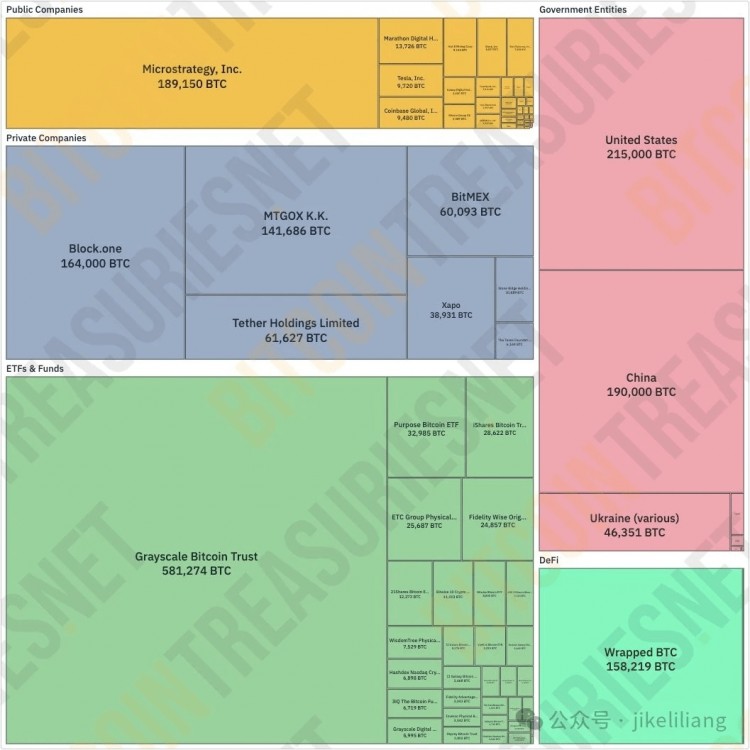

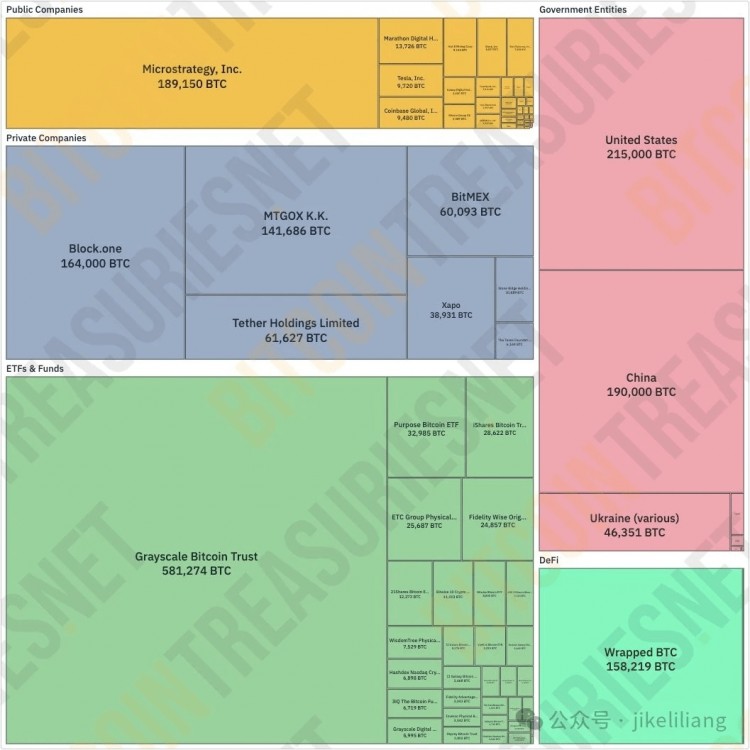

1. Listen to what they say and watch their actions. Shaking up positions is just for bleeding chips: After the adoption of the Bitcoin ETF, there was a lot of feedback from the mainstream financial market, and we can also hear many voices, including the boss of Morgan who put Bitcoin The depreciation of the currency is useless, but we have truly seen that heavyweight players like BlackRock are continuing to buy at a voracious speed. Even the Bitcoin ETF has surpassed the silver ETF and became the The second largest ETF position after gold is a shining star in the US asset market. And these Wall Street giants, in addition to verbal belittling, have to bring out all available topics and deal with them all, from FTX liquidation to Mentougou compensation, and even the FBI has been dragged out. Recent documents have disclosed, The U.S. government will sell $130 million worth of Bitcoin seized from the Silk Road case!

The storm is about to come, and it seems that institutions and organizations around the world are selling Bitcoin. What we have seen recently in the on-chain data are giant whales moving the coins around. The confidence of the market has been greatly affected. The leeks are very angry. You have messed up the good bull market. Putting aside all the noise in the market and returning to the essence, we can clearly see that all actions have one purpose, to bring down the price of Bitcoin, we want to get on board! These predators must try their best to absorb enough chips at the lowest price they can accept. Then will they have as much control over the market as they do in the U.S. stock market? Of course it's impossible, otherwise institutions wouldn't go to such trouble. Bitcoin's natural design is anti-centralized control. Even if it's as powerful as Wall Street, it would be difficult to control it. It can only affect the market at the level of the resources they can use. In particular, it affects retail investors and hand over bleeding chips. After all, all Bitcoins held by centralized organizations that can be verified only account for 10% of the entire market.

2. Why are they so anxious? Maybe there is a big problem with the US dollar: From the words and deeds of Wall Street bosses, we can read one word: Urgent, the Bitcoin spot ETF has been noisy for so many years, and on this day, it is urged Even before it was approved, even the officials who approved it had to speak out individually to denounce themselves. It seemed that they were being pushed by a force and had to do it. Why? Because this force is the financial capitalists in the United States, and the reason why they are anxious is, in my opinion, only one thing, and that is the issue of the US dollar. We must first understand that the natural rival of Bitcoin as an asset is the US dollar. The original intention of its birth was to oppose the central bank and print money. This is why Satoshi Nakamoto designed it as a currency with a total amount of 210 million and constant deflation. model reasons. And what’s wrong with the U.S. dollar? To put it simply, the U.S. dollar may be about to burst. Flooding liquidity will have a huge impact on financial capital, so financial capitalists are the most nervous. Why do I analyze this way? Let’s make an analogy. Suppose the US dollar is the Yellow River, and the United States is the source of the Yellow River. It continuously adds water at the source. The river flows eastward to the sea and to all parts of the world. In the middle reaches, due to the sedimentation of river sand, the river bed continues to rise, so The dams were continuously raised, and finally a magical above-ground river was formed, that is, the river was much higher than the city. It would be fine if it stayed like this, but suddenly one day, water had to be added upstream, and a challenger appeared downstream and deliberately blocked the river. Then it is only a matter of time before the river bank collapses. “Printing dollars is adding water, constantly raising interest rates is building embankments, and what a certain rabbit is doing is blocking the river downstream. The United States has printed too many U.S. dollars. So far, the scale of U.S. debt has reached an astonishing 34.1 trillion U.S. dollars, and it is still growing rapidly. In 2020 alone, the United States has made M2 the same size as M1! In other words, the current assets of the United States are basically printed in US dollars!

This is an extremely scary thing. In the past, the United States could solve it through the tide of the dollar. It raised interest rates to raise the dam, and at the same time let the sea water pour in, absorbing all the assets of countries with loose financial supervision and unhealthy economic structures in the world, such as Ukraine, which went bankrupt this time. Argentina and the like, and then wait until they are full, then start the printing mode crazily, increase the water supply, pour water into all parts of the world, buy high-quality assets at the bottom, and wait for the next tidal harvest. For such a huge amount of printing this time, according to the previous script, a big fat sheep must be able to fill in the blanks. Unfortunately, the big fat sheep was too alert and closed the door tightly to prevent leakage, causing the tidal flow to stop, and then the problem arose. The interest rate hike was originally intended to absorb water back, but the water could not be returned, and only a few lambs were killed. Then, because of the interest rate hike, domestic inflation became serious, and the price of gasoline soared by 68%, and the people complained. Embarrassment is the second most embarrassing thing. The most embarrassing thing is that now the target fat sheep can't do it, and the sheep that the global village can do have all been messed up. If we tighten the interest rate, our own embankment will probably collapse first, and the flood will flood our land. , so why have the hawks stopped being hawks recently and started engaging in expectation management again? Why are they cutting interest rates! And this time, if we continue to print money, there is a high probability that the U.S. debt will default, which means that Americans will not be able to repay their debts. This is basically a nuclear bomb for the financial market. If it happens, the United States will default on its debts since World War II. All the world influence that has been established may be wiped out overnight. The U.S. dollar may also experience a relatively large depreciation. The worst thing is that Trump, who has been polarized at this time, is very likely to be re-elected. With his America First strategy and businessman methods, he will not be able to settle accounts without counting. The American redneck in question will probably be happy to make a lot of money. Spring River Plumbing Duck Prophet, Wall Street, which is most sensitive to financial currencies, is the most sensitive to all this. In this case, Bitcoin has naturally entered the field of vision, with a constant total amount and overall deflation, and the value foundation has been paved for more than ten years. , the flow is more convenient, the harvest is also more convenient, and it is still played by a large group of retail investors or low-end financial players. In the eyes of Wall Street predators, it is just like college students and elementary school students going to school together, so let Bitcoin be legalized in the United States as soon as possible , grasping enough chips as soon as possible and opening up the channel between the US assets and the encryption market as soon as possible have become the most urgent issues facing bankers.So why before it is passed, there are still many big Vs guessing that it will not pass. This is a typical case of blinding the eye. To put it harshly, let alone the SEC at this time, even the old Biden does not dare to block Wall Street. After all, the United States really The owner is not in Washington.

3. Bitcoin is optimistic in the long term, but under pressure in the short term: Many leeks always like to stare at the K-line for 15 minutes when looking at the market. They don’t even cover a coin, and they are frightened and sell quickly after a piece of news. This kind of leeks is ugly to say the least. To fuel the market, our real holders must take a long-term view, and understand the real voice beyond the market noise. From various signs, we can conclude that Bitcoin will surely grow. In my opinion, Bitcoin ETF solves two big problems. One is the legal endorsement of Bitcoin. Although the SEC has repeatedly emphasized that although they have passed the ETF, it does not mean that they endorse Bitcoin. This is a screw-up attitude. It’s simply funny. Whether you like it or not, the endorsement is a foregone conclusion. Bitcoin’s 15-year underground gray journey is over. Legally speaking, it has become a legal and compliant asset. Although it has been done in some small countries before, it is not the same as the United States. The endorsement is still far behind. From now on, BTC must have a place in the world's major asset categories. The second is to open up the channel for large amounts of fiat currencies to enter and exit the crypto market. Although the ETF adopts a sandbox mechanism and users do not directly touch Bitcoin, the ultimate target is still Bitcoin. In the past, there was a gap between large amounts of fiat currencies and the crypto market. There is a certain degree of difficulty, and ETF reduces this difficulty to 0, and entering and exiting the crypto market will be very smooth. The magnitude of funds in the crypto market will not be the same in the future as it has been in the past.

And ETF is the best encryption advertisement for the general public. Through education and promotion by large institutions, more people and capital will become interested in Bitcoin, and more goods and services will accept the circulation of cryptocurrency. In the context of high inflation or even flooding of the US dollar, this trend will become more intense. Overall, the Bitcoin and crypto markets will develop better and better in the long term. The future is bright, but the road is tortuous. In the short term or even the medium term, the Bitcoin and crypto markets are likely to fluctuate and rise. Especially in the short term, institutions must use all their resources to influence prices, disappointing and despairing retail investors holding Bitcoin, and ultimately unable to bear it. In the case of bleeding, give up the chips in your hand, so why do some people say that 80% of retail investors will be shaken off in this bull market.

4. Pay close attention to the actions of the Federal Reserve: Don’t read the gossip when doing transactions. What you need to pay most attention to is the news from authoritative institutions of your opponent, such as the Federal Reserve. Many people say they can’t understand it. Lao Bao talks so fast. You have to read it word by word. It is not easy for you to understand Lao Bao! Behind the scenes, there are capitalists with guns pointed at them. If you say the wrong thing, your life will be lost. Moreover, these capitalists are not all in the same wave. Some are engaged in transnational finance, and some are engaged in industrial technology, and their demands are different, so we analyze Lao Bao’s speech. , to combine various scenarios. For example, some time ago, several banks related to the currency circle collapsed. The Federal Reserve, which had been hawkish for a long time, immediately became intimidated and launched a targeted and targeted special release of BTFP to extend the lives of the banks. Then Lei Gang from the banking industry pressed on, and he had to meet the needs of domestic votes, suppress inflation, and see if he could still move the big fat sheep on the other side. As a result, he just said that the Wall Street boss Just say that the current inflation level in the United States is fine, don't raise interest rates... Look at how difficult it is for Lao Bao. 2024 is an election year in the United States. If nothing major happens, the Federal Reserve may have to make peace this year. And Bob, the imperial framer, will do his best to manage expectations. If it is high, it will lower it a little. Shout out to the Eagle and hold on until the new master is determined in the general election, and only then can there be any big moves. But regardless of expectations, the sight of swollen rivers and high embankments shows that a huge collapse may not be far away. 2024 may really be a year of drastic changes, and the more chaotic and declining it is, the more it shows the leadership and preciousness of Bitcoin. It can be said that as long as there is no nuclear war, decentralized cryptocurrency will exist forever. If the development continues, as a leek, what you need is to continuously improve your knowledge, make your own choices before this epic change, and jump on the bus without hesitation!