时间:2024-03-22|浏览:275

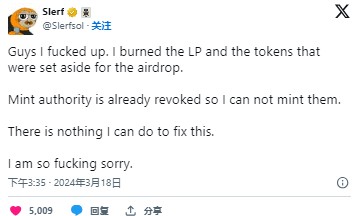

In a dramatic turn of events, the developers of Solana-based memecoin $SLERF found themselves in perilous territory after an operational "accident" resulted in the accidental burning of over $10 million worth of funds that were intended as investments part of the initial airdrop.

The incident caused an uproar in the cryptocurrency community, prompting major cryptocurrency exchanges such as HTX (formerly Huobi), Bitget, and BingX to pledge support by donating trading fees to affected users to compensate for losses.

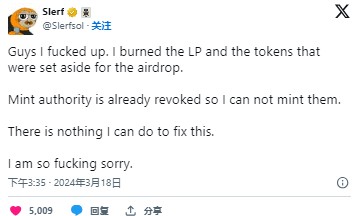

Slerf, a sloth-themed meme coin, initially gained significant traction when it raised $10 million in a presale on the Solana blockchain on March 18. The celebrations were short-lived, however, as the project's anonymous developer later revealed a catastrophic error on social media.

The developers freely admitted that they accidentally sent all pre-sale funds, as well as the project’s liquidity pool tokens and airdrop allocations, to an irretrievably burned address. The error effectively destroyed over $10 million worth of investor funds, preventing new tokens from being minted or refunds being issued.

This is truly the worst thing that can happen to a founder. It stands to reason that it will be difficult to screw up the issuance of a cryptocurrency anymore. For some reason, the crypto community loved it, and Slerf got a lot of attention as memes blew up crypto Twitter.

In response to this disaster, several major cryptocurrency exchanges have pledged to support the affected Slerf community by donating a portion of trading fees from their tokens.

As one of the first platforms to list Slerf, HTX Exchange announced that it will donate all trading revenue generated from Meme coins to traders who participate in its platform’s private sale. Tron network founder and HTX advisor Justin Sun confirmed the exchange’s commitment to the cause on social media platform X (formerly Twitter). “We will donate all Slerf trading revenue to pre-sale participants,” Sun promised.

Subsequently, Bitget Managing Director Gracy Chen also pledged to donate her platform’s transaction fees to support the Slerf community. Singapore-based exchange BingX went a step further and not only pledged to donate fees, but also announced plans to airdrop its future initial token offerings to Slerf private sale participants who did not receive tokens due to the burn event.

Additionally, LBank Exchange announced its commitment to raise funds to support pre-sale participants, providing global cryptocurrency traders and investors with dedicated wallet addresses to donate funds to affected investors.

"The Slerf team has 0 access to this wallet. So the funds are SAFU. This is not a pre-sale, but a donation to support burn victims," the Slerf team wrote in a statement to reassure those affected by the incident impact investors.

Despite the controversy surrounding the $10 million burn, Slerf has seen significant growth in both token value and trading activity. SLERF rallied to nearly $1.50 on Tuesday, generating a 24-hour gain of well over 40% in just 24 hours.

Meanwhile, Meme Coin is trading at $0.71 per token at the time of writing, having seen significant losses since its peak.

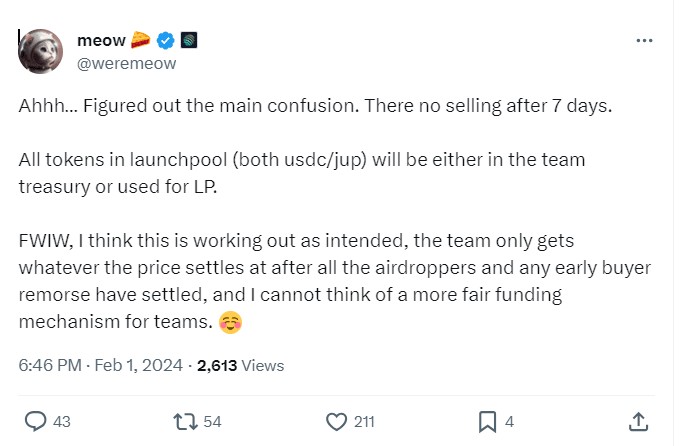

Somewhat shockingly, the token has seen multiple days of trading volumes exceeding $1 billion, showing the impact of the intense “memetic hype” currently sweeping the crypto ecosystem and growing investor interest in these digital assets. Without the $10 million loss, we can’t tell if this would have happened, but it seems to have helped drive the coin’s growth. It also helps that pre-sale buyers cannot sell their tokens.

Slerf’s long-term value proposition is uncertain, to say the least, as it is a memecoin with no identifiable and sustainable utility. However, the cryptocurrency community appears to be seizing the opportunity to speculate on the asset’s volatile price movements. In recent weeks, Solana has become more like a casino than a blockchain network.

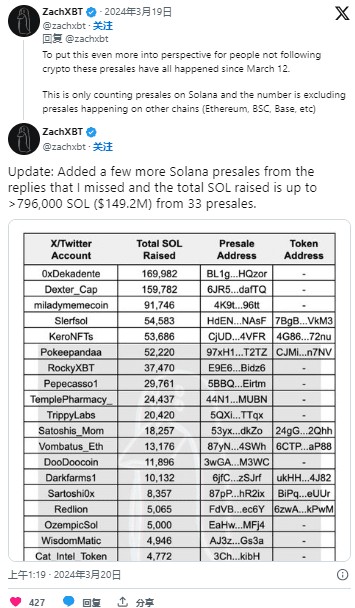

The Slerf saga unfolds against the backdrop of the memecoin pre-sale craze sweeping the Solana ecosystem. According to on-chain researcher ZachXBT, various meme coin offerings have raised a staggering 796,000 SOL (approximately $149 million at current prices) in 33 presales since March 12.

Slerf’s presale ranked fourth among them, raising 54,583 SOL before the unfortunate burn event. The top three pre-sales are 0xDekadente (169,982 SOL), Dexter_Cap (159,782 SOL) and miladymemecoin (91,746 SOL).

This pre-sale trend is mainly due to the fear of missing out on abnormal price increases (FOMO), which is a double-edged sword for investors. While projects like Book of Memes (BOME) have seen their share prices rise rapidly, soaring more than 1,291,399% in less than two days to reach a market cap of over $1 billion, the risks associated with such investments are just as significant (if not greater).

The Slerf incident has reignited discussions about the importance of trust and transparency in the cryptocurrency space, particularly when it comes to pre-sales and how exchanges handle investor funds.

One aspect that has received much attention is Slerf’s selection of LBank Exchange as the custodian for its donation addresses. LBank has faced accusations of misappropriating user funds in the past, casting doubt on its reliability and raising concerns about the security of donated funds.

Blockchain security firm Hacken recently conducted a review of LBank in September 2023, which highlighted key issues including transparency issues, security vulnerabilities, and potential market manipulation. The report concluded that “LBank is an unreliable exchange for cryptocurrency trading due to apparently fabricated liquidity and exploitable cybersecurity issues.”

LBank has been addressing many of these issues. For example, the exchange announced the adoption of Merkle Tree Proof of Reserves to enhance asset security and transparency. However, given past controversies, the Slerf initiative has raised eyebrows in the crypto community.

As the Slerf saga continues to unfold, the incident is likely to draw scrutiny from regulators, especially given the frenzy of cryptocurrency pre-sales and the potential risks these products pose to investors.

Authorities may seek to investigate the circumstances surrounding the $10 million burn and the exchange’s subsequent refund actions. Questions may arise regarding the adequacy of investor protection and the possibility of market manipulation or other fraudulent activity.

Additionally, the broader trend of memecoin pre-sales on the Solana network may be subject to regulatory scrutiny, with authorities likely to assess the risks associated with these speculative investments and the need for appropriate oversight and consumer protection measures.

Going forward, the Slerf incident and the meme token pre-sale frenzy are likely to intensify discussions around the need for greater transparency, accountability, and regulatory oversight in the cryptocurrency space, particularly when it comes to protecting the interests of unwary retail investors.