时间:2024-01-03|浏览:325

We are experiencing an unprecedented bull market wave, and it's just getting started. After conducting over 1,000 hours of research during the bear market, I've put together a list of what I consider to be my top bull picks for 2024.

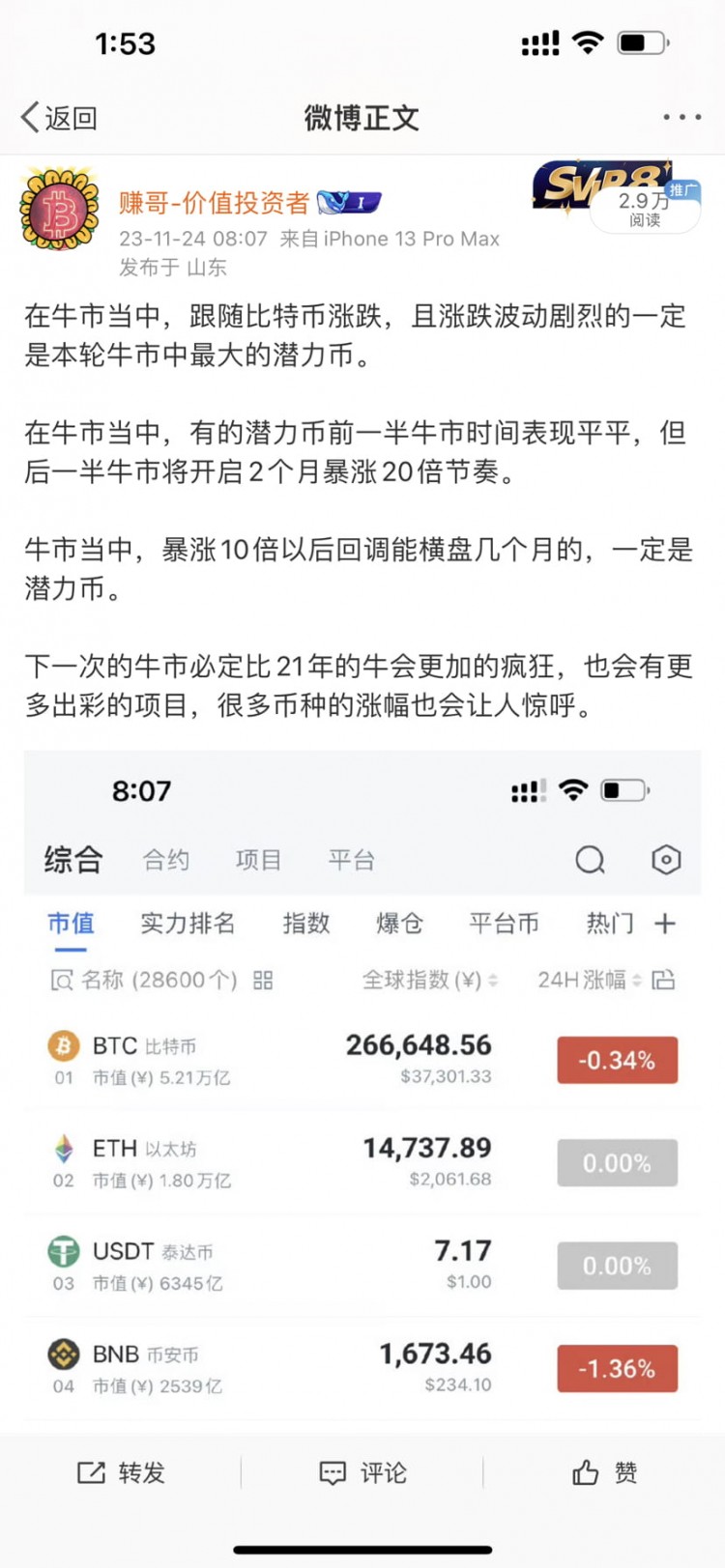

Your primary portfolio should always include BTC and ETH. However, as Bitcoin dominance peaks, we can expect altcoins to start outperforming (capital rotation). This article will outline my top altcoins heading into 2024 and will provide a full in-depth analysis of each coin listed.

I've categorized it as follows:

• Large market cap: over $5 billion

• Mid-cap: US$1 billion – US$5 billion

• Small cap: $200 million - $1 billion

• Micro market cap: less than $200 million

A diverse portfolio should include projects of all sizes. The percentage allocated to each category will depend on your personal risk tolerance.

1. Chainlink(LINK)

Bullish Catalysts: Industry Standard Oracles, Chainlink Staking, Chainlink Economic Model 2.0

Risk/Put: Token Economics and Revenue Capture, Team Selling Pressure

Chainlink has the potential to become the Google of crypto.

2. Cosmos(ATOM)

Bullish Catalysts: Forked Airdrop ATOM1, Projects Built on IBC, Network Effects

Risk/Put: Which fork will succeed? Revenue Capture, Community Divided

Is the Cosmos Hub fork bullish or bearish?

3. THORChain(RUNE)

Bullish Catalysts: Significant growth in decentralized exchange (DEX) trading volumes, native exchanges (no bridge required), borrowing and lending

Risk/Put: There has been a big move (upside), competitors

RUNE’s flywheel effect is in full effect, with trading volumes on the platform continuing to surge. Bullish.

4. Bittensor(TAO)

Bullish Catalysts: Decentralized AI, growing subnetworks, AI adoption/growth

Risks/Puts: High operating expenses, tough competition

This is a fascinating project that is already seeing huge gains in 2023. I think it's probably one of the most important investments in artificial intelligence.

5. Injective(INJ)

Bullish Catalysts: Institutional Adoption, Bullish Token Burns, Ecosystem and Scaling Integration

Risk/Put: Competition (order book), price has moved higher

Injective has had a great year, rising nearly 1,000%.

6. Arbitration (ARB)

Bullish Catalysts: Leading Layer 2, Adoption Surge (Total Locked Value), Arbitrum STIP

Risk/Put: ZK/OP Competition, Future Unlocks/Circulating Supply

ARB remains my favorite Layer 2 investment and I think it will continue to do well in a bull market.

7. Maker(MKR)

Bullish catalysts: RWAs (revenue returns), potential token splits, DAI growth

Risks/Puts: Decoupling risk, regulatory risk

Maker is a “money printing machine” that earns revenue from Treasury bond proceeds and the growth in decentralized finance adoption.

8. Frax(FXS)

Bullish Catalysts: RWA/LST Growth, Decentralized Finance Ecosystem (Holy Trinity), Fraxchain (Layer 2)

Risks/Puts: Regulation (stablecoins), reliance on USDC

Feeling bullish on FXS, they seem to have a long-term view and are creating an ecosystem of cool products.

9. GMX(GMX)

Bullish Catalysts: Revenue Generation, Perpetual DEX Growth, Real Yields

Risks/Puts: Fierce Competition, GLP Risks

GMX hasn’t performed as well in 2023 as some of the other coins on this list. In the process of catching up, it could be a sleeping giant with huge upside potential.

10. Kujira (KUJI)

Bullish catalysts: Sonar wallet, strong tokenomics, upcoming perpetual contracts and margin trading

Risk/Put: There has been a big upside, revenue generation

Kujira is up 500% this year and is one of my favorite projects. A true phoenix rising from the ashes.

11. Pendle(PENDLE)

Bullish Catalysts: Innovative Yield Tokenization, LSDFi, Strong Adoption

Risks/Puts: Regulatory, low-cap projects

Pendle is a great project with a very unique product. Strong market adaptability.

12. Radiant(RDNT)

Bullish Catalysts: Listing on Ethereum, STIP Grant - ARB Leads New dLP Locker, LayerZero Narrative

Risks/Puts: Token Unlocks, Competitors (Lending)

There is a lot of potential in the full-chain lending space, and Radiant has a real advantage.

13. THENA(THE)

Bullish catalysts: BNB chain growth, ALPHA perpetual contract, expert trading model

Risk/Put: Early stage/low market cap, circulating supply/issuance

Although the price action for this project is poor, the fundamentals are bullish (volumes, revenue, market fit).

We are in the early stages of the next bull market and the timing feels good. However, no one can accurately predict the exact direction of the market, but I firmly believe that if you work hard in the next few years, you will reap huge rewards. In a bull market, narratives shift quickly, and once-touted projects can quickly be forgotten. Therefore, it is crucial to remain flexible and adapt to market conditions. As always, please do your own research on the items I list. This does not constitute any investment advice.