时间:2024-03-16|浏览:321

BTC market trend analysis: Will there be another sharp decline next week?

1. Thinking and observing

1. In fact, everyone has thought that it is not difficult to reach around US$80,000, but the main force seems to intend to delay this process.

2. In particular, everyone believes that the market price may rise to between US$75,000 and US$80,000; and once the price falls, it is expected to fall back to the US$60,000 area.

3. The main force can fully understand the expectations of retail investors, so it deliberately operates within a price range that neither rises nor falls, in order to tease us leeks.

4. If the main force operates in this range for a long time, everyone will have a feeling that the bull is over. Then once the main force thinks that the time is ripe, the main force will directly violently push the $80,000 mark, directly pushing it to $90,000 to $100,000.

2. Data analysis

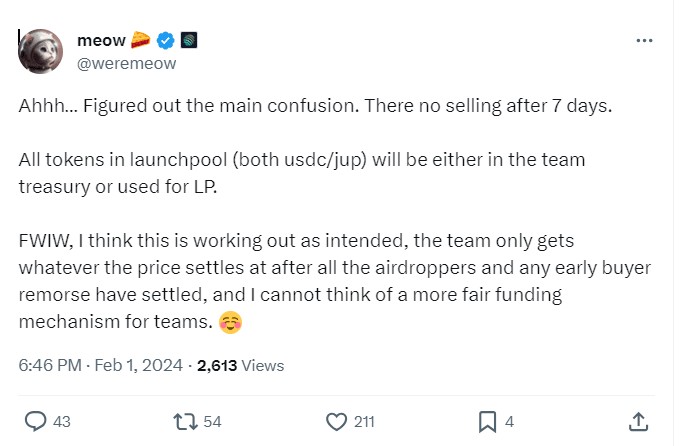

1. In last Friday’s trading, the net inflow amount of ETF BlackRock was less than 140 million US dollars, about 2,000 Bitcoins, which was a decrease of about one-third compared with the previous days, and was the highest in the past 8 transactions. It was the lowest level since yesterday, compared with declines on the previous two Fridays.

3. Technical analysis

1. The market fluctuated sideways over the weekend, and the price tried to break through the yellow pressure line upwards, but the first two attempts were unsuccessful. If it can break through this time, there is a high probability that the price will rise to around $72,000.

2. It may continue to try to hit the key resistance area near $78,000 next week. This area coincides with the super crab pattern in the weekly chart. Reaching this price may trigger a deeper whipsaw.

4. Personal analysis

1. At present, the price in the range of 68,600 to 68,800 US dollars has not yet been completely stable, and the following Monday and Tuesday may be a critical period to determine the future trend.

2. Script analysis:

Script 1: If the washout is completed, the main force may directly push the price to $72,000, then directly to $78,000, and then undergo a deep correction.

Script 2: Continue to wash the market and lower it to the $64,000 area. It may briefly touch around $58,000, prompting retail investors to exit, while institutions may absorb chips at this low level. (The possibility of this scenario is relatively low, because the main force is unlikely to provide an opportunity for leeks to re-enter at a low price, unless it is through several months of sideways trading or the end of the bull market)

Script 3: The sideways movement continues. The most ideal situation is for Bitcoin to fluctuate on the daily chart, using the current area as a storage area, not to directly break through 80,000, but to accumulate energy for the next round of main rise by oscillating back and forth. On the eve of the halving, it rushed directly to $100,000.

Final plan:

1. If the first scenario appears early next week, you can consider bargain hunting opportunities in short-term contracts or spot prices.

2. If it is the second scenario, we need to clean up the contract positions and wait for the long-term correction of profitable spot positions.