时间:2024-05-08|浏览:250

事实证明,减半对比特币来说是一次“抛售新闻”事件,而且由于利率持续存在不确定性,新一轮反弹可能需要一段时间。

比特币减半已经过去两周了,至少在短期内,这一罕见事件并没有带来多头所希望的价格爆炸式增长。

你可能会说,其中很多事情都超出了 BTC 的控制范围。中东紧张局势加剧导致加密货币市场突然急剧下跌。

我们在 4 月 19 日就看到了这一点,当时以色列对伊朗领土发动袭击的消息传出后,比特币跌破 60,000 美元。

尽管价格迅速回升,但这场日益复杂的冲突的进一步动乱或升级可能会带来进一步的阻力。

虽然 60,000 美元已被证明是 BTC 的一个重要心理门槛,但决心在 5 月 1 日受到了严峻考验,当时价格跌至 56,555 美元的低点。

以下是

自减半以来我们学到的五件事,可以帮助我们规划接下来会发生什么。

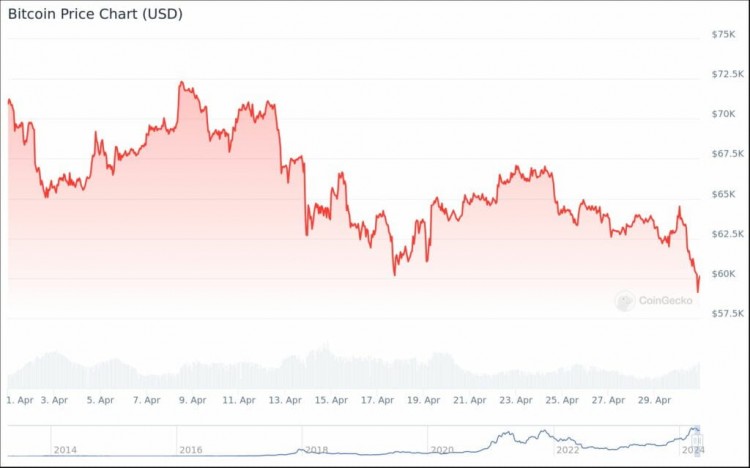

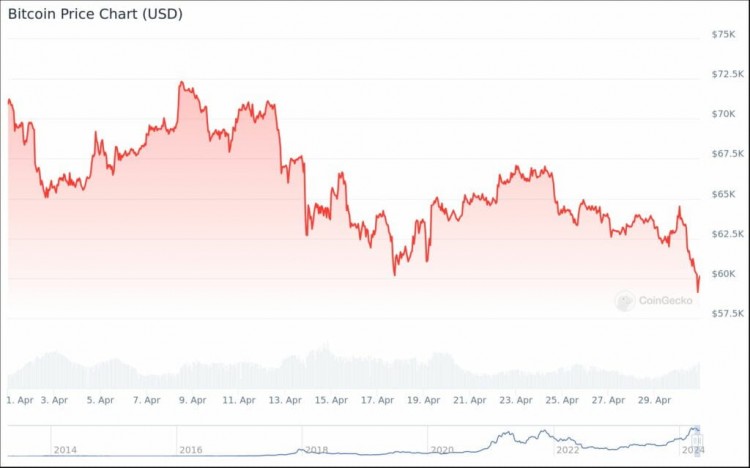

4 月份比特币价格 |资料来源:CoinGecko 1. 四月是比特币近两年来最糟糕的一个月

几周来,加密货币恐惧和贪婪指数一直在闪烁着“贪婪”或“极度贪婪”的分数,但交易者在五月初得到了发人深省的现实检验。

为什么?因为4月份BTC大幅下跌。在创下历史新高 71,329.30 美元后,价格暴跌 14.95%,月收盘价为 59,228.70 美元。

尽管目前价值已成功恢复,但人们仍对未来持谨慎态度。这是比特币在减半前首次创下历史新高。

一些分析师认为,这可能是当前牛市周期中最好的情况,而另一些分析师则认为,在反弹恢复之前可能需要很长时间的等待。

“Left Curve”是一篇关于为什么你对 #crypto 不够乐观的文章。是时候闭上眼睛了,BTFD! https://t.co/0pQyOjZhPS pic.twitter.com/r9QUiGYZTG

— 亚瑟·海耶斯 (@CryptoHayes) 2024 年 4 月 23 日

2. 对比特币前景的预测好坏参半

BitMEX 前创始人 Arthur Hayes 声称他一直看到这种情况的发生,一系列完美的事件拖累了比特币的下跌:

“美国纳税季、对美联储将采取的行动的惊愕、比特币减半抛售的新闻事件以及美国比特币 ETF 管理资产增长放缓在过去两周结合在一起,产生了急需的市场清理。”

阿瑟·海耶斯

尽管如此,他确实相信比特币现在已经触及局部低点,“直到 8 月份,价格将在 60,000 美元到 70,000 美元之间波动”。

尽管渣打银行加倍预测 BTC 到今年年底将达到 150,000 美元,但该银行警告称,比特币价格可能进一步跌至 50,000 美元。

Bloomberg Intelligence’s senior commodity strategist Mike McGlone has also struck a cautious tone. In a note shared with crypto.news, he said “sticky inflation appears connected to speculative excesses in Bitcoin and equity prices” — and there may be some time yet before the Federal Reserve starts easing interest rates. He wrote:

“If the S&P 500 is starting to retrace the almost straight up rally from the October low, the highly volatile crypto might suffer. Our view is the Fed is unlikely to ease until beta tells it to by deflating, with headwinds for all risks assets and potential tailwinds for gold.”

Mike McGlone

Bitcoin ETF inflows since their launch in January | Source: SoSo Value 3. Times are tough for Bitcoin ETFs

Bitcoin ETF inflows since their launch in January | Source: SoSo Value 3. Times are tough for Bitcoin ETFs

After initial euphoria following their approval by the U.S. Securities and Exchange Commission in January, appetite for exchange-traded funds based on Bitcoin’s spot price looks like it’s starting to cool.

Data from SoSo Value shows there were record outflows of $563 million from BTC ETFs on May 1 — with a six-day streak in the red snapped on May 3, when there were total inflows of $378 million. Bloomberg Intelligence analyst James Seyffart said at the time that “inflows and outflows are part of the norm in the life of an ETF.”

Nonetheless, despite lofty predictions that the arrival of Bitcoin and Ethereum ETFs in Hong Kong would deliver trading volumes that far exceeded the debut on Wall Street, it was a disappointing launch, to say the least.

Just $8.5 million in trading volumes were recorded across spot Bitcoin ETFs on day one — 98.6% less than the $628 million seen when they arrived in the U.S. But JAN3 CEO Samson Mow believes exchange-traded funds in Asia just need time to find their feet:

#Bitcoin ETFs in HK are going to be big. Maybe not on day 1 or 2, but the long term implications are massive. There is really nothing else for Chinese investors to put their money into at this time. https://t.co/hOSCa7siid

— Samson Mow (@Excellion) April 29, 2024

4. A nervous wait for miners

4. A nervous wait for miners

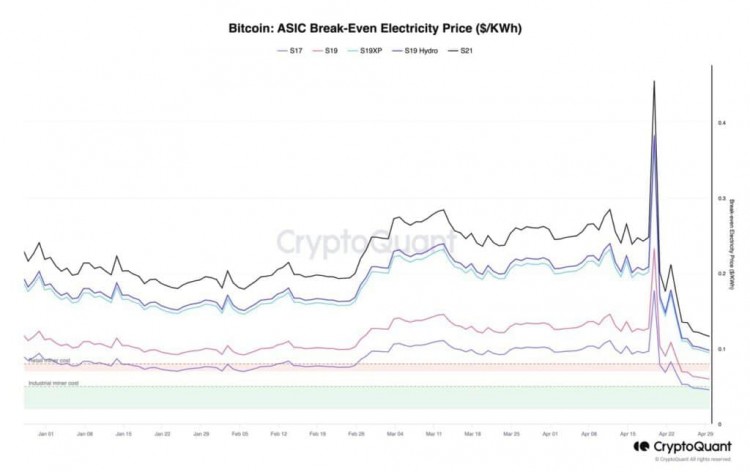

CryptoQuant recently told crypto.news that Bitcoin miners could face significant challenges unless prices recover in the coming weeks — with higher electricity costs and permanently lower block rewards leaving the industry feeling the pinch. Head of research Julio Moreno said:

“[The market is] more likely to see a miner capitulation if prices don’t recover significantly during the summer. Especially with the hashprice (average miner revenue per hash) making new lows.”

Julio Moreno

But there’s a problem: trading volumes across the board tend to decline during the summer months — with Bitcoin typically performing below average between June and September.

#Bitcoin Emerges pic.twitter.com/vNEIgeH2TU

— Michael Saylor️ (@saylor) May 4, 2024

5. Keep an eye on these two

Undeterred, some executives are continuing to get their hands on as much Bitcoin as they can.

MicroStrategy 目前拥有 214,400 BTC,平均价格为每枚 35,180 美元。鉴于撰写本文时比特币的交易价格为 63,600 美元,Michael Saylor 的大赌注意味着该公司坐拥 81 亿美元的账面利润。

与此同时,由 Twitter 前首席执行官杰克·多西 (Jack Dorsey) 领导的 Block 现在已开始将其毛利润的很大一部分用于购买额外的 BTC。

无法预测比特币下一步将走向何方,但看起来有理由保持乐观。

您可能还喜欢:全球金融的下一步是什么?