时间:2024-03-15|浏览:246

#Bitcoin Falls Below $69,000 as #grayscale Moves Over $400 Million in $BTC to #coinbase

Bitcoin experienced a setback today, dipping below its recent all-time high to under $69,000 per coin. However, the leading #cryptocurrency by market cap has since bounced back, currently trading above $70,000. Nonetheless, it remains notably lower than the $73,700 level reached yesterday, according to CoinGecko data.

Bitcoin's recent surge was largely attributed to the success of new spot Bitcoin exchange-traded funds (ETFs). However, market sentiment shifted on Thursday following the release of data from the Labor Department's Bureau of Labor Statistics, revealing a 0.6% increase in the producer price index last month. This unexpected rise in prices fueled concerns about inflation, leading traders to speculate that the Federal Reserve might delay interest rate cuts in May. Consequently, this triggered a sell-off in both digital assets and stocks.

Another contributing factor to the market movement is the transfer of approximately $400 million in Bitcoin by Grayscale to its custodian, Coinbase, as reported by Arkham Intelligence data today.

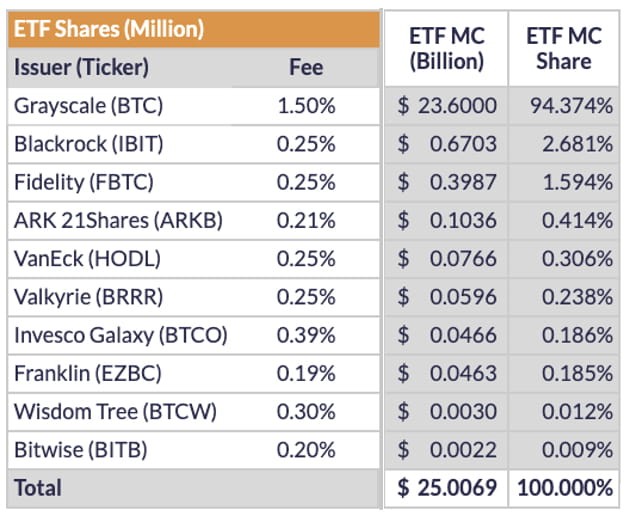

While the inflation narrative plays a significant role, the increased Grayscale selling may also be influencing market dynamics. Grayscale has previously been observed selling large amounts of digital coins, particularly after converting its fund into a Bitcoin exchange-traded fund (ETF) on January 10. This shift in strategy led to downward pressure on Bitcoin's price.

James Butterfill, Head of Research at Coinshares, suggested that both developments—Grayscale's selling and the inflation concerns—are contributing factors to the recent market movements.

Following Grayscale's conversion to a Bitcoin ETF, investors have been eager to redeem their holdings and realize profits. This trend appears to continue, contributing to the ongoing market volatility.

Despite the Grayscale redemptions, the overall inflows for the other nine #ETFs trading surpassed the $1 billion mark, reaching a record high on Tuesday.

Source - decrypt.co