时间:2024-06-21|浏览:383

介绍

可扩展性是区块链技术的关键问题之一。在区块链的背景下,它指的是网络处理越来越多同时进行的交易的能力。主要问题是,随着越来越多的交易被添加到待处理交易的积压中,网络通常会变得更慢、成本更高。

零知识解决方案提供了一种解决可扩展性问题的有前途的方法。在本文中,我们将探讨 ZKsync 扩展解决方案、其工作原理、与 Optimistic Rollup 的区别以及它的一些优点。我们还将讨论 ZK 代币的使用和通过空投进行分配。

什么是 ZKsync?

ZKsync 是一种

第 2 层

扩展解决方案,旨在通过在以太坊主链之外处理交易,使

以太坊

上的交易更快、更便宜。它通过使用所谓的零知识汇总 (

zk-rollups

) 来实现这一点。 Zk-rollups 是将多个交易捆绑在一起并

在链下

处理的解决方案。

我们可以将第 2 层解决方案视为在拥堵的高速公路上增加的额外车道。通过为汽车(交易)提供更多移动空间,它减少了主干道(以太坊)上的交通拥堵。这条额外的车道代表了 ZKsync 使用 zk-rollups 进行的链下交易处理。

ZKsync 如何工作?

1. 聚合交易

一切始于使用 zk-rollups 收集和打包链下交易,ZKsync 避免单独处理这些交易,以减轻以太坊主链的负载。

例如,想象一下在邮局中,不是将每封信件单独邮寄到特定地址,而是先将它们收集和分组,然后一次性投递,从而使流程更加高效。

2. 使用零知识证明

Then, ZKsync creates zero-knowledge proofs (ZKPs) to verify the batches. ZKPs ensure that transactions within the batches are valid while keeping their details private.

You can think of ZKPs as a method of proving you know a secret password without actually sharing it. For instance, if Alice wants to prove that she knows the password to a secret club, she can answer specific questions that only someone with the password would know, without ever revealing the actual password itself.

These ZKPs are then submitted to the Ethereum mainnet where they are thoroughly checked. Once verified and validated, they are accepted by the Ethereum network, meaning transactions are officially recorded and confirmed on the blockchain.

ZK tokens allow users to participate in the ZKsync governance system by offering voting power. Their voting power can be activated through the process of delegation. Let’s take a look at how it works:

To activate the voting power of your ZK tokens, you must delegate it to a ZKsync address. It can be your own or someone else's.

The person who controls that address becomes a Delegate who can vote on governance proposals.

Delegating does not change token ownership but activates the voting power for the chosen address.

Delegation can be changed at any time by the token holder and lasts until altered or tokens are transferred.

Delegation cannot be split across multiple addresses. All voting power held in one wallet is delegated to a single address.

The ZK token was listed on Binance with the seed tag applied on June 17, 2024. Please refer to the official listing announcement for more details.

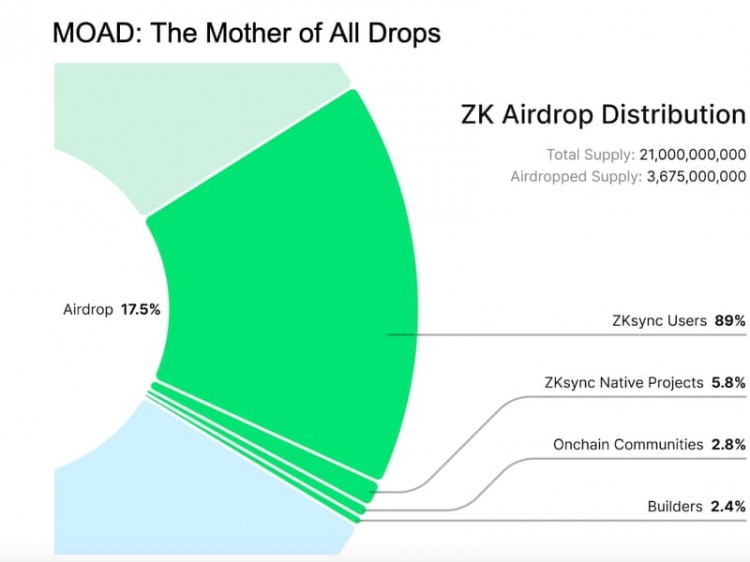

The ZK token airdrop distributed 17.5% of the total supply to eligible wallets. The allocation was divided between users and contributors.

To be eligible for the airdrop as a user, you had to bridge your funds onto ZKsync Era and meet at least one of the following seven criteria:

Interact with at least 10 non-token smart contracts on ZKsync.

Use paymasters for at least 5 transactions on ZKsync Era. Paymasters are special accounts designed to cover transaction costs for other accounts, potentially making certain transactions free for end-users.

Trade at least 10 distinct ERC-20 tokens on the ZKsync Era decentralized exchanges (DEXs).

Provide any amount of liquidity to the tracked DEXs and Lending/Borrowing protocols on ZKsync Era.

Hold at least one Libertas Omnibus non-fungible token (NFT) at the time of the snapshot.

Be active for over 3 months on ZKsync Lite before the ZKsync Era mainnet.

Donate to Gitcoin via rounds hosted on ZKsync Lite.

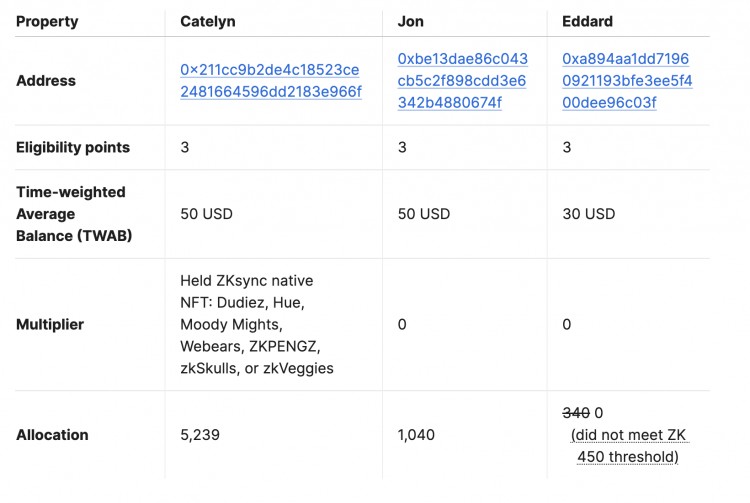

According to ZKsync, the allocations were based on a value-scaling formula that consisted of multiple steps:

1. The first step was to determine the daily balance of crypto assets held by an address. This included both the wallet balance and the crypto sent to decentralized finance (DeFi) protocols.

2. Next, crypto assets in DeFi protocols were valued at 2x their nominal value. For example, if you had $100 worth of crypto in a DeFi protocol, the formula would count it as $200.

3. Finally, the daily balances were summed up and divided by the snapshot period (366 days) to calculate the time-weighted average balances.

For example, imagine that Alice sent $200 worth of crypto assets to ZKsync Era 30 days before the snapshot and immediately allocated 1/4 of them ($50) to a DeFi protocol. The other $150 was kept in her wallet until the snapshot. Now, let’s calculate her time-weighted average balance (TWAB):

TWAB = ( ($150 * 30 days) + ($50 * 2 * 30 days) ) / 366 = $20.50

Each address could receive additional multipliers based on specific activities that indicated genuine user behavior or contribution to ZKsync. These multipliers were added on top of the allocations. Here are some activities that could add multipliers:

1. Hold at least one of the following ZKsync native NFT collections at the snapshot: Dudiez, Hue, Moody Mights, Webears, ZKPENGZ, zkSkulls, or zkVeggies.

2. Hold at least 50% of the ARB/OP/ENS airdrop for more than 90 days after claiming it.

The ZK token airdrop also included specific allocations for various contributors to the ZKsync ecosystem. Here is a detailed breakdown of the contribution-based airdrop:

1. ZKsync native projects: 215,250,000 ZK tokens were allocated directly to the contributors and treasuries of native projects building on ZKsync Era, including DeFi protocols, gaming, ZK chains, NFT collections, infrastructure, and more.

2. Builders: 86,895,375 tokens were allocated to individuals, developers, researchers, communities, and companies who contributed to the ZKsync ecosystem through development, advocacy, or education.

GitHub developers: Developers with at least 25 commits across eligible repositories before March 24, 2024.

Protocol Guild: Ethereum researchers and developers.

ZK quest participants: Participants in the ZK quest developer activations at Istanbul Devconnect 2023 and/or ETH Denver 2024.

And many others.

3. On-chain communities. 102,375,000 tokens were allocated to a small group of experimental on-chain communities for exploring ways to use tokens and NFTs, such as:

Season 1 DEGEN token airdrop recipients.

Season 1 BONSAI token airdrop recipients.

Participants in Seasons 1 and 2 of Crypto The Game (CTG) and the CTG team.

Pudgy Penguin and Milady Maker holders.

Be wary of fake websites and phishing attacks. Make sure you are using the official websites and channels.

Follow these steps to check your eligibility and claim your ZK tokens:

1. Visit the official airdrop website and check whether you are eligible for the airdrop. Enter your wallet address or GitHub username and press [Check].

2. Click [Connect wallet] and follow the prompts to connect your crypto wallet.

3. Next, you will have to delegate the voting power of your ZK tokens. You can either delegate to yourself or any community member.

4. Finally, press [Claim your tokens] and follow the prompts. If you encounter an error, click [Claim your tokens] again.

To claim ZK tokens from Binance, eligible users need to deposit a minimum of 0.02 ETH from a whitelisted address on the ZKsync Era network to their Binance account. Only deposits made directly from addresses included in the active ZKsync user whitelists will be considered valid for this distribution.

Whitelisted Address Batches:

Batch 1

Batch 2

Batch 3

Batch 4

ZK tokens will be distributed on a first-come, first-served basis to users who meet the criteria. Each user can only claim ZK tokens once (i.e., one claim per Binance User ID), with a limit of 200 ZK tokens per user. Even if a user deposits 0.02 ETH from multiple addresses to a single Binance UID, they can only claim the airdrop once for a total of 200 ZK tokens.

The first ZK Token airdrop on Binance is scheduled to start on June 25, 2024. Please refer to the official announcement for more details on the Binance ZK Token Distribution Program.

The ZKsync airdrop has sparked controversy among the cryptocurrency community, raising concerns about its execution and fairness.

The ZKsync airdrop was criticized for the lack of effective measures against Sybil attacks. Many users argued that it was easy to exploit the eligibility criteria, allowing the creation of multiple wallets to trick the system and get more tokens.

In response, ZKsync developers explained that they deliberately chose not to use overly strict Sybil detection to avoid accidentally excluding many organic users. Instead, they implemented value scaling and multipliers to detect potential Sybil attacks while prioritizing organic users.

Some argued that ZK tokens were not fairly distributed. Critics stated that the maximum cap of 100,000 ZK tokens per address was too small as it unfairly cut the rewards for users who were heavily involved in the ZKsync ecosystem. Some users claimed they didn’t get anything despite following the eligibility criteria and using ZKsync’s products for multiple years.

To address these concerns, ZKsync clarified its distribution strategy, emphasizing its focus on rewarding active participants. The team pointed out that 89% of the airdropped tokens were given to users who actively engaged with ZKsync Era.

Optimistic rollups start by assuming that all transactions are valid. They use a method where nodes are paid to check the transactions after they are processed. If any problems are found, they are reported, and transactions are corrected. The issue with this approach is its reliance on human actors who can easily make mistakes.

In contrast, ZKsync uses ZKPs to ensure transaction security. This approach can offer a relatively higher level of accuracy compared to optimistic rollups.

Optimistic rollups have a so-called 7-day challenge period. It is necessary because optimistic rollups initially assume that all transactions are valid, and only corrects them if someone disputes their validity. Transactions are not finalized until this period ends, leading to slower settlement times.

In contrast, ZKsync uses ZKPs to verify transactions. Transactions are finalized as soon as they are verified by the nodes. This approach skips the need for a challenge period, making settlement times faster.

ZKsync enhances the scalability of the Ethereum network by processing transactions off the main Ethereum chain using zk-rollups. This lowers transaction fees and speeds up transaction times. As a result, ZKsync allows Ethereum to support more users and decentralized applications (DApps).

EVM compatibility means that developers who have already created DApps for the Ethereum Virtual Machine (EVM) can migrate them to ZKsync with minimal changes. This reduces the learning curve and makes it easier for them to adopt ZKsync scaling solutions.

By using zero-knowledge rollups (zk-rollups) and zero-knowledge proofs (ZKPs), ZKsync is a Layer-2 scaling solution that can enhance transaction speed and reduce costs on the Ethereum network. Compared to optimistic rollups, ZKsync can offer better security and faster settlement times. In addition, its EVM compatibility makes it easy for developers to learn and adopt its scaling solutions.

What Is a ZkEVM and How Can It Enhance the Ethereum Ecosystem?

What Are ZKThreads and How Do They Work?

What Are Validiums and How Do They Work?

区块链可扩展性 - 侧链和支付渠道

免责声明:本内容按“原样”提供给您,仅供一般信息和教育目的,不作任何形式的陈述或保证。它不应被视为财务、法律或其他专业建议,也不旨在推荐购买任何特定产品或服务。您应该向适当的专业顾问寻求自己的建议。如果文章是由第三方贡献者提供的,请注意,这些观点属于第三方贡献者,并不一定反映币安学院的观点。请在此处阅读我们的完整免责声明以了解更多详情。数字资产价格可能会波动。您的投资价值可能会下跌或上涨,您可能无法收回投资金额。您对自己的投资决策负全部责任,币安学院对您可能遭受的任何损失概不负责。本材料不应被视为财务、法律或其他专业建议。有关更多信息,请参阅我们的

使用条款

和

风险警告

。