时间:2023-12-23|浏览:198

Da Kongyi may be one of the few people in the currency circle who achieves wealth not by Bitcoin, nor by issuing digital currency, but by investing his entire net worth of 100,000 in a Coin Stud, holding it for three years, and letting him It didn't sell even if it increased ten times, a hundred times, or a thousand times. Now the coin in Da Kongyi's hand has increased ten thousand times, with a profit of over one billion.

This digital currency frenzy has created a huge human stage: greed, fear, worry about gains and losses, and the collapse of faith are happening all the time. All the characters are involuntarily involved. Entering the industry early, understanding the technology, and having connections cannot guarantee that you will escape 100%.

Some people insist on "don't touch it if you don't understand it", such as Buffett; more people believe that "wealth can be obtained through risk". They repeatedly ask themselves: "You have missed the Internet and real estate, do you still dare to miss Bitcoin?"

After you have made a lot of money once and enjoyed the joy and confidence brought by getting rich overnight, it will be difficult to adapt to the loss of "making less", and it will be difficult for you to give up the idea of obsessing with shortcuts.

In a world where wealth is whizzing by, a score of 59 is more despairing than a score of 0.

100,000 All in IOTA, despite the turmoil, remained unmoving, and in the end, the income exceeded 10,000 times in 3 years.

Today’s protagonist is a legendary figure in the currency circle, a mysterious boy born in the 1990s in Shenzhen—Dakong Yi.

Ohsora Tsubasa, whose real name is Du Yitian, is a true post-90s generation. He first joined the community as "Osora Tsubasa". Ohsora Tsubasa is the protagonist in the Japanese comic "Tuna Tsubasa". He has been passionate about football since he was a child, and in real life, Du is also the protagonist. Football lovers, the origin of the name may be derived from this.

He entered the currency circle in 2013, when he was still in his sophomore year. When his peers were thinking about where to travel during the summer vacation, he returned to his hometown from the UK. At that time, he spent money carefully on Taobao and assembled a mining machine that cost 20,000 yuan. This was Da Kongyi’s earliest investment into the cryptocurrency industry; at that time, the computing power of the GPU could no longer mine any Bitcoins. It was the era of Roasted Cat Mining Machines and Avalon Mining Machines, so Da Kongyi decided to mine some Bitcoins that no one else was mining. altcoins, such as Worldcoin and Feathercoin; by the end of the summer vacation, Da Kongyi had converted all the altcoins into Bitcoin, about 80 of them. At that time, the price of a Bitcoin was 4,000 yuan, and Da Kongyi earned 10,000 yuan in this way. At this time, he was still 4 years away from achieving his small goal.

At that time, Da Kongyi just wanted to make some money and did not have a deep understanding of various currencies. It would not be an exaggeration to say that he was speculating on currencies. But gradually, his concept changed. In his own words, he Belief began.

"King of Stud" is the honorific title given to Da Kongyi by the currency circle, but even Da Kongyi's friends may have a hard time matching his ordinary self with this title. In the eyes of his friends, he is just an ordinary boy. , loves to listen to Jay Chou, likes to travel, and makes tea when he has nothing to do. How come he suddenly became what others call a "gambler", but in fact, he is indeed a gambler, but compared to most people's blind gambling, he A little more rational and endurance.

Initially, his belief mainly came from his admiration for the talented people in the community. He believed that the world’s top and most thoughtful talents were in the community. This was a group of great people with great beliefs. Their beliefs and driving force came from Fanatic admiration for "decentralization", "They do development not for money at all. The reason why the market has risen so much is recognition of them and technology."

As one of the first people to join the community, he still has a deep affection for the community.

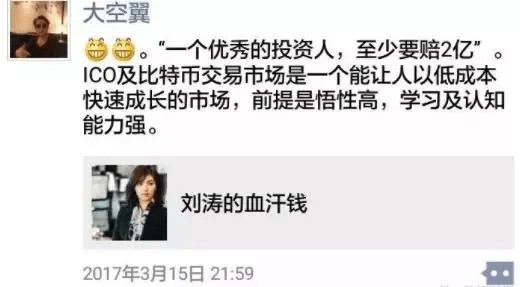

Screenshot of Dakongyi circle of friends

Become famous in one battle

Sometimes, success is just a matter of doing something right.

IOTA’s investment made Dakongyi famous in one battle.

In 2015, there was a digital currency called IOTA doing ICO crowdfunding. IOTA is a non-blockchain encrypted digital currency based on a new type of distributed ledger - Tangle. It is considered to be applicable to the Internet of Things. In the micro-payment scenario.

At that time, only seven or eight people from China participated, but in the end only two people won: Da Kongyi and Jimmy (the head of the IOTA Chinese community). IOTA raised a total of more than 1,300 Bitcoins at that time, worth about 3 million yuan, and each IOTA issued was about 0.001 yuan.

From late 2015 to June 2017, IOTA was always cheap. The IOTA China QQ group had less than 300 people until May 2017. However, since the ICO craze started in June, IOTA has skyrocketed. By December 2017, it once rose to 36 yuan, an increase of 36,000 times. In this way, his 100,000 became 3.6 billion, which is how he became a legend in the currency circle.

IOTA finally raised more than 1,300 Bitcoins, worth about three million yuan.

Then the story begins from here. From the end of 2015 to June 2017, IOTA has been very cheap. However, since the ICO craze started in June, IOTA has skyrocketed. By the beginning of December 2017, it once rose to about 36 yuan, which is 36,000 times higher than the issue price. It is a big short The 100,000 yuan in Yi's hands has turned into billions.

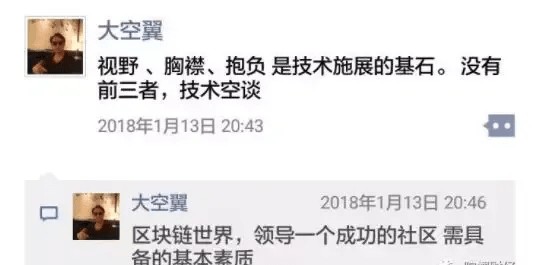

In June 2017, Da Kong Yifa’s WeChat Moments stated that IOTA had “taken it for two years without making any move.”

In June 2017, Da Kong Yifa’s WeChat Moments stated that IOTA had “taken it for two years without making any move.”

Picture from Dakongyi Moments. This is the price of IOTA on June 13, 2017. It reached the highest point of 36 yuan in early December.

If Da Kongyi holds the IOTA until December, his income will have exceeded 3 billion. Someone once asked him to confirm that he had earned several billions. "How many billions?" Da Kongyi laughed incredulously, "There must be no one in the country who has earned so much." But he then added: "But half I know there are people." This sentence seems to say nothing, but in fact it says everything that needs to be said.

Compared with other big names in the currency circle, Da Kongyi is just a grassroots V. He does not have the capital or connections to open a mine, open an exchange, or issue tokens. He easily achieved it just because he insisted on an investment for 3 years. He has achieved the freedom of wealth that everyone dreams of, but he also has his own dream. If he had only been willing to be a miner, mining altcoins to make a little money, or like many gamblers to move in and out quickly, today's currency circle may be different. There is one less legendary story.

Gambler's self-cultivation

It is no exaggeration to use these words to describe the currency circle in recent years. What is the force that prompted Da Kongyi to invest all his wealth for 3 years? Of course, you can say that it is because of the small amount of funds. Don't worry, leave it like that, it is indeed possible, but can we also try to re-understand this legendary figure from another angle?

The currency circle is a zero-sum game. Everyone who enters the game wants to win, but if there is a win, there will be a loser. Who usually loses? He is a person who cannot hold his breath.

Da Kongyi has also lost before. In 2014, Bitcoin had a sharp decline. He lost more than 1 million at that time to more than 100,000. He was very depressed at one time. "People are just not satisfied. At that time, I patted my thighs every day and just wanted to It would be better if I sold earlier." People are like this. They are afraid of going short before buying. After the price goes up, they feel that they bought less. When the price goes down, they regret why they didn't sell earlier. This is an endless cycle, but there is only one core: when Once you have made a lot of money and enjoyed the pleasure of getting rich overnight, you will no longer be able to accept the reality of "making less".

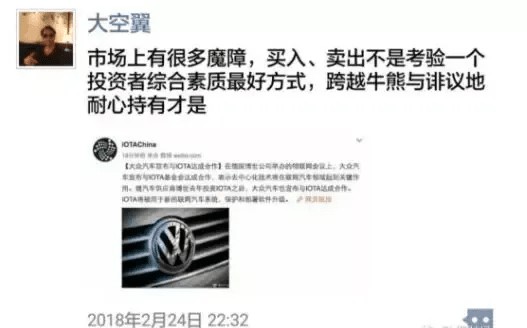

But Da Kongyi saw through this early on. He believed that "buying and selling is not the best way to test an investor's overall quality. It is to hold patiently across bulls, bears and criticisms."

He warned his friends that the most taboo thing about investing is emotion. "Manage your emotions well and maintain objectivity, so that you can last." From this perspective, his investment style is also quite Buddhist.

If gamblers also have self-cultivation, then what is reflected in Da Kongyi is: continuous learning, staying rational, not hesitating when it is time to take action, and not getting off easily when you are interested.

But it's easier said than done, and how many can be accomplished.

Some people say that Da Kongyi wins because of faith. People in the currency circle love to talk about faith, but how many people know that it is not faith that makes them make money, but that they happen to meet a good opportunity and do some things right. This is the fundamental, but the reality is that some people spend their entire lives and still fail to find the trick.

If you also believe this, Da Kongyi may be your best example to learn from.

When investing in the currency circle, follow Yumo, and share with Yue Xianhuo every day for free. No threshold circle