时间:2024-03-15|浏览:336

Today, the price of Bitcoin fell below $67,000, with the 24-hour decline expanding to 8.18%.

Bitcoin prices have been on an upward trajectory recently, breaking through $73,000 on March 12, setting a new all-time high. In the following days, the price fluctuated above $70,000.

However, as of the morning of March 15, the price of Bitcoin suddenly fell sharply and fell below the key support level of $67,000. According to Tradingview data, as of now, the price of Bitcoin is $67,314, and the 24-hour decline has expanded to 8.18%.

According to data from Coinglass, the liquidation amount across the entire network reached US$220 million in the past 4 hours, of which the liquidation amount for long orders was US$186 million and the liquidation amount for short orders was US$34.14 million.

Why did it fall?

There are several reasons for the price drop. First of all, the community believes that the US Producer Price Index (PPI) data in February may be one of the important reasons affecting the trend of the crypto market. PPI rose by 0.6% month-on-month in February, higher than economists' expectations of 0.3%, which means that U.S. inflation still exists and the Federal Reserve may maintain high interest rates for a longer period of time.

Affected by this, major U.S. stock indexes fell. The S&P 500 fell 0.3%, the Dow Jones Industrial Average fell 0.4% and the tech-heavy Nasdaq Composite fell 0.3%. JPMorgan Chase said in a report that Bitcoin's record rise means that there is a growing bubble in risk assets, which may lead to the Federal Reserve delaying interest rate cuts later this year.

Therefore, the disclosure of US economic data naturally makes the capital market take a conservative attitude towards the short-term fluctuations of Bitcoin.

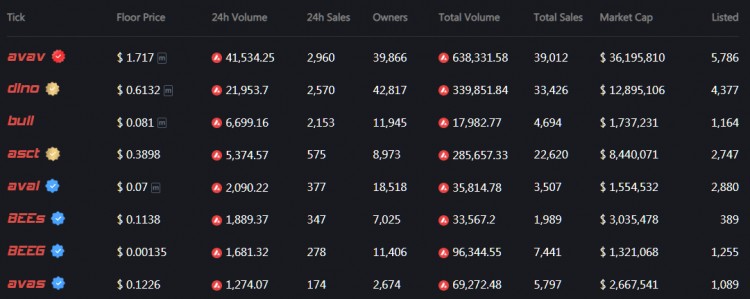

Secondly, the net outflow of ETFs exceeded US$200 million, and BlackRock IBIT also faced more challenges. According to data from farside investors, the current (non-final data) net outflow of the U.S. Bitcoin spot ETF has reached $212 million. BlackRock IBIT's net inflows yesterday would need to exceed $212 million to maintain overall net inflows.

Regarding the decline in Bitcoin prices, some analysts said that this is a normal market adjustment. For example, the founding partner of Matrixport believes that in a bull market, a healthy 5% flash crash is quite normal.

Markus, an analyst at Matrixport and a researcher at 10X Research, predicted that the price of Bitcoin could reach $125,000. Therefore, there is no need to worry too much about a sharp correction in a bull market, especially after Bitcoin hit all-time highs. Corrections are a natural phenomenon.

In the bull market, you don’t have a direction yet. You are still cutting meat and buying and selling all day long, so why not join a group together.

Hurry up and nod your avatar, follow me, and I will take you to the forefront of the bull market for free, and enjoy the atmosphere of eating pig's feet rice for free every day in the circle.