时间:2024-03-11|浏览:279

比特币以波动和新的历史高点开始了新的一周,因为比特币价格波动仍然牢牢占据主导地位。

这种最大的加密货币已经创下了有史以来最高的周收盘价,但多头在突破更高点时仍然面临着严峻的阻力。

随着价格发现之战愈演愈烈,比特币陷入了一种熟悉的不断变化的状态——关键心理价格水平的抛售压力,加上现货交易所交易基金 (ETF) 的持续竞价。

本周哪个将占据上风?

很少有人对 ETF 购买带来的影响规模做好准备。

即使是长期看涨的人也在重新评估他们认为 BTC/USD 在未来几年可能的走势,从长期来看,100 万美元越来越被视为保守。

相反,其他人警告说,加速的牛市可能会比预期更早引发宏观比特币价格见顶。

临近目前,美国宏观数据即将公布,这将为美联储即将做出的利率决定“定下基调”。

与此同时,随着比特币处于十字路口,矿商们正在抓紧时间在四月份的区块补贴减半之前锁定利润。

Cointelegraph 在每周潜在 BTC 价格波动催化剂概要中仔细研究了这些主题以及更多内容。

比特币价格发现之前创下每周新高

比特币在 3 月 10 日的周收盘价中经历了经典的波动,结果很容易创下历史最高水平。

Cointelegraph Markets Pro 和 TradingView 的数据证实,比特币/美元在 69,000 美元的高位未能持续,几分钟后急剧下行,跌至 67,120 美元。

BTC/美元 1 小时图。 来源:TradingView

与上周触及的 69,000 美元区域相呼应,随后出现了缓解性反弹——最终将比特币在 3 月 11 日的亚洲交易时段创下历史新高。

受欢迎的交易商 Skew 在 X(前身为 Twitter)上的回应中写道:“由于缺乏现货出价,价格仍在 7 万美元左右下跌。”

Skew 强调 63,500 美元至 65,500 美元之间的区域是保持当前上涨趋势的关键,如果接下来出现更大幅度的下跌的话。

“Starting to see more considerable bids from $60K, likely plunge protection bids,” he noted about spot order book behavior on the largest global exchange, Binance.

“Overall condensed price chop here with lack of passive spot buyers.”

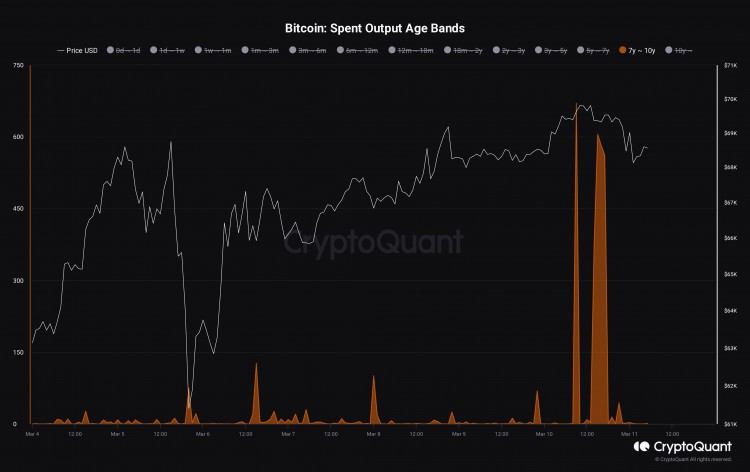

Adding to the picture, Maartunn, a contributor to on-chain analytics platform CryptoQuant, revealed the on-chain movement of coins previously dormant for up to a decade.

He referenced the Spent Output Age Bands metric, which groups coins involved in transactions by how long they were previously stationary on the network.

“Before the drawdown, there was a movement of 2,877 BTC with an age of 7 to 10 years,” he wrote about the weekly close.

Bitcoin Spent Output Age Bands. Source: Maartunn on X

CPI week looms with Fed rate cut bets absent

Another “classic” week in terms of U.S. macroeconomic data is due to be headlined by the Consumer Price Index (CPI) print for February.

Due on March 12, CPI makes for volatile short-term trading across risk assets, while Bitcoin offers mixed reactions.

The current narrative around inflation and Fed policy remains disjointed. Markets are eager to see interest rate cuts, while Fed officials, including Chair Jerome Powell last week, are attempting to cool their expectations.

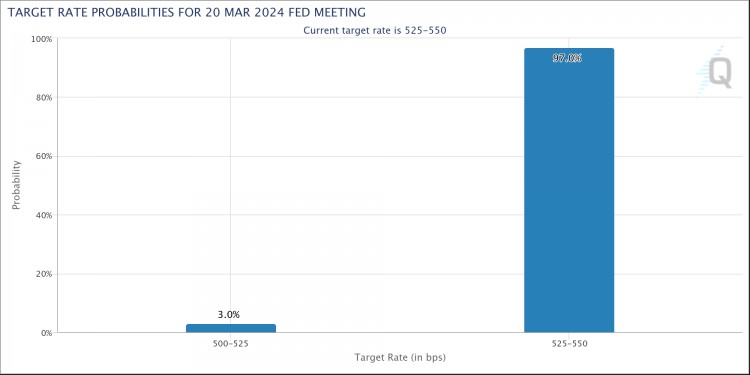

The nature of CPI figures and other data points will thus form a key reference point, with the next Fed meeting just over one week away.

“A hot CPI inflation report this week would really set the tone of the March Fed meeting,” trading resource The Kobeissi Letter wrote in part of its weekly diary post on X.

“Huge week ahead.”

Fed target rate probabilities. Source: CME Group

According to the latest estimates from CME Group’s FedWatch Tool, hardly anyone sees a surprise rate cut at this month’s gathering, with the odds at a mere 3% at the time of writing.

Other key data to come this week include the Producer Price Index, or PPI, along with jobless claims on March 13 and 15, respectively.

ETF Bitcoin buyer pressure seen expanding

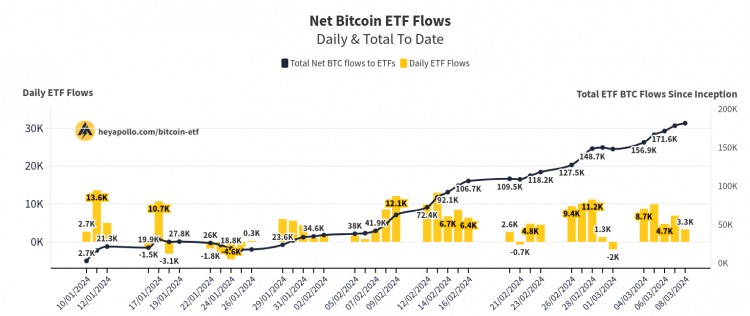

Bitcoin market observers are waiting for one thing as the week begins: the resumption of buying by the spot ETFs.

Now the most successful ETF launch in history, the nine participants have presided over a BTC price transformation that many see continuing.

While reservations are visible, ETFs may see waning demand and thus no longer buoy the price trajectory, so a sense of optimism among institutions now stands out.

Last week, Cathie Wood, CEO of asset manager ARK Invest, said that the firm’s $1-million BTC price target for 2023 had been “brought forward.”

“No platform has approved Bitcoin yet, so all of this price action has happened before they approve it, and so we haven’t even begun,” she said about the absence of major U.S. wirehouses such as Morgan Stanley and UBS.

As Cointelegraph subsequently reported, industry insiders are gearing up for this to happen and the price impact that could follow.

In a memo on March 9, crypto-native asset manager Bitwise listed “major warehouses,” “institutional consultants” and “large corporations” as being next in line to add BTC exposure.

“Based on current trends, I’d suspect we’ll see our first significant flows from these three groups in Q2 2024, and I think those flows will accelerate throughout the year as these investors become more comfortable with the new products,” chief investment officer Matt Hougan wrote.

Net Bitcoin ETF Flows. Source: Apollo

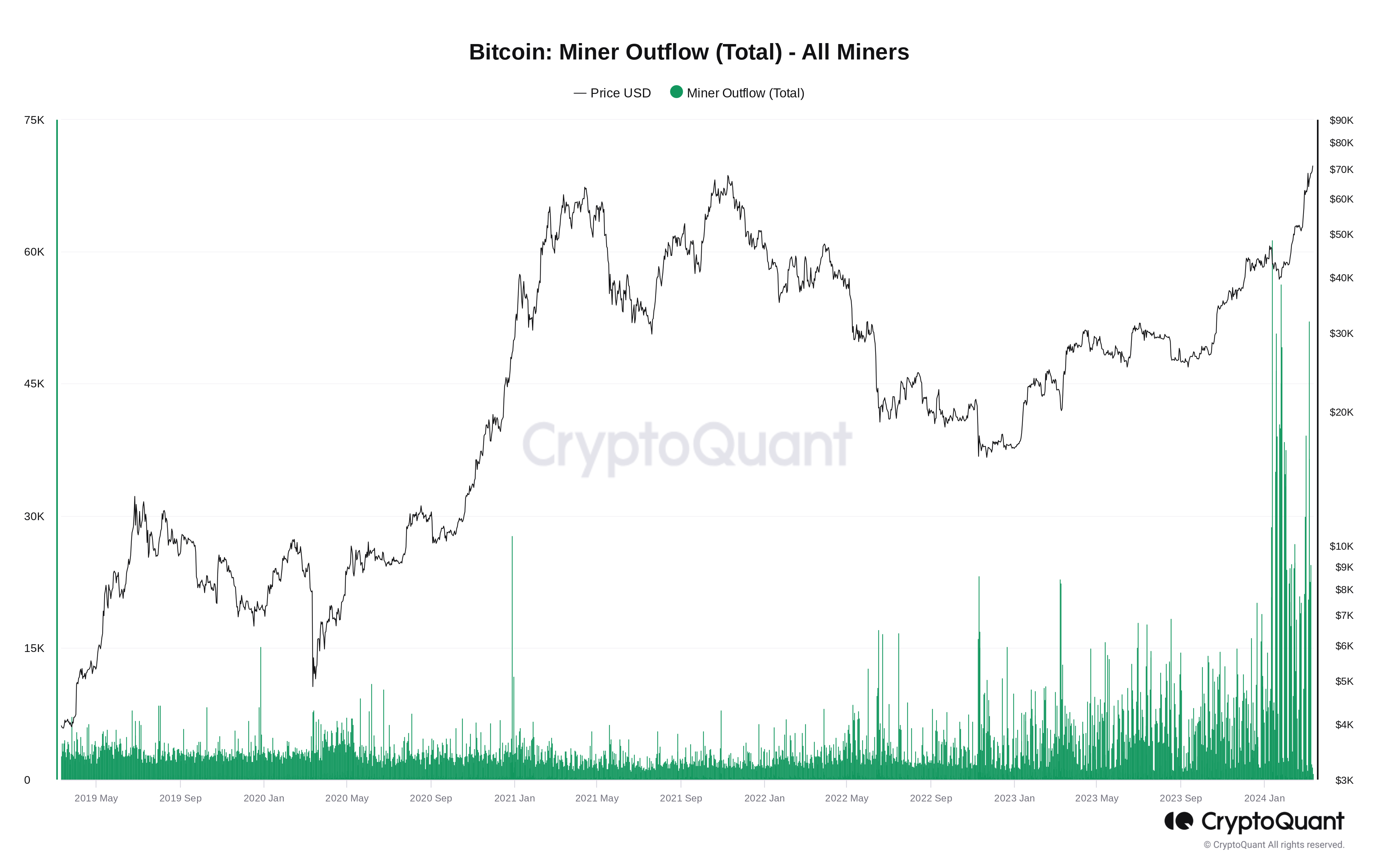

Puell Multiple nears multi-year high amid mushrooming miner outflows

Bitcoin has hit a new all-time high before its next halving — a unique event in its history.

This has surprised many, and miners appear to be no exception. Despite the upcoming halving exposing them to 50% less “new” BTC per block, miners have significantly upped their selling around the highs.

The phenomenon has been witnessed throughout 2024, with outflows from miner wallets beginning at the launch of the ETFs on Jan. 11, CryptoQuant data shows.

Bitcoin miner outflow. Source: CryptoQuant

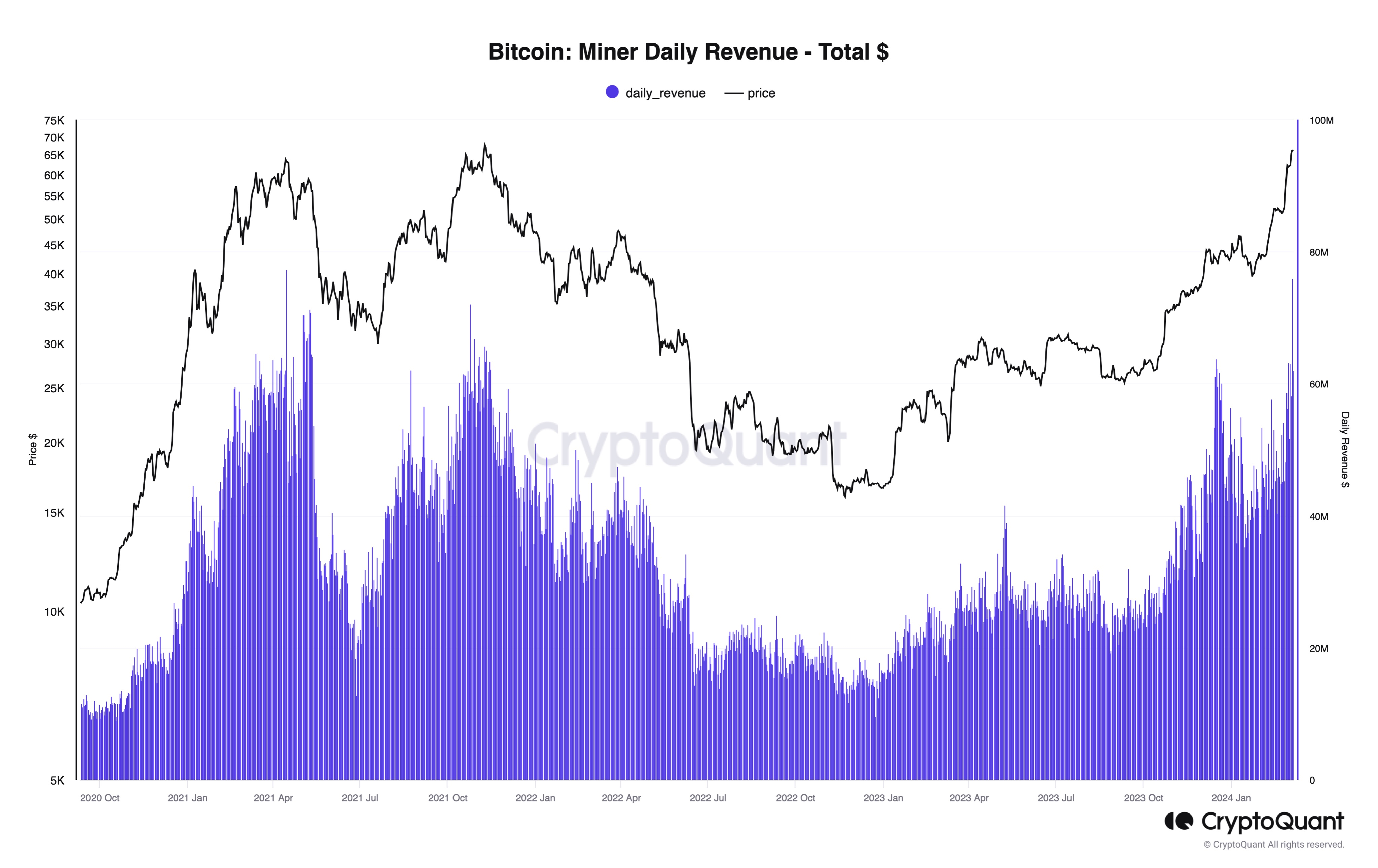

Total daily revenue on March 7, meanwhile, was the second-highest ever at $75.9 million, CryptoQuant contributor Julio Moreno revealed on X.

Bitcoin miner daily revenue. Source: Julio Moreno on X

“With the recent price of Bitcoin soaring, miner revenues have rapidly increased,” trading suite DecenTrader continued on the topic on March 11.

DecenTrader referenced the Puell Multiple — a measure of the value of coin issuance against its yearly moving average — hitting some of its highest levels in six years. The multiple functions as a guide to macro tops and bottoms.

“That has resulted in a Puell Multiple score of +2.4 which is historically on the high side — though not as high as previous cycle peaks,” it noted.

Bitcoin Puell Multiple. Source: DecenTrader on X

Hodlers stay resistant to selling

Amid the inbound price discovery, seasoned Bitcoin hodlers are keeping their hard-earned coins firmly in their wallets.

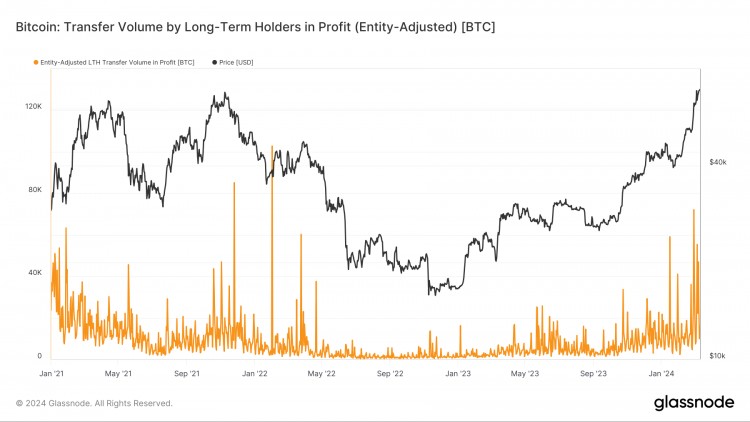

Data from on-chain analytics firm Glassnode shows long-term holders (LTHs) not yet matching transfer volumes seen during 2021, the year when BTC/USD first hit $69,000.

Bitcoin transfer volume by LTHs in profit. Source: Glassnode

The largest recent spike of around 72,000 BTC, in fact, occurred on Feb. 24, with $70,000 and higher so far not generating a larger single-day tally.

According to crypto education resource On-Chain College, meanwhile, the net unrealized profit/loss (NUPL) for LTHs, while strong, is not yet at levels systematic of a blow-off top.

“Bitcoin’s most convicted holders are still holding at unrealized profit levels that usually occur well before the cycle peak,” it told X followers on March 11.

![[斯凯拉]BTC 价格突破 7 万美元——本周关于比特币需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[斯凯拉]BTC 价格突破 7 万美元——本周关于比特币需要了解的 5 件事](/img/20240311/3792631-1.jpg)

![[安迪·沃斯]本质上看跌低于 41,500 美元:本周比特币需要了解的 5 件事](/img/20231218/2978296-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)

![[泰勒]关于以太坊 Dencun 升级需要了解的 5 件事](/img/20240313/3824780-1.jpg)