时间:2024-03-21|浏览:280

The market has fallen sharply recently, but that's not a big problem, because the previous rise was too sharp and it will inevitably correct, otherwise it will be unhealthy. After this wave of decline, it will rush back. From a long-term perspective, this is nothing. So we still have to come and continue to look at the projects, and learn as a puzzle every day. We can’t extricate ourselves. If we don’t look at the market, our mentality will be very good. What I’m talking about today is also a project that was launched some time ago, and it’s something that group members have been strongly insisting on talking about. So let’s talk about it, it’s nibiru, everyone calls him niubi. FDV, which currently has a market value of only 750 million, is also a cross-chain AMM. Today Let’s take a look.

Introduction

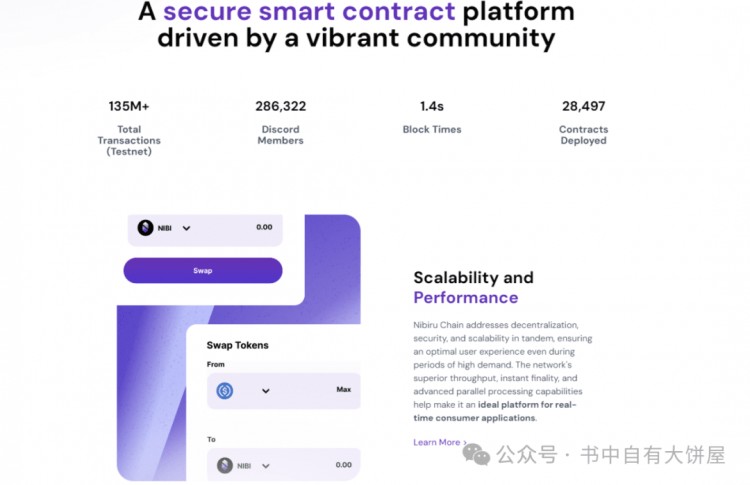

NibiruChain is a cosmos-based Layer 1 blockchain and smart contract ecosystem that provides superior throughput and unparalleled security. Nibiru combines leveraged derivatives trading, spot trading, staking and bonding curve liquidity, aiming to provide a seamless user experience, enabling users of more than 40 blockchains to use a set of composable decentralized applications Make leveraged trades. The Nibiru blockchain drives a decentralized and entirely on-chain perpetual futures exchange called NibiPerps. Nibiru attempts to solve some open problems with this exchange: minimizing latency during periods of high volatility. Minimize open interest imbalances. Increase the number of independent traders on the platform. Reduce Perpetual Fund Losses: One of the top priorities of the Nibiru Perpetual Contract Protocol is to keep funding rates for listed perpetual contracts consistent with all other perpetual futures exchanges, while monitoring arbitrage opportunities.

Architecture

An interoperable, multi-chain smart contract platform

CosmWasm

WebAssembly smart contracts built for the Cosmos ecosystem

Inter-chain communication (IBC)

Provides a connection bottom layer for multi-chain futures and enables permissionless transmission between blockchains.

consensus

Because it uses Tendermint’s consensus, the network can tolerate up to one-third of node failures (whether due to failure or malicious behavior).

If a network partition occurs and neither part has more than two-thirds of the nodes, the network will be stopped to prevent any forks or double-spends. This is because Tendermint prioritizes safety (consistency) over liveness (availability).

In the event of a node failure, the network will continue to operate as long as more than two-thirds of the remaining nodes are operational. If a failed node comes back online, it can synchronize with the rest of the network and resume its operations.

Key aspects of Tendermint core include:

Immediate Finality: Once a block is proposed and verified, it is committed to the blockchain and is immediately considered final. Users can be confident that their transactions are completed as soon as a block is created, without the need for multiple confirmations or wait times (unlike blockchains like Bitcoin and Ethereum). This improves user security.

State machine replication: Tendermint can build arbitrary applications through the Application Blockchain Interface (ABCI). This means it doesn’t just apply to cryptocurrencies, but to any decentralized application.

Byzantine Fault Tolerance: Tendermint uses a Byzantine Fault Tolerance (BFT) consensus protocol, specifically the Practical Byzantine Fault Tolerance (PBFT) method. This ensures that all nodes in the network agree on the order of transactions in the blockchain, even if up to a third of the nodes are Byzantine (i.e. malicious or malfunctioning).

PBFT uses a two-phase submission process to reach consensus, with nodes first proposing a block and then validating it through a series of voting rounds. This process ensures that all nodes in the network agree on the order of transactions and prevents malicious nodes from compromising the integrity of the network.

Rotating Proposers: To increase fairness, the right to propose the next block rotates based on the interests of validators and the number of times they have proposed a block.

Nibiru Chain4 major products

The real core technology of Nibiru lies in its product ecosystem. Currently, the Nibiru ecosystem consists of four core components:

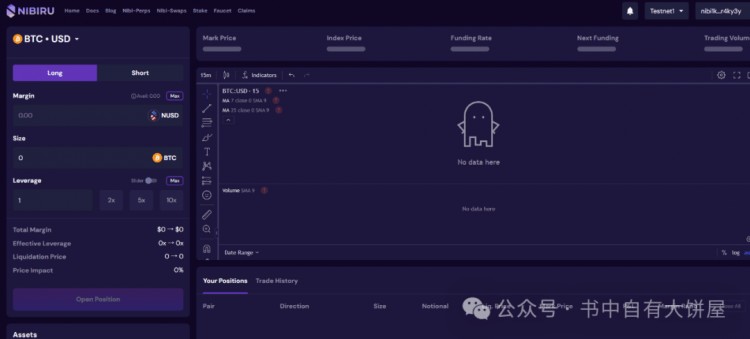

Here-Perps

Currently, the vast majority of centralized contract exchanges are based on off-chain order books, and Nibi-Perps provides fully decentralized on-chain contract trading. Allows users to trade with up to 10x leverage on popular crypto assets such as BTC, ETH and ATOM. Stakeholders of $NIBI will have Nibi-Perps governance rights and transaction fee discounts.

Some features:

● Supports both cross position and isolated position margin;

●$NIBI pledgers have Perps governance rights (parameter changes/reward mechanisms, etc.);

● VIP service. Stakers of $NIBI can enjoy discounts on transaction fees.

● Black swan event early warning mechanism: For contract transactions, extreme price fluctuations will bring catastrophic consequences to the agreement. Nibiru handles black swan events through the Ecosystem Fund (EF) and Treasury (Treasury). Among them, the financial treasury is the last layer of guarantee mechanism to maintain the normal operation of the agreement. It was initially managed by multi-signatures by the core members of the team, and eventually transitioned to be completely managed by the community.

● The initial supply of Ecosystem Fund EF comes from the creation community token distribution. The later growth of EF reserves comes from three parts: 1) Perpetual contract transaction fees; 2) Liquidation fees; 3) Capital investment income. EF reserves are mainly used to balance long and short positions, compensate for bad debts caused by failure to liquidate in time, etc.

Here-Swap

Nibiru's spot trading DEX, Nibi-Swap is one of the four core components independent of contract trading. Nibiru V1 architecture supports 2 different LP pool types: StableSwap pool and constant product pool. Nibiru's StableSwap is based on Curve and supports Swap of stable coins.

3.NUSD stable currency

Nibiru launches its own fully collateralized stablecoin $NUSD. The first collateral it supports is the stablecoin $USDC.

Users mint NUSD by providing $NIBI and collateral (such as USDC), and the specific ratio of the two is determined by the Collateral Ratio (CR).

If CR= 70%, which means to mint 100NUSD, the user needs to provide collateral equivalent to 70NUSD and NIBI equivalent to 30NUSD.

In the future, Nibiru Chain will support more types of collateral. Currently, $NUSD is more like $FRAX of the Cosmos ecosystem.

4.Oracle oracle

Most blockchain networks use third-party oracles (such as Chainlink, Pyth, etc.) to feed asset prices. Nibiru has taken a different approach and developed its own decentralized oracle. In the Nibiru network, the validator node plays the role of oracle.

● On the Nibiru blockchain, validator nodes act as oracles by voting on exchange rates between crypto asset pairs. Nibiru Chain’s x/oracle module manages off-chain price provision in a fair and decentralized manner.

● A voting cycle occurs every few blocks, called VotePeriod. Within each VotePeriods, the protocol counts the votes, creating one vote for each rate. To disincentivize bad actors, oracles are rewarded for posting “good prices” and slashed for posting “bad prices.” The weighted median of votes then becomes the on-chain exchange rate.

In 2024, Nibiru Chain will focus on expanding the ecosystem, and its main developments include multiple plans, such as integrating with major DeFi projects on multiple chains, listing on first-class centralized exchanges, completing parallel optimistic execution, and achieving comprehensive EVM compatibility.

Financing situation

Nibiru has conducted three rounds of financing in total, the first of which was an $8.5 million seed round in April 2023 with a valuation of $100 million. Tribe Capital, Republic Capital, NGC Ventures and Original Capital co-led the investment.

The second round was Coinlist’s community sale completed in January 2024, with a total of $6 million of tokens NIBI sold at $0.05.

The third round was a US$12 million financing completed in February 2024, with participation from Kraken Ventures, ArkStream, NGC Ventures, Master Ventures, Tribe Capital and Banter Capital.

ecosystem

There are currently 100+ projects in the ecosystem, and there are currently 600,000 fans on twitter and 500,000 on discord.

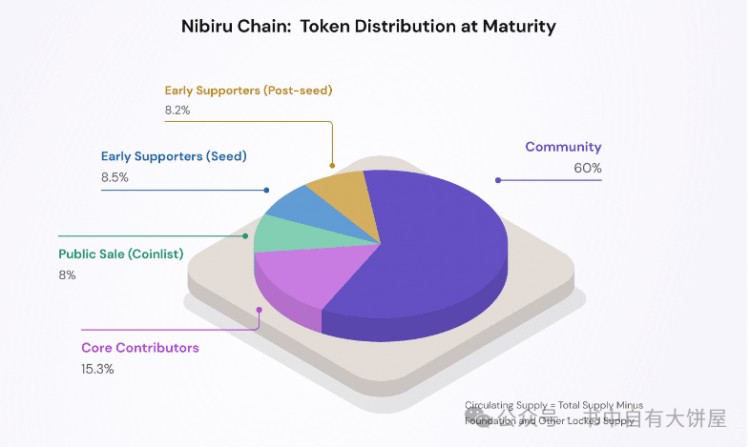

Token economy

The total number of tokens is 1,500,000,000. The initial circulation has not yet been found, but according to the white paper, it should be 400 million in the first year. The current price is US$0.54, and it was almost US$1 when it was launched at its peak. In terms of token distribution, 60% is for the community, 15.3% for core contributors, 8% for the public sale, 8.5% for the seed round, and 8.2% for early contributors. So from this point of view, the project side is quite humane. The community has given so much, but I have taken very little. I have to give the project a thumbs up for this, and then all the tokens will be released in 8 years.

Finally, to summarize this project, it should be the current cross-chain derivatives AMM project. Many people say that it is based on DYDX, but in fact it is not. DYDX currently only supports a few chains, and you have to switch, and nibi is based on cross-chain. It is built with Cosmos and has certain advantages, but the current product experience is still relatively poor. Although the mainnet is said to be online, it cannot be used and there is only a testnet. So the project team is a little anxious to list the currency, but the product has not been completed well. Judging from the number of fans, it is okay. The product concept is actually good, because there is indeed a demand for cross-chain AMMs, and in centralized exchanges , when you use udsc, it is insensitive to which chain it is. It can be eth or other chains. I can buy eth or near, so the user side must be insensitive. This is the evolution path of DEX. So the project requirements are there. But from the perspective of the track, compared to DYDX’s 3 billion FDV, it is still a bit low. #热门话题 #DEX