时间:2024-02-26|浏览:224

Project Name: Bittensor | Project Type: Artificial Intelligence (AI) | Codename: $TAO | Cryptocurrency Ranking:#30| Market Cap: $3.3 billion | FDV: $3.3 billion | Circulating supply: $6.23 million (total supply 29.69%) | Maximum supply: $2.1 million

The artificial intelligence industry has boomed in recent years, especially the emergence of breakthrough technologies like ChatGPT, attracting US$25 billion in investment in 2023 alone, five times the amount in 2022. This massive influx of capital fully demonstrates people’s positive expectations for artificial intelligence to become a trillion-dollar industry.

However, what are the signs that AI will get better and better in the future? Here are some key points:

●First, the field of artificial intelligence is currently quite fragmented. Different AI models cannot learn from each other, which severely limits their functionality. Additionally, connecting it with other applications or data often requires special permissions, adding further complexity.

●Secondly, the threshold for AI is quite high. Training artificial intelligence models requires a lot of resources, which has led to the monopoly of this field mainly by large enterprises.

●Although cryptocurrencies are still in their early stages of popularity, they have already shown potential as a powerful tool for motivating and organizing distributed resource networks. Additionally, by leveraging blockchain technology, AI applications can achieve interoperability and enhance their ability to work together.

There have been some exciting success stories in the AI-enabled cryptocurrency space in particular recently, and people are beginning to recognize the opportunities.

We are therefore at an AI crossroads: a fragmented and resource-intensive field of AI on the one hand, and a clear market opportunity on the other. What we need now is a core solution that can match both. And this is exactly what Bittensor provides, and it's really worth paying attention to.

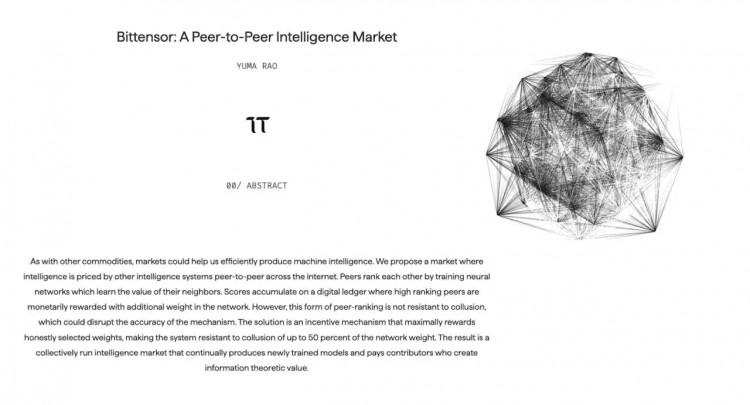

Bittensor shifts the control of artificial intelligence from large companies to the broader community, changing the development landscape of artificial intelligence. Its protocol turns machine learning into a tradable commodity, thereby encouraging the rapid spread of knowledge like an ever-expanding library.

Founded in 2019 by AI researchers Ala Shaabana and Jacob Steeves, Bittensor was originally conceived as a Polkadot parachain, but made a strategic shift in March 2023 and decided to develop its own proprietary blockchain aimed at leveraging cryptocurrencies as A mechanism to incentivize global machine learning nodes and promote a decentralized approach to AI development. By enabling these nodes to train and learn collaboratively, Bittensor introduces a new paradigm that enhances the collective intelligence of the network by integrating incremental resources, thereby expanding the contributions of individual researchers and models as a whole.

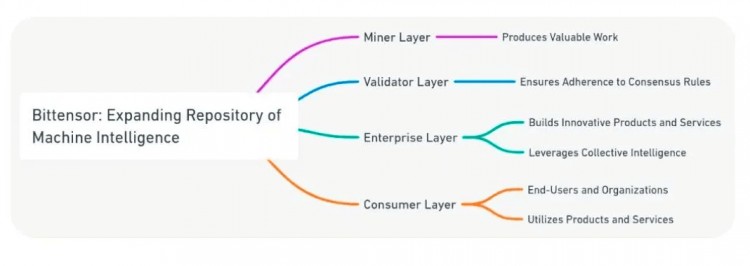

Bittensor’s architecture is designed to support a robust AI ecosystem through a decentralized network:

●Miner layer: This layer is the core of AI-driven innovation within Bittensor, where miners host and run diverse AI models.

●Verifier layer: Verifiers play a key role in maintaining the integrity and consensus of the blockchain, ensuring that the network operates according to established rules.

●Enterprise layer: Committed to developing cutting-edge applications and leveraging the network’s AI capabilities to solve complex problems.

●Consumer layer: The final layer serves end users and organizations, providing network-generated solutions and services.

Bittensor as an oracle

Bittensor also serves as an Oracle to connect the blockchain system with external data. In this way, it allows AI and blockchain technology to be combined to create innovative solutions.

Network dynamics

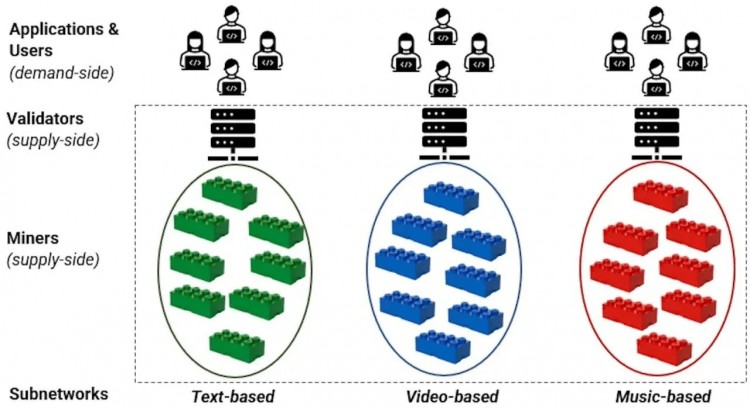

The Bittensor ecosystem relies on its unique subnet dynamics, each offering different rewards, making it ideal for a wide range of AI applications. This setup promotes diversity and the generation of new ideas, serving areas that may be overlooked by larger AI companies. At the same time, it uses a single TAO token ecosystem to support these activities, giving token holders a large say in the direction of AI growth within the network.

Bittensor Machine Learning methods and mechanisms

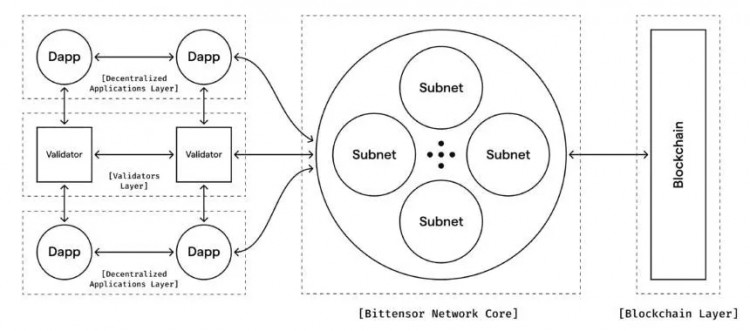

Bittensor connects two types of key players in the network:

-Validator: Responsible for maintaining the integrity of the blockchain and ensuring that transactions and operations comply with the rules of the network.

- Off-chain machine learning miners: They provide AI services by hosting and running AI models that perform various tasks from data analysis to generating opinions.

This bridge enables secure and efficient cooperation between blockchain operations and AI services.

Domain details

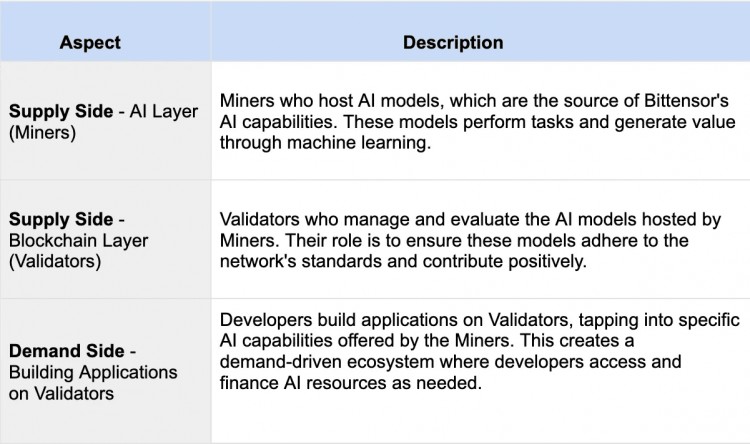

Supply Side - AI Layer (Miners) Miners that host the AI models that are the source of Bittensor’s AI capabilities. These models perform tasks and generate value through machine learning.

Supply Side - Blockchain Layer (Validator) Validators that manage and evaluate AI models hosted by miners. Their role is to ensure that these models meet the standards of the network and contribute actively.

Demand Side - Building Applications on Validators Developers build applications on validators to take advantage of the specific AI capabilities provided by miners. This creates a demand-driven ecosystem where developers can access and fund AI resources as needed.

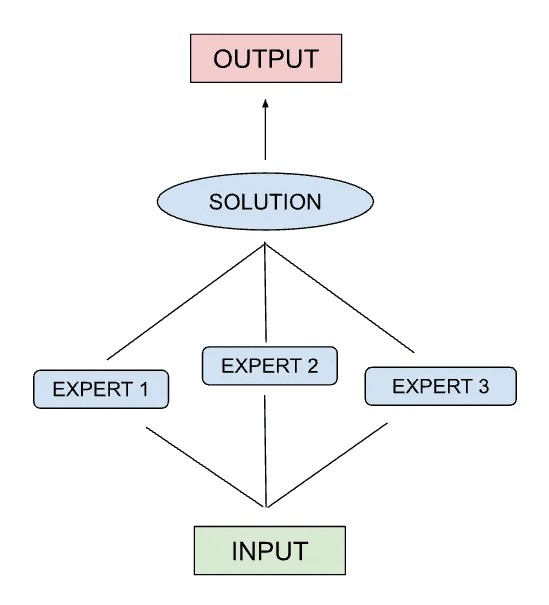

Bittensor uses a distributed expert model (MoE) to optimize artificial intelligence predictions, and improves the accuracy and efficiency of solving complex problems by coordinating multiple specialized AI models. This approach combines the unique strengths of each model to produce more accurate and comprehensive results than traditional single-model approaches. For example, when we want to generate Python code with Spanish comments, AI’s multilingual model and code expertise model can be combined to jointly produce results. This provides a superior solution compared to a single model.

Smart proof is a mechanism used by the Bittensor network to reward nodes for adding useful machine learning models and results. Similar to Proof of Work (PoW) and Proof of Stake (PoS) in blockchain networks, Proof of Intelligence requires nodes to perform machine learning tasks to prove their intelligence rather than solving mathematical puzzles. If the node's machine learning work is accurate and valuable, it has a greater chance of being selected to add new blocks to the chain and receive TAO tokens as a reward. In order to receive rewards in the Bittensor network, a server must not only generate valuable knowledge, but also be recognized by a majority of validators. Using this consensus mechanism, Bittensor incentivizes valuable contributions, promotes collaboration, and ensures the security of the blockchain.

Powered by the $TAO token, the Bittensor ecosystem represents an innovative approach in the field of decentralized artificial intelligence, and its special subnet structure is critical to the integrity and performance of the ecosystem. Bittensor provides 32 slots for these subnets to promote a competitive but dynamic environment that drives innovation. This demonstrates Bittensor’s commitment to inclusivity and its strategic focus on prioritizing quality over quantity. Note that subnets in Bittensor are where real value is created through competition and cooperation.

The ecosystem’s blockchain technology ensures transparency and security, while the Bittensor API facilitates participation by providing the necessary tools and guidance.

Participants can participate in building the community as subnet owners, validators, or miners, with each role critical to the health of the ecosystem. The Yuma consensus mechanism is a key feature that promotes consensus by rewarding contributors with TAO tokens.

Strategic partnerships, such as the one between OpSec and Tensorage, are critical to advancing decentralized AI technology and provide seamless data processing and storage solutions.

The integration of platforms like AITProtocol into the Bittensor network highlights its growing influence and diverse applications of decentralized artificial intelligence models.

Given Bittensor’s growth potential, we expect these partnerships and integrations to continue to develop, and perhaps, Bittensor is likely to become one of the key players shaping the future of artificial intelligence.

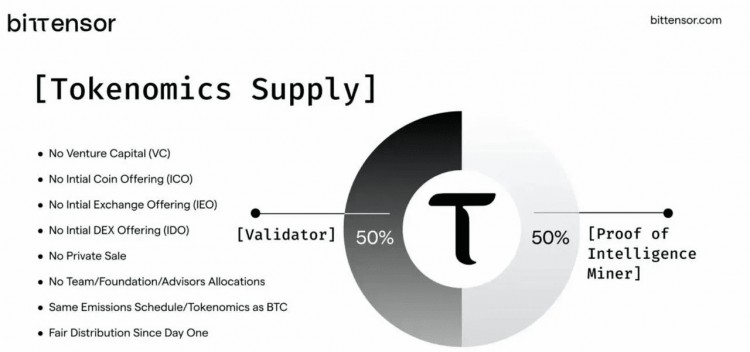

●Maximum supply: 21 million TAO tokens.

●Issuance schedule: Tokens will be fully issued in 256 years.

●Current price: $624.97.

●Market value: US$3.92 billion, ranking 27th.

●Fully diluted valuation: US$3.9 billion, ranking 49th.

●Current circulating supply: 6.25 million TAO tokens, accounting for 29.75% of the maximum supply.

●Total supply: 6.25 million TAO tokens.

Token generation and distribution

●TAO tokens are created through mining and network verification activities to promote the development of a decentralized ecosystem.

●The network conducts a halving event every 10.5 million blocks, with 64 halvings scheduled for approximately 45 years.

●Rewards are distributed at a rate of 1 TAO per block, approximately every 12 seconds, with a total of approximately 7,200 TAO tokens distributed daily. These rewards will be distributed to miners and validators.

●Holding TAO tokens provides access to various digital resources on the network, including data and core ideas based on artificial intelligence. It is important to note that the value of TAO tokens is directly linked to the artificial intelligence services provided by the Bittensor network. As the importance and usefulness of these artificial intelligence services continue to increase, the demand for TAO tokens will increase accordingly.

Artificial intelligence technology has a wide range of applications in the blockchain industry, including machine learning, neural networks, decentralized storage, artificial intelligence agent training, markets, and data processing.

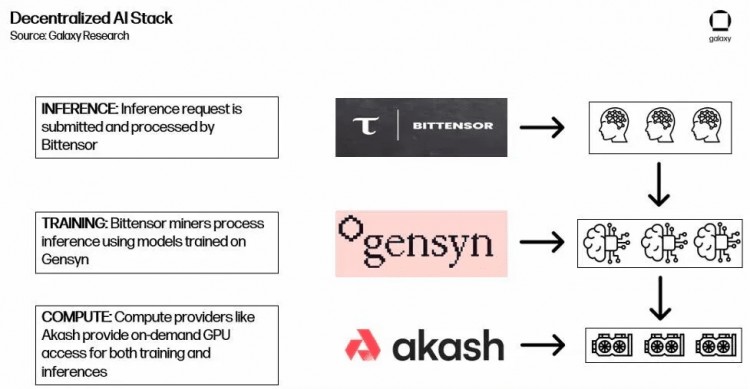

Given this diversity, it may not be entirely appropriate to directly compare Bittensor to projects like Akash. The services provided by Akash are similar to cloud computing, while Bittensor focuses on specific areas such as artificial intelligence model training.

Further research led us to Gensyn, an emerging project that appears to be a closer competitor to Bittensor. Let's take a closer look at it.

Get closer to Gensyn

Ben Fielding and Harry Grieve met at the Entrepreneur First accelerator program in early 2020 and began collaborating to create Gensyn that same year, always focusing on research. , until the second quarter of 2023. They are looking forward to launching the testnet this year.

In June 2023, Gensyn successfully received US$43 million in Series A financing from investors including a16z, Protocol Lab, CoinFund, Canonical Crypto, Eden Block and multiple angel investors.

Gensyn is building a network based on the L1 PoS protocol, leveraging the Substrate framework for peer-to-peer communication.

Gensyn aims to create a super scalable ML network. It provides a global set of computing resources that everyone can access at any time. The goal is to make AI model training possible on any device around the world by connecting many different computing devices, from idle data centers to personal laptops with GPUs. This initiative aims to significantly increase the availability of global ML computing resources.

What sets Gensyn apart from typical computing networks is its unique approach to examining computing work. It introduces a new system called Probabilistic Proof-of-Learning, which uses data from gradient optimization, a key method in machine learning. This technique provides a scalable and reliable way to verify work without the need for replication, making machine learning tasks more efficient.

In contrast, Bittensor offers two key advantages:

●First, it uses a mixture of experts (MoE) model to enhance AI predictions by letting multiple specialized AI models work together. This collaboration aims to improve the accuracy and reliability of AI results.

●Secondly, Bittensor adopts a unique machine learning method called AI building blocks. The concept of AI building blocks is to use blockchain to make AI development more open and decentralized, accessible and efficient. By building on the idea of "Compute Legos," it focuses on the versatility of general computing to promote machine learning innovation. Bittensor’s vision is to establish a global community network of ML nodes to address specific complex challenges while enhancing the collective intelligence and capabilities of AI models.

But we can also build a different scenario whereby permissionless blockchains enable various protocols to integrate and enhance the overall decentralized AI ecosystem. For example, Akash, Gensyn, and Bittensor may jointly handle inference requests, thereby demonstrating synergies between different AI solutions based on the chain.

Comparison with centralized AI models:

Comparing Bittensor to centralized AI models such as OpenAI, which was recently valued at $29 billion by Microsoft, provides a clear picture of its potential. Bittensor’s decentralized approach, which aims to achieve the compounding and broader integration of AI intelligence, has the potential to surpass OpenAI’s capabilities and value if successful. This sparked discussion about the huge potential value of Bittensor.

Through its decentralized model approach, Bittensor allows AI models to share insights and build on each other’s findings, reducing duplication of effort. According to Bittensor:

“The only thing bigger than Open AI or any other centralized alternative is their combination”

●Bittensor’s tokenomics are designed to encourage fair distribution practices and ensure incentives are aligned among network participants. As the network participant base expands, TAO tokens are expected to grow exponentially.

●About 89% of all TAO tokens currently in circulation have been pledged, amounting to 5,561,230? (the current total issuance is 6,254,373?).

●TAO token issuance is designed so that the creation rate decreases over time and stops completely after reaching the total supply limit. This strategy will shift the incentive focus of miners to direct payment tasks.

●The artificial intelligence market is expected to reach US$1.8 trillion by 2030, demonstrating the huge economic potential of artificial intelligence technology.

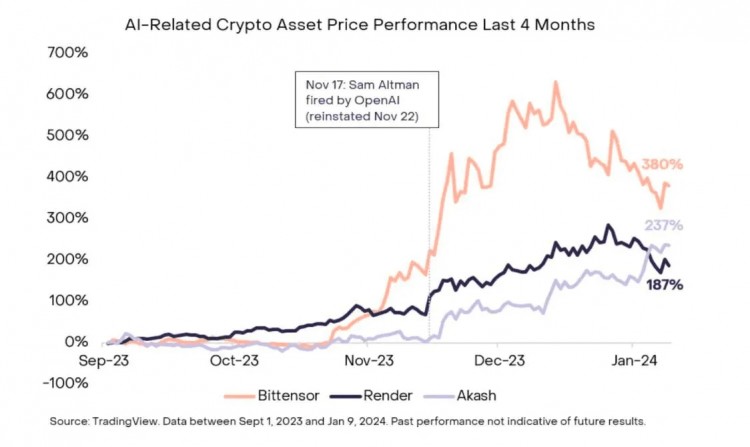

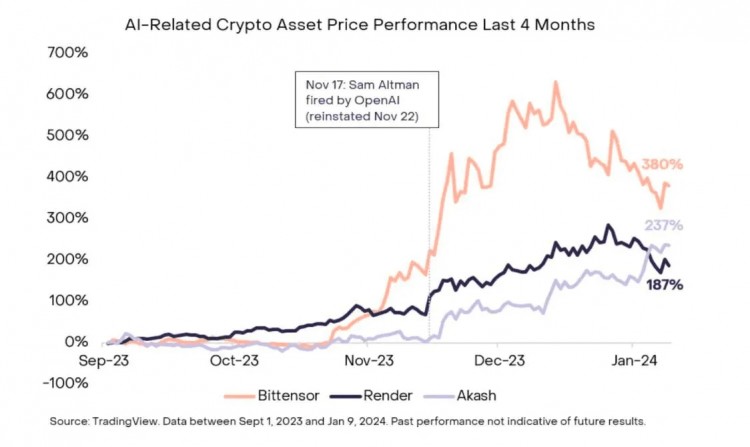

●Cryptoassets related to artificial intelligence have performed well since OpenAI made significant progress, highlighting the growing interest and investment in the field.

●Bittensor aims to create a self-sustaining ecosystem for machine learning and promote the development and application of AI models. This vision lays the foundation for innovation and practical applications in the field of AI.

●Bittensor’s network has more than 4,000 AI models with a total of 10 trillion model parameters. This scale not only exceeds models like GPT-3 (which has 175 billion parameters), but also highlights Bittensor’s significant scale and diversity in AI development.

●Bittensor is ranked among the top 25 projects and has not received any first-level token listing information to date. While it’s unclear whether this should be seen as a positive, its strong position makes one think about the possibilities that TAO tokens will bring once they become more widely available.

●Although Bittensor has not been widely criticized, there are still some critics. Some question the simplicity of its code but its high valuation. Others, such as Kyle, the founder of Multicoin VC, are particularly critical of how TAO validators select top miners, arguing that the lack of extensive application background (unlike Chat GPT) prevents validators from making judgments. He believes there is a need to strengthen the connection between user interface and model updates. We recommend keeping an open mind and considering diverse perspectives in the crypto space.

●Although decentralized artificial intelligence has huge potential, it is still in its initial stage and has risks. Our past research on AI projects shows that many decentralized platforms have not been adequately tested for durability. They often face difficulty attracting users and rely heavily on developers to keep them running.

●Another important challenge is the barrier to access to extensive databases and cutting-edge AI hardware relative to the resources available to large tech companies. This limitation poses considerable risks to the growth and profitability of platforms like Bittensor.

VanEck’s latest research calls Bittensor the “Bitcoin of machine intelligence.” The study outlines the ways in which its network provides economic incentives for AI/ML models, involving a system of "miners" developing AI models and "validators" evaluating the model output. However, given that developers can create dApps on Bittensor, and that the network is built as a main network with many smaller sub-networks focused on specific areas of AI, I think a more appropriate comparison is to view Bittensor as decentralized Ethereum in the field of AI.

Artificial intelligence has huge economic potential, expected to reach a market value of $1.8 trillion by 2030, and Bittensor aims to capture this opportunity by taking a decentralized path.

During the DeFi boom, Cardano’s market capitalization was close to $100 billion. With Bittensor’s current market capitalization of $4.2 billion, its growth potential remains an exciting prospect, especially if AI trends are similar to DeFi.

At Greythorn, we always advocate a cautious approach to these markets. If you are interested in this article, we invite you to contact us. You can explore our previous research and visit our website for more information.

This document has been prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) ("Greythorn"). The information contained in this document is for general information purposes only and is not intended to provide investment or financial advice. This document does not constitute advertising, nor is it an offer or invitation, or is intended to buy or sell any financial instrument or to participate in any specific trading strategy. In preparing this document, Greythorn has not taken into account the investment objectives, financial situation or specific needs of any recipient. Accordingly, before making any investment decision, the person or institution receiving this document should evaluate his or her individual circumstances and consult his or her accounting, legal or other professional advisor for professional advice.

This document contains statements, opinions, projections and forward-looking statements that are based on certain assumptions. Greythorn assumes no obligation to update such information. These assumptions may or may not be correct. Greythorn and its directors, employees, agents and consultants make no warranties or representations as to the accuracy or likelihood of realization of any forward-looking statements or the assumptions underlying them. Greythorn and its directors, employees, agents and consultants make no warranty or undertaking of any kind as to the accuracy, completeness or reliability of the information contained in this document. To the fullest extent permitted by law, Greythorn and its directors, employees, agents and consultants exclude liability for any loss, claim, damage, cost or expense arising out of or in connection with the information contained in this document.

This document is the property of Greythorn. The person or entity receiving this document agrees to keep its contents confidential and agrees not to reproduce, provide, transmit or disclose in any form any information contained in this document without the written consent of Greythorn.