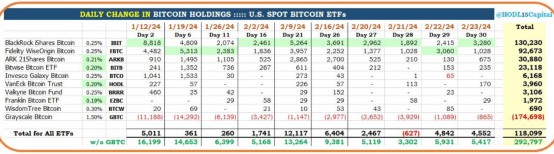

SEC may reject Bitcoin ETF proposal, and the market may face liquidation pressureAccording to a report from Matrixport, the SEC is expected to reject all Bitcoin spot ETF proposals in January due to failure to meet key requirements. The move sparked market concern and could lead to liquidation activity that could lead to a rapid 20% drop in Bitcoin prices.Key analysis:The SEC's attitude has become stricter: The five-member SEC voting committee led by Democrats has a more conservative attitude toward the approval of Bitcoin spot ETFs. Concerned about legalizing Bitcoin as an alternative store of value, the SEC may reject all proposals.Risk of liquidation activities: If the SEC refuses to approve a Bitcoin ETF, the market may usher in large-scale liquidation activities, triggering a rapid decline in the price of Bitcoin. Investors need to be vigilant and take precautions against risks.Opinion analysis:Short-term market shock: Rejection of Bitcoin ETF will bring short-term uncertainty and shock to the market. Investors need to remain calm, not be swayed by short-term fluctuations, and make prudent decisions.Still bullish in the medium term: Even if the SEC vetoes the ETF, Matrix on Target predicts that by the end of 2024, Bitcoin prices are still expected to exceed the $42,000 level at the beginning of the year. In the medium term, Bitcoin still has strong growth potential.Investor advice:Pay close attention to the SEC's decision: Investors should pay attention to the SEC's decision on the Bitcoin ETF proposal, obtain market dynamics in a timely manner, and adjust investment strategies.Flexibly respond to market changes: Considering possible market fluctuations, investors should remain flexible, respond to market changes in a timely manner, and avoid excessive speculation.Mid-term holding strategy: For investors who are optimistic about Bitcoin in the long term, they still maintain a holding strategy in the mid-term and believe in the long-term appreciation potential of Bitcoin.Conclusion:The Bitcoin market may face a period of uncertainty, and investors need to face it with a steady attitude and adjust their investment plans according to market changes. No matter how the market fluctuates in the short term, the bullish stance on Bitcoin in the medium term has not changed

热点:Bitcoin etf ETF