时间:2024-02-24|浏览:277

(This article is reproduced from my personal Substack, you can read it on the Haodu version there)

Good morning, fellow angel investors

It’s time to talk about Cardano: As an OG project that was launched on the mainnet in 2017, many players in the currency circle should be familiar with it, and many are even $ADA token holders. In this article, let’s start with the fundamentals to see if Cardano is as good as everyone thinks, whether there are any developments worth looking forward to in 2024, and my currency price analysis of $ADA. This is a semi-public report (readers with free subscriptions can read the content before up to "Profitability"). Welcome to use paid subscription to support my report output If you like it, please like it, or leave me a message to give me feedback, the following text.

️ Note: This is my research and analysis, not investment advice. You must do your own homework before investing (DYOR). Any investment has risks! I will also disclose whether I hold a position in $ADA and my prediction of its currency price later in the article.

Article directory0.0 Cardano Project Introduction1.0 Cardano Team2.0 Cardano Products and Services3.0 Cardano Future Outlook4.0 Cardano Profitability5.0 Risks & Challenges of Cardano6.0 My predictions and thoughts ($ADA currency price)7.0 References

Cardano is a Layer 1 blockchain. If I had to describe it in one sentence, I would say: "The blockchain that values on-chain governance and decentralization the most." Compared with Ethereum's pursuit of ultimate security, Solana's pursuit of Ultimate Efficiency—Cardano pursues the goal of building a blockchain world that can develop steadily and that everyone can participate in.

Cardano is a POS blockchain that uses Ouroboros as the consensus mechanism (Polkadot and Mina later also chose to use this mechanism), and the TPS is about 10. One-sidedly, 10 feels very slow. However, Cardano’s accounting system (EUTXO) allows users to package multiple transactions into one and send them out, so the actual speed is much higher than 10. With Cardano’s Layer2 upgrade (Hydra), theoretically TPS will be able to reach about 3M.

Another interesting point is that the development of the Cardano blockchain is developed around the form of "scientific research".

What is the "scientific research" form? To put it simply, every major development of Cardano’s blockchain requires Peer Review (multi-party review) by the engineering team, mathematicians, and scientists before it can be developed. They believe this format helps reduce coding errors and enhances the resilience of the blockchain.

This method is quite novel, but its shortcoming is also obvious: "slow". As a blockchain that was launched in 2017, it should have a first-mover advantage, but it only has smart contract functions in 2021 (a full 4 years!). As a result, the DeFi maturity and total TVL on the chain are now compared to Several other chains have no special advantages (we will mention these later in the report).

To see whether the project will be successful, the team is the key. Let’s first take a look at Cardano’s team, including project teams, investment institutions, partners, and communities.

1.1 Project Team

Cardano was founded in 2015 by Charles Hoskinson and Jeremy Wood, both of whom were core members of the Ethereum team. Here we mainly look at Charles Hoskinson - he is the face of Cardano and an OG figure in the blockchain field.

Charles Hoskinson graduated from CU Boulder in Colorado, USA (Master of Mathematics). He was one of the original eight founders of Ethereum. He also served as the CEO of the Ethereum Foundation. Finally, in 2014 due to disagreements with Vitalik, he Choose to leave Ethereum and create Cardano. It is said that the reason for the quarrel is that Charles wants to turn Ethereum into a for-profit organization, while the team headed by Vitalik believes that Ethereum should continue to maintain its original (non-profit) form.

Charles's own technical strength is not as strong as Gavin Wood (Founder of Polkadot) and Vitalik Buterin (Founder of Ethereum). I feel that he is a more marketing and management-oriented talent. In addition, Charles often broadcasts live on his personal YouTube to update the community on Cardano’s current progress and partners. He is a down-to-earth and very likeable founder.

There are three main teams behind the Cardano blockchain - IOG (Input Output Global), EMURGO, and Cardano Foundation.

IOG: The engineering team behind Cardano, headquartered in the United States, is led by Charlies Hoskinson and is responsible for designing, building and maintaining the Cardano blockchain. There are currently about 300 people.

EMURGO: The for-profit organization behind Carano, headquartered in Singapore, is mainly responsible for developing, supporting and incubating business opportunities, and helping to integrate businesses into the Cardano ecosystem. Currently there are about 50 people

Cardano Foundation: Cardano is a non-profit organization located in Switzerland, mainly responsible for developing various applications of the Cardano ecosystem.

The three teams work together in a division of labor, and each received a certain percentage of $ADA tokens as start-up capital during the ICO period. At present, the development of Cardano is still decided by these three, but as Cardano continues to develop towards decentralization (the key update is CIP-1694, expected to occur this year), these three institutions will abdicate and be controlled by the community. Cardano Vault leads the trend of blockchain with on-chain governance

1.2 VC investment institutions and investors

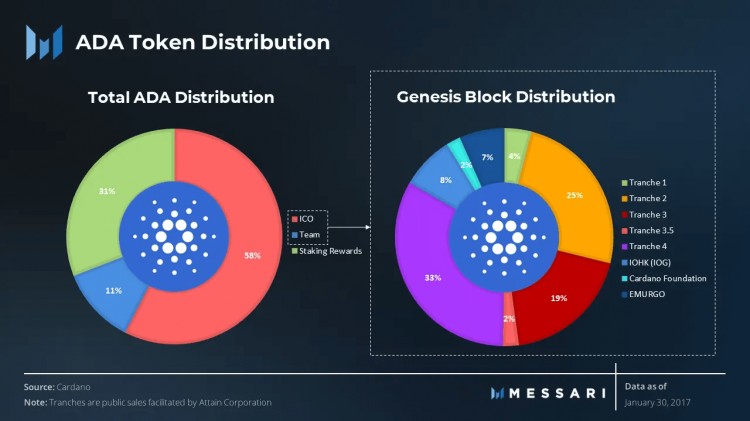

There is no large VC investment behind Cardano, and the method of raising funds is mainly through ICO (Initial Coin Offering). This fair issuance method avoids the emergence of giant whales to a large extent and strengthens the decentralization of Cardano. According to data, Cardano has issued a total of 5 rounds of ICO, raising a total of $62.2M, accounting for about 58% of the total $ADA.

1.3 Partnership

Normally I would be very excited when writing this, not only because I like to see the cooperation between major projects, but this kind of information is usually very easy to find (projects like to tout this kind of cooperation news)... but Cardano’s official website does not have it Listing their partners, even the information on the Internet is very scattered and lacks updates. Here are some of the cooperation I found.

New Balance: The project name is called NB Realchain. This is a collaboration between the retail industry and blockchain. New Balance can use blockchain technology to verify the authenticity of the products sold. It’s just that this news that came out in 2019 has not been updated in 2024, so it is impossible to know whether the cooperation has been terminated.

IBM: Charles mentioned in his YouTube live broadcast that he would cooperate with IBM Research to build a distributed software system, but there is still no update on this news that came out in 2020.

Ethiopian Government: The project name is called Atala. Cardano will help Ethiopia build their digital ID card, asset system, and governance structure. It is a very anticipated cooperation, but it seems that it stopped updating 8 months ago.

COTI: It has built Cardano Pay and DJED stable currency on Cardano. It is one of Cardano’s important partners, but it seems to be worried about the speed of Cardano’s development. Recently, it has turned to cooperating with Ethereum to build Layer 2.

Polkadot: Cardano’s upcoming Partner chain will be built using Polkadot’s Substrate SDK to improve interoperability with the Polkadot ecosystem. The first chain is called Midnight (will be mentioned later)

Usually this kind of partnership is a good marketing tool for the blockchain itself, but Cardano seems not to pay much attention to this aspect. There are many project cooperations that I think are excellent (NB Realchain, Atala) not only have no official press releases, but even no official press releases at all. Follow-up updates

1.4 Communities/Users

When evaluating a community and the number of users, I like to look at two parts - social media influence and on-chain activity. The most proud part of Cardano is its strong community. We can see from the data whether this is really the case. Below I will compare several famous Laye1 blockchains so that everyone can see the difference.

Social Media Influence (As of 2/18/2024)

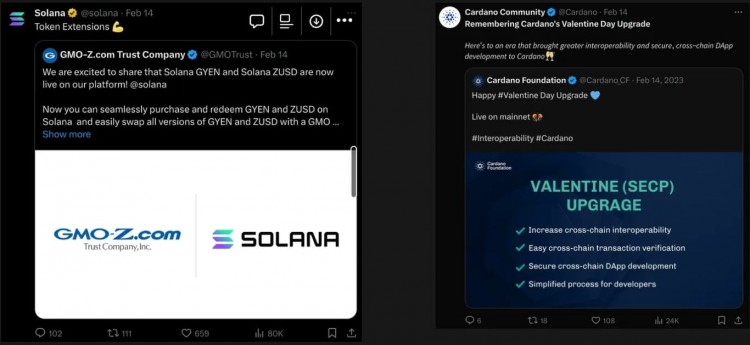

Let's look at community engagement next. I like to see the number of likes and retweets on posts on Twitter. I chose the same day and the same type of posts for comparison, and Cardano is still not as impressive as expected in terms of data.

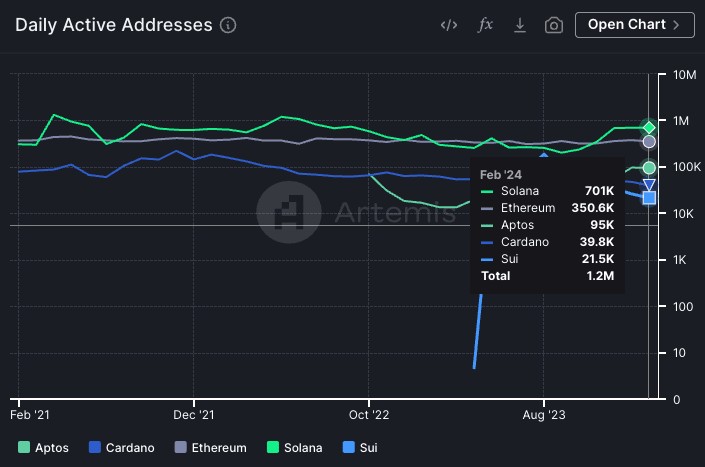

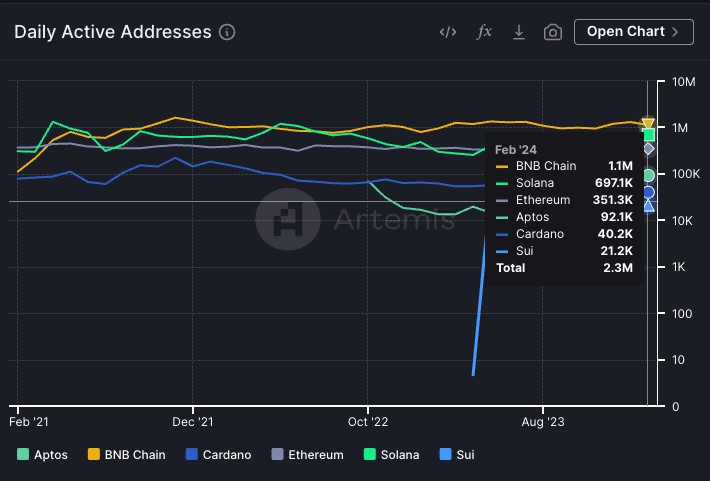

Activity level on the chain (number of active users in a single day):

Judging from various data, I don’t see much “cohesion” or “influence” in the Cardano community. The active usage on the chain is also ranked in the middle and lower reaches compared to other Layer1 blockchains.

Now, let’s look at products and services. I will analyze the core products and value proposition of the Cardano blockchain, and also see how Cardano performs in the Layer 1 track.

2.1 Core products and value proposition

Cardano's core product is the "Cardano Blockchain" as the underlying architecture, allowing Dapps developers to build their own applications on it. The more applications built on Cardano, the more users there will be, and the more users there will be, the more demand for $ADA tokens will increase.

What Cardano has to do is: attract more developers to develop programs and applications on Cardano. As long as developers and Dapps succeed, then Cardano will succeed

The question is: there are so many blockchains, as an application developer, why should you choose Cardano? Here we will talk about the value proposition that Cardano can bring, which is the characteristics that make it stand out from many blockchains. I think there are two main ones: "security" and "decentralization."

Security aspect

Cardano is developed using Peer Review and scientific research. Although it is slow, the results are actually very good. Since the launch of the Cardano mainnet, it has not been hacked or stopped producing blocks, and it is very stable. It is also worth mentioning that Cardano’s Native Token function allows tokens on the Cardano blockchain to be created without smart contracts, and there is no possibility of smart contracts being hacked.

Decentralization aspect

Cardano currently has 3,113 staking pools and approximately more than 6,000 nodes. Compared with other blockchains that are often managed through centralized servers, the servers used by Cardano nodes are more decentralized, which can greatly ensure the stability of the blockchain. In addition, in order to further strengthen decentralization, Cardano created the K parameter to encourage stakers to create more pledge pools, which means: compared to joining existing pledge pools, creating new ones will allow stakers to get more Staking rewards.

Compared with speed and performance, Cardano focuses on "decentralization" and "stability". Although these two things are valuable, the difficulty is that it is difficult to quantify their achievements with numbers (compared to performance = TPS). This makes Cardano lose some hype and attention, and does not excite users.

2.2 Market share and competitor analysis

When judging the market share of Layer 1 blockchains, I like to look at three numbers:

TVL (Total Locked Volume): How much money is on the chain

Number of active users (number of addresses): How many users are using applications on Cardano

DeFi Activity (Trading Volume): How much DEX trading volume is happening on the Cardano blockchain

Cardano’s current TVL is $414M, ranking tenth, even lower than Sui; but the devil is in the details: most of the TVL of public chains now comes from Liquid Staking, and Cardano because of its Due to the design of the blockchain, the liquidity-staking $ADA does not need to be locked, so it is not included in TVL, causing Cardano TVL to be relatively undervalued. If these assets pledged on the blockchain are included, Cardano’s TVL should be around $2B.

Let’s look at the number of active users and DeFi activity. I compared Cardano with several well-known public chains on the market (Aptos, BNB Chain, Ethereum, Solana, Sui). From the figure below, you can see Cardano’s active addresses In terms of quantity, it is about the same as Aptos and Sui, two emerging public chains. It belongs to the second echelon and is still some distance away from the first echelon (BNB and Solana).

In terms of the number of Dapps, Cardano currently has 52 decentralized applications built on it, which is relatively small compared to other chains (Solana has 230, Ethereum has 4495). Looking at the DEX transaction volume section, Cardano's data is similar to Aptos and Sui. Although it is not as high as the first level (Solana, Ethereum), it is not "no one uses it".

Cardano gives me the feeling of one word: "stable", emphasizing the slow progress of seeking truth from facts. It is not like the "rapid development, fast failure" promoted by ordinary startups. It seems that every step is taken very carefully, and they develop the blockchain with them. It is consistent with the "scientific research" philosophy used, which also results in its lack of any hot spots and popularity, and its DeFi activity is worrying.

The above is part of the report. Others include Cardano’s future prospects, narrative development, profitability... etc. You can go to my Substack to read it. Cardano can be said to be a breath of fresh air in the public chain track. Other public chains first speculate in coins and engage in projects, and then start to work on "decentralization" and "on-chain governance"; but Cardano directly does the opposite. Unexpectedly, Instead, it has created a powerful and stable blockchain architecture.

I’m cryptocurrency researcher Max ️, see you next time!

(This is forwarded to my personal Substack, welcome to read the full text there)