时间:2024-03-07|浏览:361

Summary:

•China has strictly banned cryptocurrency trading since September 2021, but interest in Bitcoin is increasing.

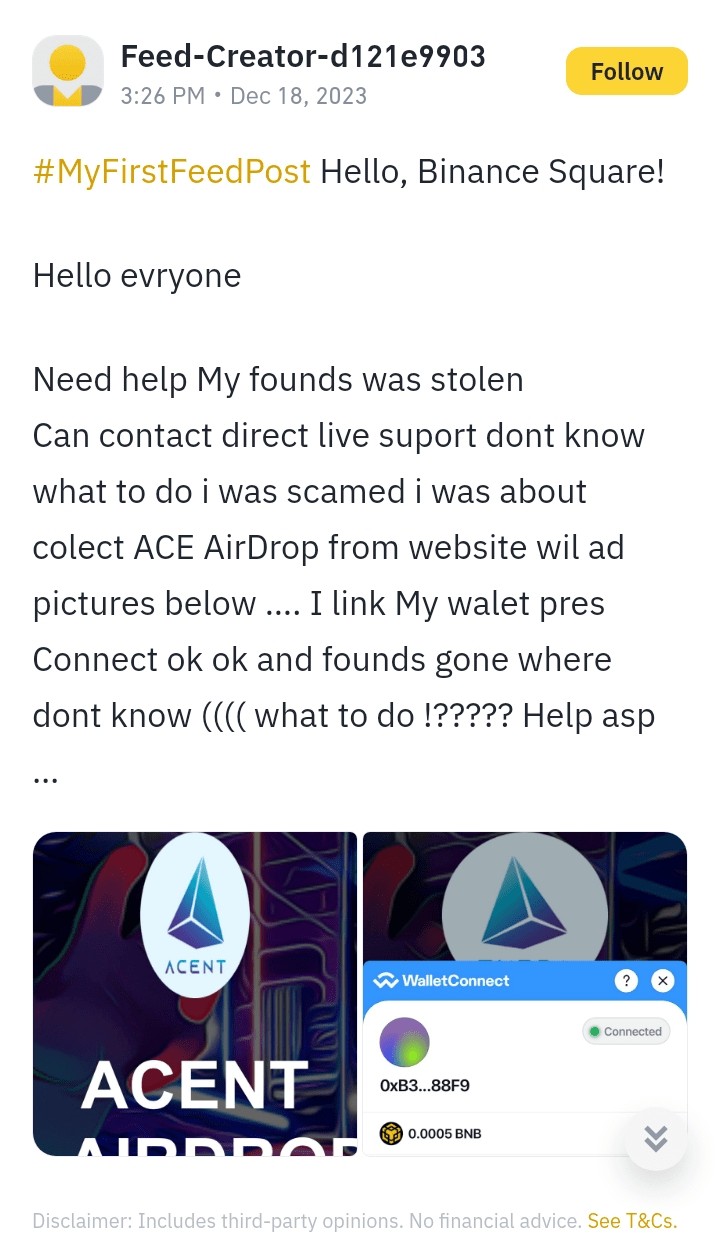

•Despite the ban, China’s underground cryptocurrency market still has huge trading volumes.

•Hong Kong is open to digital assets and faces an economic downturn pushing investors towards cryptocurrencies.

Recent developments have sparked discussion about whether China may reconsider its stance on cryptocurrency trading. Despite an explicit ban on cryptocurrency trading that has been in place since September 2021, there has been a noticeable increase in interest in cryptocurrencies within China. This is clearly proven by the growing trend of searching for Bitcoin on platforms such as Weibo and WeChat.

Now, some are discussing whether China will lift its ban on cryptocurrency trading, especially given Hong Kong’s more open attitude towards digital assets.

Will China lift its ban on cryptocurrencies?

China’s Economic Daily once again warned investors to remain wary of Bitcoin and related products. It underscored China's longstanding stance of prohibiting such transactions. Beijing lawyer Xiao Sa

This position was further emphasized by highlighting the fact that it is impossible for residents of mainland China to legally engage in cryptocurrency trading.

Xiao Sa said: “The approval of the Bitcoin ETF does not mean that cryptocurrencies will make breakthrough progress in the short term.”

Despite these restrictions, the appeal of cryptocurrencies has not diminished among Chinese investors. Bitcoin's stunning 58% gain so far this year, hitting new all-time highs, has reignited interest. This comes against the backdrop of China's overall economic slowdown and weak stock market. It has prompted individuals and financial institutions to explore cryptocurrency-related projects, especially in Hong Kong.

Despite the outright ban, China’s cryptocurrency market has shown remarkable resilience. With an estimated transaction volume of $86.4 billion between July 2022 and June 2023, the activity of the underground market is undeniable.

Techniques ranging from using gray market traders to taking advantage of Hong Kong’s relatively lax regulatory framework for digital asset trading have demonstrated investors’ ingenuity in responding to the ban.

Neeraj Agrawal of Coin Center said: “China appears to have been unsuccessful in banning cryptocurrency trading entirely, potentially putting its strict capital controls at risk.”

Financial institutions with stagnant domestic markets are increasingly looking to digital assets as an avenue for growth. Notably, Hong Kong-based subsidiaries of major Chinese financial institutions are delving deeper into the cryptocurrency space, a move that highlights a broader interest not just limited to individual investors but also at the institutional level.

The situation presents a complex picture. On the one hand, the Chinese government’s firm warnings and legal restrictions reflect a cautious attitude toward digital currencies, possibly due to concerns about financial stability and capital outflows. On the other hand, economic pressure and the lure of high cryptocurrency returns push individuals and institutions to creatively work around these restrictions.

A strong underground cryptocurrency market, coupled with the government’s hardline stance, has raised questions about the direction of China’s future cryptocurrency regulatory framework. While the official stance remains unchanged, developments in Hong Kong may pave the way for a more nuanced approach. #加密货币禁令 #中国

![[Crypto_Market_Analyst]XRP Forms Largest Bull Flag in Cryptocurrency Hist](/img/20231220/2993722-1.jpg)