时间:2024-04-09|浏览:476

比特币的算力不会下降那么多

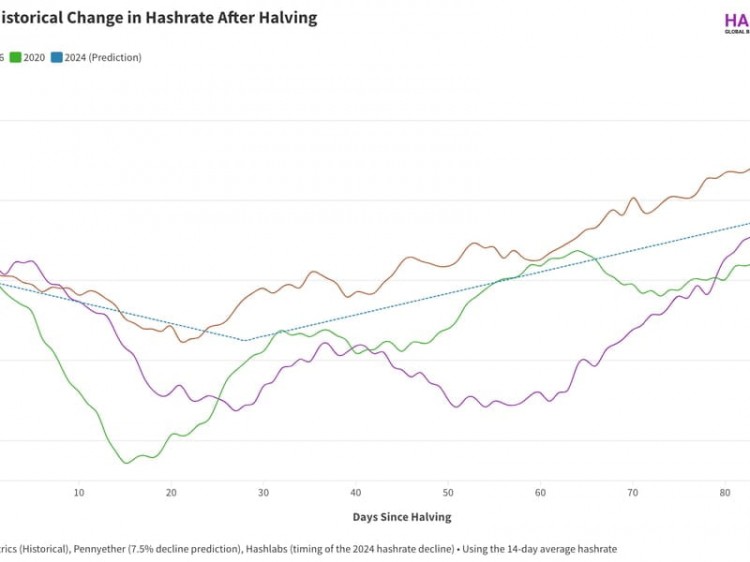

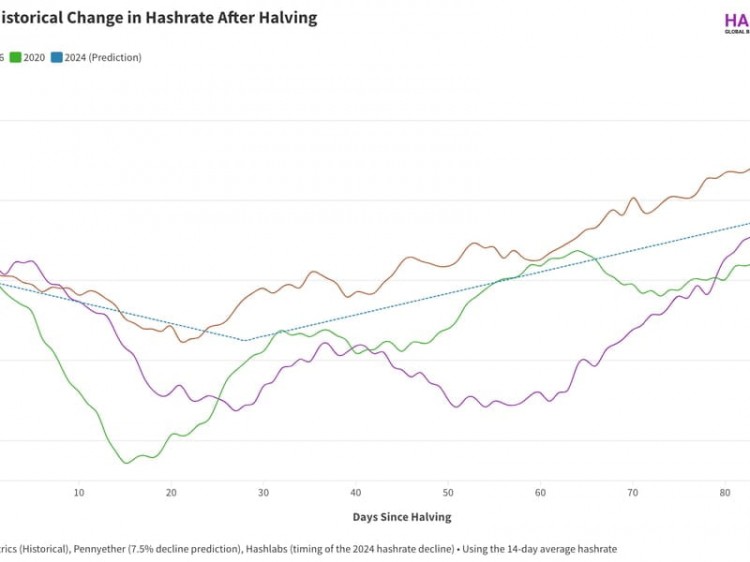

与普遍看法相反,减半可能不会导致网络算力大幅下降。比特币前三次减半后,算力暴跌了 25%、11% 和 25%,看来许多分析师和矿工都预计(或希望?)这次算力也会出现类似的下降。

我同意 Pennyether 的预测,即即将到来的比特币减半预计将导致算力小幅下降,幅度为 5% 到 10%。这一预测也与算力指数的 3-7% 的预测相差不远。

这一谨慎的预测源于目前比特币挖矿的高盈利能力,这是由其高价格推动的,并且观察到,大约 70% 的比特币算力是自 2022 年 1 月以来引入的,在挖矿经济条件下运行,有时不如现在预期的那样有利。 -减半。

此外,预计算力将从这次小幅下跌中迅速反弹。在过去的三次减半中,网络平均在 57 天内恢复了减半前的算力水平。这一趋势凸显了一个重要的观点: 减半不应被视为降低算力的事件,而应被视为算力不断上升轨迹中的短暂暂停。

矿工不断努力用最新、最高效的型号更新设备,进一步增强了算力的稳健性。预计这一策略不仅可以抵消算力的短期下降,而且还可能导致未来几个月算力的大幅上升。

从本质上讲,即将到来的比特币减半可能只是网络算力轨迹中的一个短暂的小问题,而不是一次重大挫折。

高成本矿工将被迫升级车队

CoinMetrics 的数据突显出,大多数行业目前都在使用效率相对较低的机器,例如 Antminer S19J Pro。这些矿商需要 0.05 美元/千瓦时或更低的运营成本才能在减半后保持健康的毛利率。

然而,根据算力指数,美国的平均托管率略低于 0.08 美元/kWh,许多美国矿商在减半后可能面临现金流挑战,从而被迫进行大规模的设备升级。

比特大陆推出的新机器,包括 S21、T21 和 S21 Pro(每台机器的效率都低于 20 J/TH),正好赶上减半。这一发展促使许多美国托管提供商推动其客户从 S19J Pro 切换到 S21 型号。考虑到美国高昂的托管费用,这种推动可以被视为一种必然,而不是一种选择。

Referring to the chart above, it's evident that the S19J Pro models are unlikely to generate positive cash flow when hosted at $0.08 per kWh, considering their direct bitcoin production cost stands at $75,000. Thus, miners facing higher operational expenses must transition to more efficient hardware, such as the Antminer S21 or similar models, to maintain profitability.

While upgrading to the latest machines allows operations to continue even in high-cost environments, it's hardly a viable long-term strategy. The necessity to constantly update hardware, often before the previous investments are recouped, underscores the unsustainability of such an approach.

My underlying message is clear: if you need to use the latest-generation hardware to stay cash flow positive, your operating costs are too high.

Miners will find creative ways to increase profits

Bitcoin mining is one of the most free and competitive markets globally, a market that Adam Smith himself would admire. This inherent competitiveness fuels a relentless pursuit of innovation, especially during challenging periods such as the halving events. In response to the pressures exerted by the halving, miners are adopting some of the most inventive strategies to maximize the utility of their existing resources.

One such strategy is underclocking, a process in which the machines’ electricity consumption is reduced to increase the energy efficiency and reduce costs. This process, which can be facilitated by third-party firmware like LuxOS, significantly improves machine efficiency — a critical adaptation in an environment where margins are thin. The movement towards underclocking is likely to gain momentum.

Moreover, the quest for increased profitability extends beyond operational tweaks to include novel revenue-generating approaches. A compelling example comes from Hashlabs in Finland, where we are undertaking a project taking advantage of several revenue streams to boost mining profitability.

In Finland, we have diversified our income streams to include selling waste heat from our miners to a district heating system, earning fees for contributing to the stabilization of the electric grid, and strategically selling electricity back to the market during periods of high spot prices. These ancillary revenue channels are significantly bolstering the profitability of our mining operation.

The upcoming halving is set to act as a catalyst, driving miners worldwide to emulate Hashlabs by exploring and implementing creative strategies to augment their profits.

Some miners will diversify away from mining

The fierce competitiveness that defines the current state of the mining industry is prompting many, especially public miners, to explore new horizons. Increasingly, there's a move towards AI computing, with companies like Iren and Hive Digital Technologies leading the charge.

The trend towards diversification is expected to pick up momentum over the challenging coming months. Yet, the dynamics of the mining industry are cyclic. Predictions for a bull market in 2025 portend a reversal of this diversification trend. As the value of bitcoin potentially climbs, miners may set aside their diversification strategies in favor of maximizing returns from mining, diving back into the fray with renewed vigor on extracting value from every hash.

This shift between diversification and focused mining reflects the broader ebbs and flows of the market. Miners' strategies evolve with the market, balancing between seizing immediate opportunities in new industries and preparing for the next upsurge in bitcoin mining profitability.

Bitcoin mining will become more geographically decentralized

Currently, the United States commands a substantial portion of the global hashrate, accounting for 40%, while China and Russia are also key players, contributing 15% and 20%, respectively. However, the industry is gradually shifting towards a more globally dispersed model, driven by the perpetual quest for cost efficiencies, especially cheaper electricity.

As miners brace for the upcoming halving, many are exploring emerging mining markets across Africa, Latin America, and Asia where electricity is exceptionally cheap. For instance, Bitfarms is making strides in Argentina and Paraguay; Bitdeer is expanding its capacity in Bhutan; Marathon is entering the United Arab Emirates and Paraguay; and Hashlabs is offering hosting solutions in Ethiopia.

The impending halving event acts as a catalyst for hashrate migration, compelling miners to venture beyond developed nations to secure more economical electricity sources. This move towards a more geographically decentralized mining network is poised to have a profound positive impact on Bitcoin. By distributing the hashrate more evenly across the globe, Bitcoin mining will not only become less susceptible to regional regulatory risks and power cost fluctuations but also align more closely with the decentralized ethos that underpins Bitcoin itself.

Little impact on the bitcoin price

The forthcoming Bitcoin halving is eagerly awaited as a potential trigger for the next bull market. Yet, considering the current annualized issuance rate sits at an already meager level of 1.6%, and with nearly 94% of all Bitcoin already in circulation, the anticipated supply shock from this halving is likely to have a minimal impact on the bitcoin price.

The impact of the negative supply shocks in earlier halvings was profound, especially during the first halving when the annualized issuance plummeted from 25% to 12.5%, and the second when it dropped from 8.4% to 4.2%. However, in this upcoming halving, the decrease from 1.6% to 0.8% represents a much less significant shift compared to the dramatic changes observed in previous cycles.

Don't misunderstand my position; I still foresee a bull market in the wake of this halving. However, the growing demand, and not the meager supply decline, will be the main factor fueling the price surge.

I like Dylan LeClair’s analogy of the halving as a "global advertisement," suggesting that its principal effect on bitcoin's price is not so much the immediate result of decreased supply but rather the increased media attention and investor enthusiasm it generates. This heightened awareness could stimulate demand, turning the halving into a self-fulfilling prophecy of bullish market sentiment.

This perspective also aligns with insights from Daniel Polotsky questioning the continuing relevance of bitcoin's four-year cycle. While fluctuations in demand will persist, the impact of supply changes is becoming increasingly negligible.

At this point, the issuance rate of Bitcoin has become so low that its supply has a minimal effect on its price, which is now primarily influenced by demand. While the narrative surrounding the halving continues to be a strong driver and is expected to propel bitcoin into a new bull market, this influence is likely to diminish in the future. As a result, it's probable that bitcoin will eventually decouple from the four-year halving cycle.

Bring the halving on!

I have great memories from the halving in 2020. The atmosphere within the Bitcoin community was electric with anticipation as we approached the moment when the block subsidy would be cut in half. This pivotal event sparked an incredible wave of bullishness throughout the summer of 2020, setting the stage for the monumental bull market of 2021. Although I remain skeptical that the modest reduction in supply due to this halving will significantly alter bitcoin's price equilibrium, the prospect of it igniting increased demand and investor enthusiasm is something I eagerly await.

From the vantage point of a miner, the halving presents more than just a potential market rally; it's an opportunity to introspect and innovate within our operations. It prompts us to explore new methodologies to reduce costs and enhance efficiency, ensuring our survival and success in this highly competitive field. The halving isn't just a test of resilience but a catalyst for evolution within the mining community.

As we look forward to the next halving, it is essential to remember the core ethos of Bitcoin. Bitcoin wasn't created for the miners; its heart beats for the hodlers. Miners play a crucial role, no doubt, servicing the Bitcoin network and ensuring its robustness. Yet, the true spirit of Bitcoin lies in its ability to empower holders, providing a decentralized alternative to traditional financial systems. The anticipation and excitement for the halving resonate not just among miners but throughout the entire community of Bitcoin enthusiasts and investors.

因此,随着这一关键事件的临近,让我们张开双臂并以创新精神拥抱减半。它提醒人们注意比特币的动态景观,证明其弹性,并且是未来令人兴奋的发展的灯塔。对于所有持有者和矿工来说,让我们为减半做好准备。来吧!

![[静香合约]比特币减半后,PEPE币价格会如何变化?会受减半影响吗?](/img/btc/116.jpeg)