时间:2023-12-18|浏览:290

最新的每周收盘价并没有给紧张的交易者带来什么安慰,因为“仅上涨”的比特币价格活动仍在继续暂停。

距离年度蜡烛结束仅剩两周时间,风险资产的倒计时已经开始,压力也随之而来。

宏观数据——关键的短期波动催化剂——将在 12 月剩余时间内持续发布,随着市场消化美联储上周的举措,美国 GDP 数据也将公布。

目前,比特币似乎越来越不可能出现“圣诞老人集会”,而且高额费用让持有者感到苦涩,评论员建议重新关注下个月潜在的现货 ETF 批准。

潜在的一线希望来自于加密货币内外的市场情绪。虽然“贪婪”是景观的特征,但不可持续的情况却不见踪影,随着“怀疑”的出现,可能为进一步上涨留下空间。

随着年度 BTC 价格表现的关键时刻临近,Cointelegraph 将更详细地研究这些因素。

分析师列出了关键的比特币价格支撑位

12 月 17 日周收盘价约为 41,300 美元,当时正值 BTC/美元局部抛售期间。

Cointelegraph Markets Pro 和 TradingView 的数据显示,隔夜比特币继续下跌,比特币触及 40,800 美元,然后在亚洲交易时段逆转回略高于 41,000 美元。

基于最近的比特币价格走势,交易员和分析师已经对潜在的进一步下跌保持警惕,因此仍保持谨慎态度。

“图表不会说谎”,交易资源 Material Indicators 在当天 X(以前称为 Twitter)上的一篇文章的开头总结道。

Material Indicators 指出,进入新的一周,比特币已经失去了 21 天移动平均线——它称这一事件“本质上是看跌的”。

它补充说,“预计年底获利回吐和税收损失收割将在短期内盛行。”

联合创始人 Keith Alan 继续表示,争夺关键斐波那契回撤位(相当于 2021 年 11 月的历史高点)的斗争仍在继续。

受欢迎的交易商 Skew 在 4 小时时间范围内以 200 周期和 300 周期指数移动平均线 (EMA) 以及 50 天 EMA 的形式添加了一些线条——目前均比现货价格低 2,500 美元左右。

“From here there's two technical levels on 1W/1M,” he continued in commentary on weekly and monthly timeframes.

“$39K - $38K ~ Potential support on HTF, an unsustainable push lower there would be a decent bid. $47K - $48K ~ HTF resistance, unsustainable drive higher higher would be a good area to take profits.”

PCE, GDP due amid increasing belief in Fed “pivot”

The coming week sees the November print of the Personal Consumption Expenditures (PCE) Index — the Fed’s “preferred” inflation gauge — lead U.S. macro events.

Coming after last week’s multiple key Fed decisions, data must now continue to show inflation abating heading into the new year.

The next Federal Open Market Committee (FOMC) meeting to decide changes to interest rates is not until the end of January, but since last week, markets are entertaining the prospect of a “pivot” becoming reality.

The latest data from CME Group’s FedWatch Tool currently puts the odds of a rate cut next meeting at around 10%, with the majority of key macro figures still to come.

“Even with stocks up, uncertainty is still everywhere,” trading resource The Kobeissi Letter concluded in an X post outlining the coming week’s prints.

In addition to PCE, jobless claims and revised Q3 GDP will both hit on Dec. 21.

As Cointelegraph reported, U.S. dollar strength hit multi-month lows around FOMC in a potential fresh tailwind for crypto markets. Those lows have now faded as the U.S. dollar index (DXY) makes a modest comeback, still down around 1.9% in December.

Fees stay elevated

The heated debate over Bitcoin transaction fees has swelled in recent days thanks to these hitting their highest levels since April 2021.

With Ordinals back on the radar, those wishing to transact on-chain faced $40 fees at the weekend, while “OG” commentators argued that the fee market was simply functioning as intended given competition for block space.

Miners, meanwhile, have seen revenues skyrocket as a result — to levels not witnessed since Bitcoin’s $69,000 all-time high.

Into the new week, however, fees have already fallen considerably, with next-block transactions confirming for under $15 at the time of writing.

Commenting on the situation, popular social media personality Fred Krueger argued that market participants should now turn their attention to the decision on the first U.S. spot exchange-traded funds (ETFs) due early next month.

Noting that fees were “already falling fast,” he defended Ordinals’ creators’ right to use the blockchain to store their work.

“This debate looks like a nothingburger for now. Back to waiting for the ETF,” he concluded.

Others, including researcher and software developer Vijay Boyapati, also referenced the transitory nature of the fees debate as it has occurred throughout Bitcoin’s history.

Calling for so-called “Level 2” solutions to speed up development as a result, reactions to the recent elevated fees underscored that off-chain solutions for regular users — specifically the Lightning Network — already exist.

“L1 fees are incredibly high right now. Seems obvious — even if self-serving — that defaulting most transactions to the Lightning Network is the way to go for all exchanges and wallets,” David Marcus, the former Facebook executive now CEO of co-founder of Lightning startup Lightspark, wrote in part of an X post at the weekend.

Per data from monitoring resource Mempool.space, meanwhile, block space remains in huge demand, with the backlog of unconfirmed transactions still circling 300,000.

New addresses pose bull market momentum risk

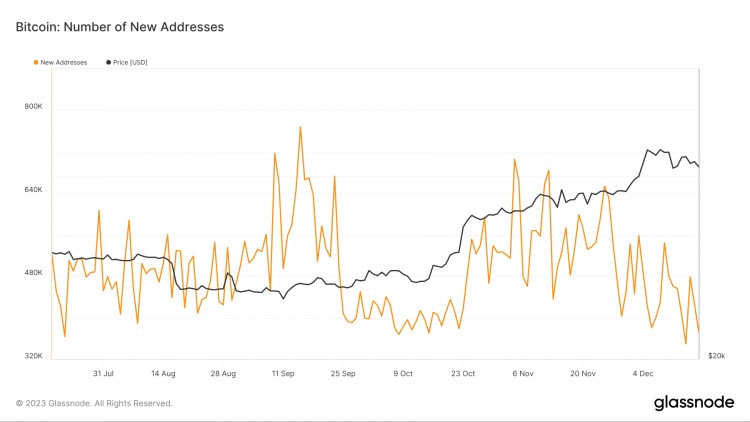

Bitcoin network growth has taken a breather this month — in-line with the bull market comeback.

New data from on-chain analytics firm Glassnode confirms that the number of new BTC addresses has continued its downtrend throughout December.

For Dec. 17, the latest date for which data is available, around 373,000 addresses appeared in an on-chain transaction for the first time. This is approximately half of the recent local daily high, which Glassnode shows came in early November.

Commenting on the numbers, popular social media analyst Ali described the tailing-off of new addresses as “noticeable” and a hurdle to BTC price expansion.

“There's been a noticeable dip in Bitcoin network growth over the past month, casting doubt on the sustainability of $BTC's recent move to $44,000,” he wrote.

“For a robust continuation of the bull rally, it's crucial to see an uptick in the number of new $BTC addresses. This would provide the needed support for sustained bullish momentum.”

Bitcoin new addresses chart. Source: Glassnode

Disbelief behind the fear

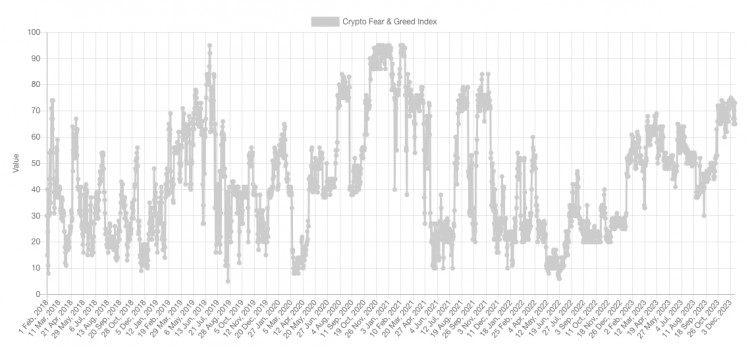

The recent cooling in Bitcoin’s latest “up only” phase has delivered a corresponding pause in market greed.

Related: ‘No excuse’ not to long crypto: Arthur Hayes repeats $1M BTC price bet

According to the latest data from the Crypto Fear & Greed Index, the majority of crypto market participants have been given pause for thought over the past week.

Currently at 65/100, Fear & Greed, which is the go-to sentiment gauge in crypto, still defines the overall mood as “greedy,” but near its least heated in almost a month.

Zooming out, Index scores over 90/100 have corresponded to long-term market tops, as irrational exuberance becomes the average market participant’s mindset. A notable exception, as Cointelegraph reported, was the 2021 $69,000 all-time high, which saw Fear & Greed reach 75/100 before reversing.

Commenting on the current status quo for the traditional market Index, meanwhile, Caleb Franzen, senior analyst at Cubic Analytics, suggested that sentiment was still emerging from the extended Fed tightening cycle that also began in late 2021.

“The Fear & Greed Index is comfortably in the ‘Greed’ range. However, it was just in ‘Fear’ 4 weeks ago and was in ‘Neutral’ to ‘Extreme Fear’ for 2.5 months in September through November,” he told X subscribers on Dec. 14.

“Euphoria? No. This is disbelief.”

![[安迪·沃斯]本质上看跌低于 41,500 美元:本周比特币需要了解的 5 件事](/img/20231218/2978296-1.jpg)

![[斯凯拉]BTC 价格突破 7 万美元——本周关于比特币需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[斯凯拉]BTC 价格突破 7 万美元——本周关于比特币需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)